Question

1.Distinguish between the three major foreign exchange exposures experienced by firms 2.Identify foreign exchange transaction exposure (at least 4 examples) 3.Analyze the pros and cons

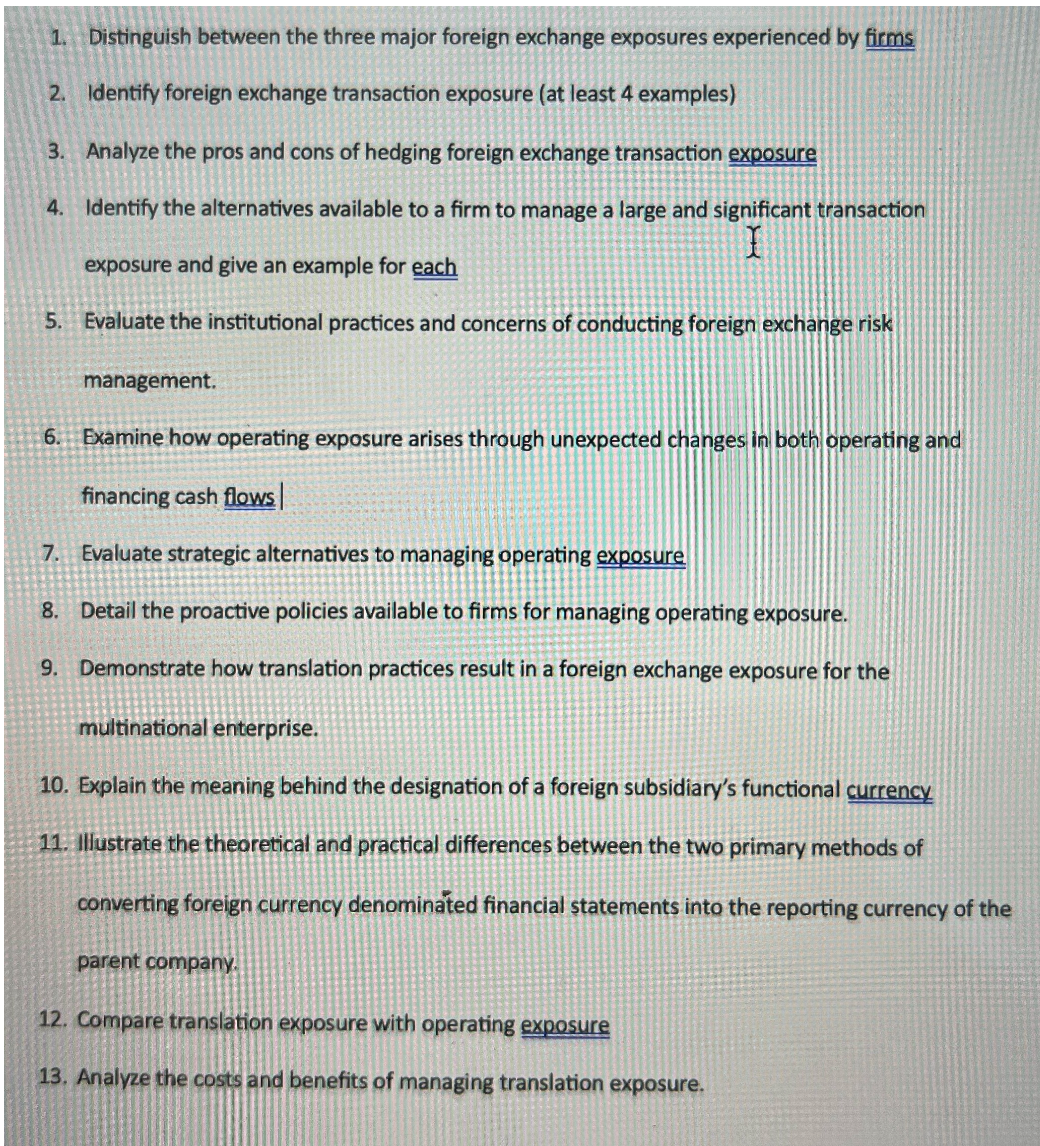

1.Distinguish between the three major foreign exchange exposures experienced by firms\ 2.Identify foreign exchange transaction exposure (at least 4 examples)\ 3.Analyze the pros and cons of hedging foreign exchange transaction exposure\ 4.Identify the alternatives available to a firm to manage a large and significant transaction exposure and give an example for each\ 5.Evaluate the institutional practices and concerns of conducting foreign exchange risk management.\ 6.Examine how operating exposure arises through unexpected changes in both operating and financing cash flows |\ 7.evaluate strategic alternatives to managing operating exposure\ 8.etail the proactive policies available to firms for managing operating exposure.\ 9. Demonstrate how translation practices result in a foreign exchange exposure for the\ multinational enterprise.\ 10.Explain the meaning behind the designation of a foreign subsidiary's functional currency\ 11.Illustrate the theoretical and practical differences between the two primary methods of\ converting foreign currency denominated financial statements into the reporting currency of the\ parent company. 12.Compare translation exposure with operating exposure\ Analyze the costs and benefits of managing translation exposure.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started