Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1)determine which costs should be allocated and which should not be allocated but rather consider corporate level costs a) Compute new Allocation Rate b) compute

1)determine which costs should be allocated and which should not be allocated but rather consider corporate level costs

a) Compute new Allocation Rate

b) compute a new OH allocation rate.

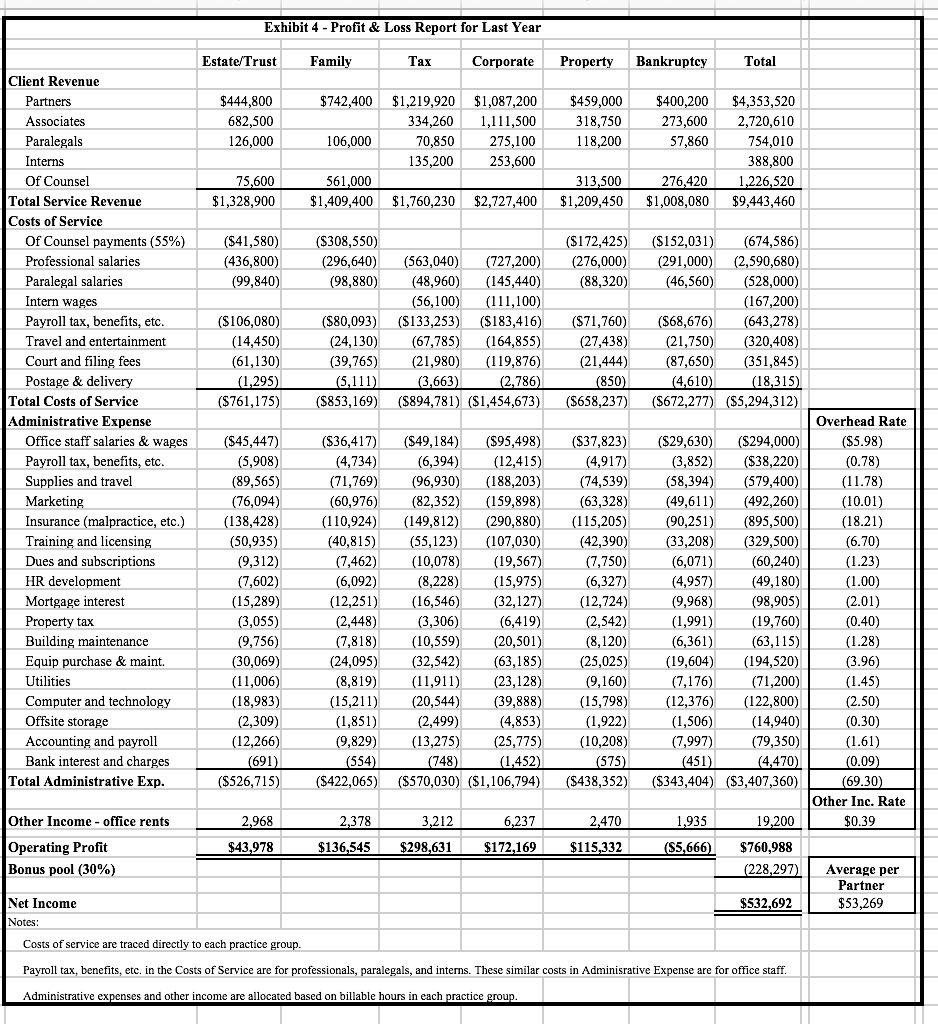

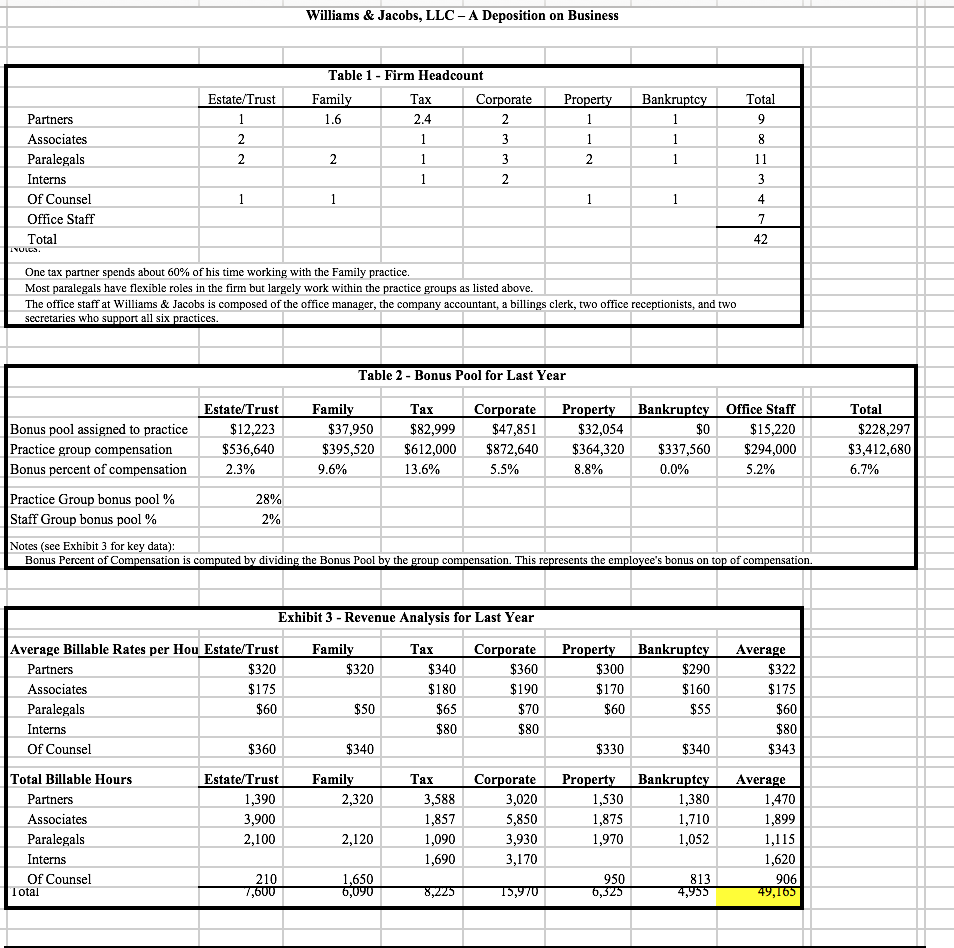

Exhibit 4 - Profit & Loss Report for Last Year Estate/Trust Family Tax Corporate Property Bankruptcy Total $742,400 $444,800 682,500 126,000 $1,219,920 334,260 70,850 135,200 $1,087,200 1,111,500 275,100 253,600 318,750 118,200 $400,200 273,600 57,860 106,000 $4,353,520 2,720,610 754,010 388,800 1,226,520 $9,443,460 75,600 $1,328,900 561,000 $1,409,400 313,500 $1,209,450 276,420 $1,008,080 $1,760,230 $2,727,400 ($41,580) (436,800) (99,840) ($308,550) (296,640) (98,880) ($172,425) (276,000) (88,320) ($106,080) (14,450) (61,130) (1,295) ($761,175) ($80,093) (24,130) (39,765) (5,111) ($853,169) (563,040) (727,200) (48,960) (145,440) (56,100) (111,100) ($133,253) ($183,416) (67,785) (164,855) (21,980) (119,876) (3,663) (2.786) ($894,781) ($1,454,673) ($71,760) (27,438) (21,444) (850) (5658,237) ($152,031) (674,586) (291,000) (2,590,680) (46,560) (528,000) (167,200) ($68,676) (643,278) (21,750) (320,408) (87,650) (351,845) (4,610) (18,315) ($672,277) ($5.294 312 Client Revenue Partners Associates Paralegals Interns Of Counsel Total Service Revenue Costs of Service Of Counsel payments (55%) Professional salaries Paralegal salaries Intern wages Payroll tax, benefits, etc. Travel and entertainment Court and filing fees Postage & delivery Total Costs of Service Administrative Expense Office staff salaries & wages Payroll tax, benefits, etc. Supplies and travel Marketing Insurance (malpractice, etc.) Training and licensing Dues and subscriptions HR development Mortgage interest Property tax Building maintenance Equip purchase & maint. Utilities Computer and technology Offsite storage Accounting and payroll Bank interest and charges Total Administrative