Question

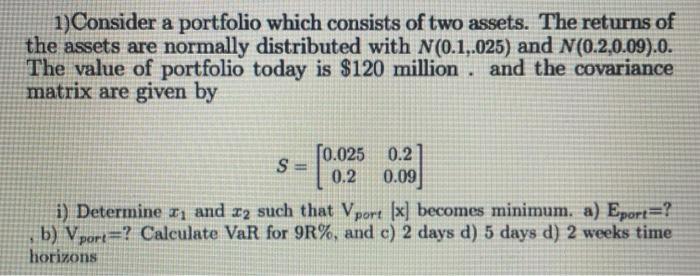

1)Consider a portfolio which consists of two assets. The returns of the assets are normally distributed with N(0.1,.025) and N(0.2.0.09).0. The value of portfolio

1)Consider a portfolio which consists of two assets. The returns of the assets are normally distributed with N(0.1,.025) and N(0.2.0.09).0. The value of portfolio today is $120 million and the covariance matrix are given by S= [0.025 0.2 0.2 0.09 . i) Determine and 22 such that Vport [x] becomes minimum. a) Eport=? b) Vport ? Calculate VaR for 9R%, and c) 2 days d) 5 days d) 2 weeks time horizons

Step by Step Solution

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To determine the values of z and z that minimize the variance of the portfolio Vport we need to solve a quadratic programming problem with the given covariance matrix and portfolio weights Given Retur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Management Science The Art Of Modeling With Spreadsheets

Authors: Stephen G. Powell, Kenneth R. Baker

4th Edition

978-1118517376, 9781118800348, 1118517377, 1118800346, 978-1118582695

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App