1D theres no unearned revenue in list so I dont know what it could be

8C its not 1.3 I already divided 15.6/12 whatever answer came up its not it

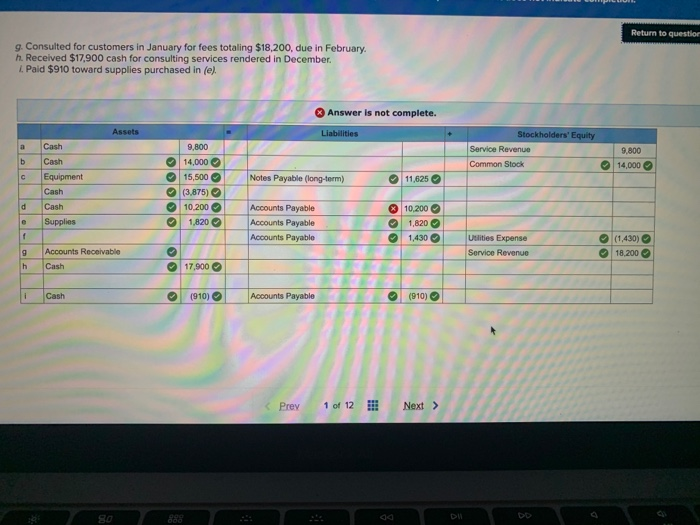

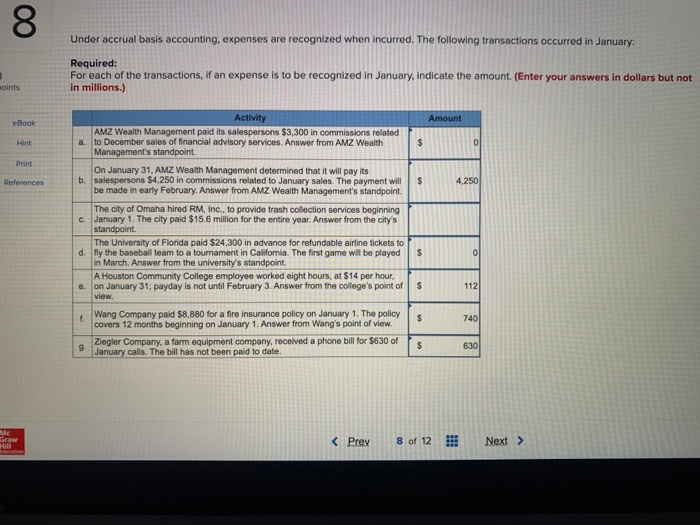

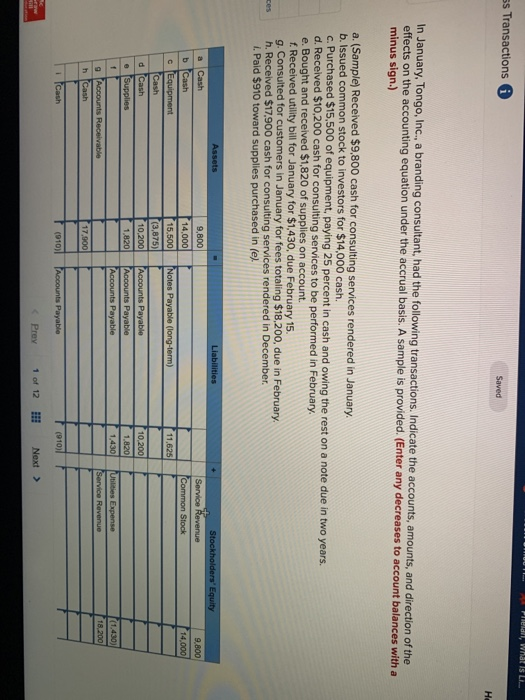

Return to question g. Consulted for customers in January for fees totaling $18,200, due in February. h. Received $17,900 cash for consulting services rendered in December Paid $910 toward supplies purchased in (e). Answer is not complete. Assets Liabilities Cash 9,800 Stockholders' Equity Service Revenue Common Stock b Cash 9,800 14,000 Notes Payable (long-term) 11,625 Equipment Cash Cash 14,000 15,500 (3,875) 10.200 1,820 d Supplies Accounts Payable Accounts Payable Accounts Payable OO 10.200 1,820 1,430 f Utilities Expense Service Revenue (1,430) 18,200 Accounts Receivable 9 h Cash 17,900 1 Cash (910) Accounts Payable s (910) Prey 1 of 12 Next > SO 8 Under accrual basis accounting, expenses are recognized when incurred. The following transactions occurred in January: Required: For each of the transactions, if an expense is to be recognized in January, indicate the amount. (Enter your answers in dollars but not in millions.) 3 oints Amount eBook Hint a. $ 0 Print References $ 4.250 Activity AMZ Wealth Management paid its salespersons $3,300 in commissions related to December sales of financial advisory services. Answer from AMZ Wealth Management's standpoint. On January 31, AMZ Wealth Management determined that it will pay its b. salespersons $4,250 in commissions related to January sales. The payment will be made in early February. Answer from AMZ Wealth Management's standpoint. The city of Omaha hired RM, Inc., to provide trash collection services beginning c. January 1. The city paid $15.6 million for the entire year. Answer from the city's standpoint. The University of Florida paid $24,300 in advance for refundable airline tickets to d. fly the baseball team to a toumament in California. The first game will be played in March. Answer from the university's standpoint A Houston Community College employee worked eight hours, at $14 per hour. e. on January 31: payday is not until February 3. Answer from the college's point of view f Wang Company paid $8,880 for a fire insurance policy on January 1. The policy covers 12 months beginning on January 1. Answer from Wang's point of view. Ziegler Company, a farm equipment company, received a phone bill for $630 of 9 January calls. The bill has not been paid to date. $ 0 $ 112 740 $ $ 630 Me Graw PII, What Is Li_ s Transactions Saved HO In January, Tongo, Inc., a branding consultant, had the following transactions. Indicate the accounts, amounts, and direction of the effects on the accounting equation under the accrual basis. A sample is provided. (Enter any decreases to account balances with a minus sign.) a. (Sample) Received $9,800 cash for consulting services rendered in January b. Issued common stock to investors for $14,000 cash. c. Purchased $15,500 of equipment, paying 25 percent in cash and owing the rest on a note due in two years. d. Received $10,200 cash for consulting services to be performed in February. e. Bought and received $1,820 of supplies on account. f. Received utility bill for January for $1,430, due February 15. g. Consulted for customers in January for fees totaling $18,200, due in February h. Received $17,900 cash for consulting services rendered in December 1. Paid $910 toward supplies purchased in (e) Assets Liabilities Stockholders' Equity Service Revenue Common Stock 9,800 14,000 Notes Payable (long-term) 11.625 Cash b Cash c Equipment Cash d Cash e Supplies 9,800 14.000 15,500 (3,875) 10,200 1,820 Accounts Payable Accounts Payable Accounts Payable 10.200 1.820 1 1.430 Utilities Expense Service Revenue (1.430) 18,200 9 Accounts Receivable h Cash 17.900 1 Cash (910) [Accounts Payable (910) Prey 1 of 12 Next >