Exp. ($45,447) (5,908) (89,565) (76,094) (138,428) (50,935) (9,312) (7,602) (15,289) (3,055) (9,756) (30,069) (11,006) (18,983) (2,309) (12,266) (691) ($526,715) ($36,417) (4,734) (71,769) (60,976) (110,924) (40,815) (7,462) (6,092) (12,251) (2,448) (7,818) (24,095) (8,819) (15,211) (1,851) (9,829) (554) ($422,065) ($49,184) ($95,498) (6,394) (12,415) (96,930) (188,203) (82,352) (159,898) (149,812) (290,880) (55,123) (107,030) (10,078) (19,567) (8,228) (15,975) (16,546) (32,127) (3,306) (6,419) (10,559) (20,501) (32,542) (63,185) (11,911) (23,128) (20,544) (39,888) (2,499) (4,853) (13,275) (25,775) (748) (1.452) ($570,030) ($1,106,794) ($37,823) (4,917) (74,539) (63,328) (115,205) (42,390) (7,750) (6,327) (12,724) (2,542) (8,120) (25,025) (9,160) (15,798) (1,922) (10,208) (575) ($438,352) ($29,630) ($294,000) (3,852) ($38,220) (58,394) (579,400) (49,611) (492,260) (90,251) (895,500) (33,208) (329,500) (6,071) (60,240) (4,957) (49,180) (9,968) (98,905) (1,991) (19,760) (6,361) (63,115) (19,604) (194,520) (7,176) (71,200) (12,376) (122,800) (1,506) (14,940) (7,997) (79,350) (451) (4,470) ($343,404) ($3,407,360) Overhead Rate ($5.98) (0.78) (11.78) (10.01) (18.21) (6.70) (1.23) (1.00) (2.01) (0.40) (1.28) (3.96) (1.45) (2.50) (0.30) (1.61) (0.09) (69.30) Other Inc. Rate $0.39 1,935 19.200 Other Income-office rents Operating Profit Bonus pool (30%) 2,968 $43,978 2,378 $136,545 3,212 $298,631 6,237 $172,169 2,470 $115,332 (S5,666) $760,988 (228,297) Average per Partner $53,269 $532,692 Net Income Notes: Costs of service are traced directly to each practice group. Payroll tax, benefits, etc. in the Costs of Service are for professionals, paralegals, and interns. These similar costs in Adminisrative Expense are for office staff. Administrative expenses and other income are allocated based on billable hours in each practice group. Williams & Jacobs, LLC - A Deposition on Business Estate/Trust Table 1 - Firm Headcount Family Tax Corporate Corporate 1.6 2.4 Property Bankruptcy Total 2 Partners Associates Paralegals Interns Of Counsel Office Staff Total TYUUES. One tax partner spends about 60% of his time working with the Family practice. Most paralegals have flexible roles in the firm but largely work within the practice groups as listed above. The office staff at Williams & Jacobs is composed of the office manager, the company accountant, a billings clerk, two office receptionists, and two secretaries who support all six practices. Table 2 - Bonus Pool for Last Year Bankruptcy Bonus pool assigned to practice Practice group compensation Bonus percent of compensation Estate/Trust $12,223 $536,640 2.3% Family $37,950 $395,520 9.6% Tax $82,999 $612,000 13.6% Corporate $47,851 $872,640 5.5% Property $32,054 $364,320 8.8% Office Staff $15,220 $294,000 5.2% Total $228,297 $3,412,680 6.7% $337,560 0.0% Practice Group bonus pool % Staff Group bonus pool % 28% 2% Notes (see Exhibit 3 for key data): Bonus Percent of Compensation is computed by dividing the Bonus Pool by the group compensation. This represents the employee's bonus on top of compensation. Exhibit 3 - Revenue Analysis for Last Year Family $320 Bankruptcy $290 Average Billable Rates per Hou Estate/Trust Partners $320 Associates $175 Paralegals $60 Interns Of Counsel $360 Tax $340 $180 $65 $80 Corporate $360 $190 $70 $80 Property $300 $170 $60 $160 Average $322 $175 $60 $80 $343 $50 $55 $340 $330 $340 Estate/Trust 1,390 3,900 Family 2,320 Total Billable Hours Partners Associates Paralegals Interns Of Counsel Total Tax 3,588 1,857 1,090 1,690 Corporate 3,020 5,850 3,930 Property 1,530 1,875 1,970 Bankruptcy 1,380 1,710 1,052 2,100 2,120 Average 1,470 1,899 1,115 1,620 906 49,165 3,170 210 7,600 1,650 6,090 8,225 15,970 970 0.950 6,325 813 4,955 Exhibit 4 - Profit & Loss Report for Last Year Estate/Trust Family Tax Corporate Property Bankruptcy Total $742,400 $444,800 682,500 126,000 $1,219,920 334,260 70,850 135,200 $1,087,200 1,111,500 275,100 253,600 318,750 118,200 $400,200 273,600 57,860 106,000 $4,353,520 2,720,610 754,010 388,800 1,226,520 $9,443,460 75,600 $1,328,900 561,000 $1,409,400 313,500 $1,209,450 276,420 $1,008,080 $1,760,230 $2,727,400 ($41,580) (436,800) (99,840) ($308,550) (296,640) (98,880) ($172,425) (276,000) (88,320) ($106,080) (14,450) (61,130) (1,295) ($761,175) ($80,093) (24,130) (39,765) (5,111) ($853,169) (563,040) (727,200) (48,960) (145,440) (56,100) (111,100) ($133,253) ($183,416) (67,785) (164,855) (21,980) (119,876) (3,663) (2.786) ($894,781) ($1,454,673) ($71,760) (27,438) (21,444) (850) (5658,237) ($152,031) (674,586) (291,000) (2,590,680) (46,560) (528,000) (167,200) ($68,676) (643,278) (21,750) (320,408) (87,650) (351,845) (4,610) (18,315) ($672,277) ($5.294 312 Client Revenue Partners Associates Paralegals Interns Of Counsel Total Service Revenue Costs of Service Of Counsel payments (55%) Professional salaries Paralegal salaries Intern wages Payroll tax, benefits, etc. Travel and entertainment Court and filing fees Postage & delivery Total Costs of Service Administrative Expense Office staff salaries & wages Payroll tax, benefits, etc. Supplies and travel Marketing Insurance (malpractice, etc.) Training and licensing Dues and subscriptions HR development Mortgage interest Property tax Building maintenance Equip purchase & maint. Utilities Computer and technology Offsite storage Accounting and payroll Bank interest and charges Total Administrative Exp. ($45,447) (5,908) (89,565) (76,094) (138,428) (50,935) (9,312) (7,602) (15,289) (3,055) (9,756) (30,069) (11,006) (18,983) (2,309) (12,266) (691) ($526,715) ($36,417) (4,734) (71,769) (60,976) (110,924) (40,815) (7,462) (6,092) (12,251) (2,448) (7,818) (24,095) (8,819) (15,211) (1,851) (9,829) (554) ($422,065) ($49,184) ($95,498) (6,394) (12,415) (96,930) (188,203) (82,352) (159,898) (149,812) (290,880) (55,123) (107,030) (10,078) (19,567) (8,228) (15,975) (16,546) (32,127) (3,306) (6,419) (10,559) (20,501) (32,542) (63,185) (11,911) (23,128) (20,544) (39,888) (2,499) (4,853) (13,275) (25,775) (748) (1.452) ($570,030) ($1,106,794) ($37,823) (4,917) (74,539) (63,328) (115,205) (42,390) (7,750) (6,327) (12,724) (2,542) (8,120) (25,025) (9,160) (15,798) (1,922) (10,208) (575) ($438,352) ($29,630) ($294,000) (3,852) ($38,220) (58,394) (579,400) (49,611) (492,260) (90,251) (895,500) (33,208) (329,500) (6,071) (60,240) (4,957) (49,180) (9,968) (98,905) (1,991) (19,760) (6,361) (63,115) (19,604) (194,520) (7,176) (71,200) (12,376) (122,800) (1,506) (14,940) (7,997) (79,350) (451) (4,470) ($343,404) ($3,407,360) Overhead Rate ($5.98) (0.78) (11.78) (10.01) (18.21) (6.70) (1.23) (1.00) (2.01) (0.40) (1.28) (3.96) (1.45) (2.50) (0.30) (1.61) (0.09) (69.30) Other Inc. Rate $0.39 1,935 19.200 Other Income-office rents Operating Profit Bonus pool (30%) 2,968 $43,978 2,378 $136,545 3,212 $298,631 6,237 $172,169 2,470 $115,332 (S5,666) $760,988 (228,297) Average per Partner $53,269 $532,692 Net Income Notes: Costs of service are traced directly to each practice group. Payroll tax, benefits, etc. in the Costs of Service are for professionals, paralegals, and interns. These similar costs in Adminisrative Expense are for office staff. Administrative expenses and other income are allocated based on billable hours in each practice group. Williams & Jacobs, LLC - A Deposition on Business Estate/Trust Table 1 - Firm Headcount Family Tax Corporate Corporate 1.6 2.4 Property Bankruptcy Total 2 Partners Associates Paralegals Interns Of Counsel Office Staff Total TYUUES. One tax partner spends about 60% of his time working with the Family practice. Most paralegals have flexible roles in the firm but largely work within the practice groups as listed above. The office staff at Williams & Jacobs is composed of the office manager, the company accountant, a billings clerk, two office receptionists, and two secretaries who support all six practices. Table 2 - Bonus Pool for Last Year Bankruptcy Bonus pool assigned to practice Practice group compensation Bonus percent of compensation Estate/Trust $12,223 $536,640 2.3% Family $37,950 $395,520 9.6% Tax $82,999 $612,000 13.6% Corporate $47,851 $872,640 5.5% Property $32,054 $364,320 8.8% Office Staff $15,220 $294,000 5.2% Total $228,297 $3,412,680 6.7% $337,560 0.0% Practice Group bonus pool % Staff Group bonus pool % 28% 2% Notes (see Exhibit 3 for key data): Bonus Percent of Compensation is computed by dividing the Bonus Pool by the group compensation. This represents the employee's bonus on top of compensation. Exhibit 3 - Revenue Analysis for Last Year Family $320 Bankruptcy $290 Average Billable Rates per Hou Estate/Trust Partners $320 Associates $175 Paralegals $60 Interns Of Counsel $360 Tax $340 $180 $65 $80 Corporate $360 $190 $70 $80 Property $300 $170 $60 $160 Average $322 $175 $60 $80 $343 $50 $55 $340 $330 $340 Estate/Trust 1,390 3,900 Family 2,320 Total Billable Hours Partners Associates Paralegals Interns Of Counsel Total Tax 3,588 1,857 1,090 1,690 Corporate 3,020 5,850 3,930 Property 1,530 1,875 1,970 Bankruptcy 1,380 1,710 1,052 2,100 2,120 Average 1,470 1,899 1,115 1,620 906 49,165 3,170 210 7,600 1,650 6,090 8,225 15,970 970 0.950 6,325 813 4,955Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started