Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.Explain how the product costs is determined under the traditional overhead allocation system. 2.Explain how the product costs is determined under the ABC-based overhead allocation

1.Explain how the product costs is determined under the traditional overhead allocation system.

2.Explain how the product costs is determined under the ABC-based overhead allocation system.

3.What is the reason behind the difference in product costs under the two systems?

4.Which one you would prefer? Explain.

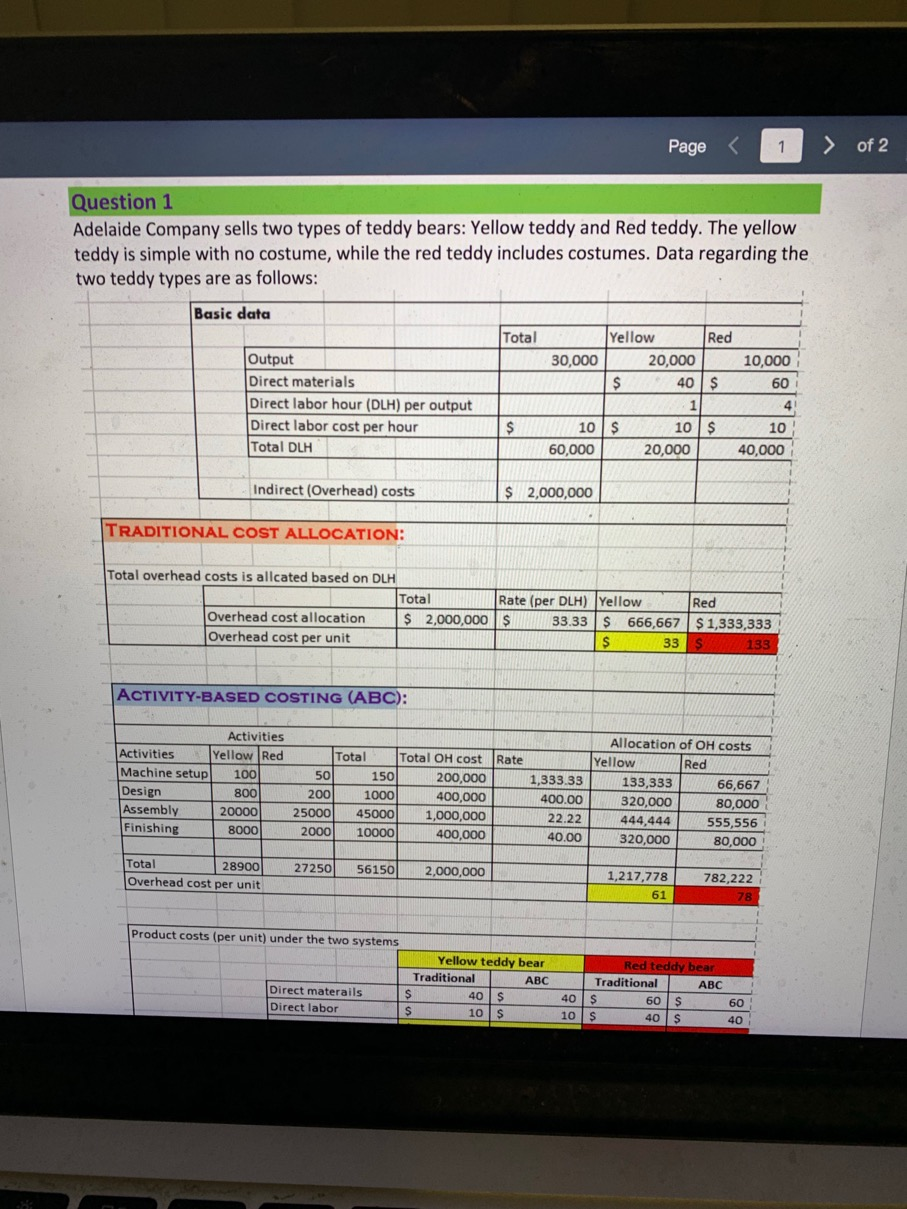

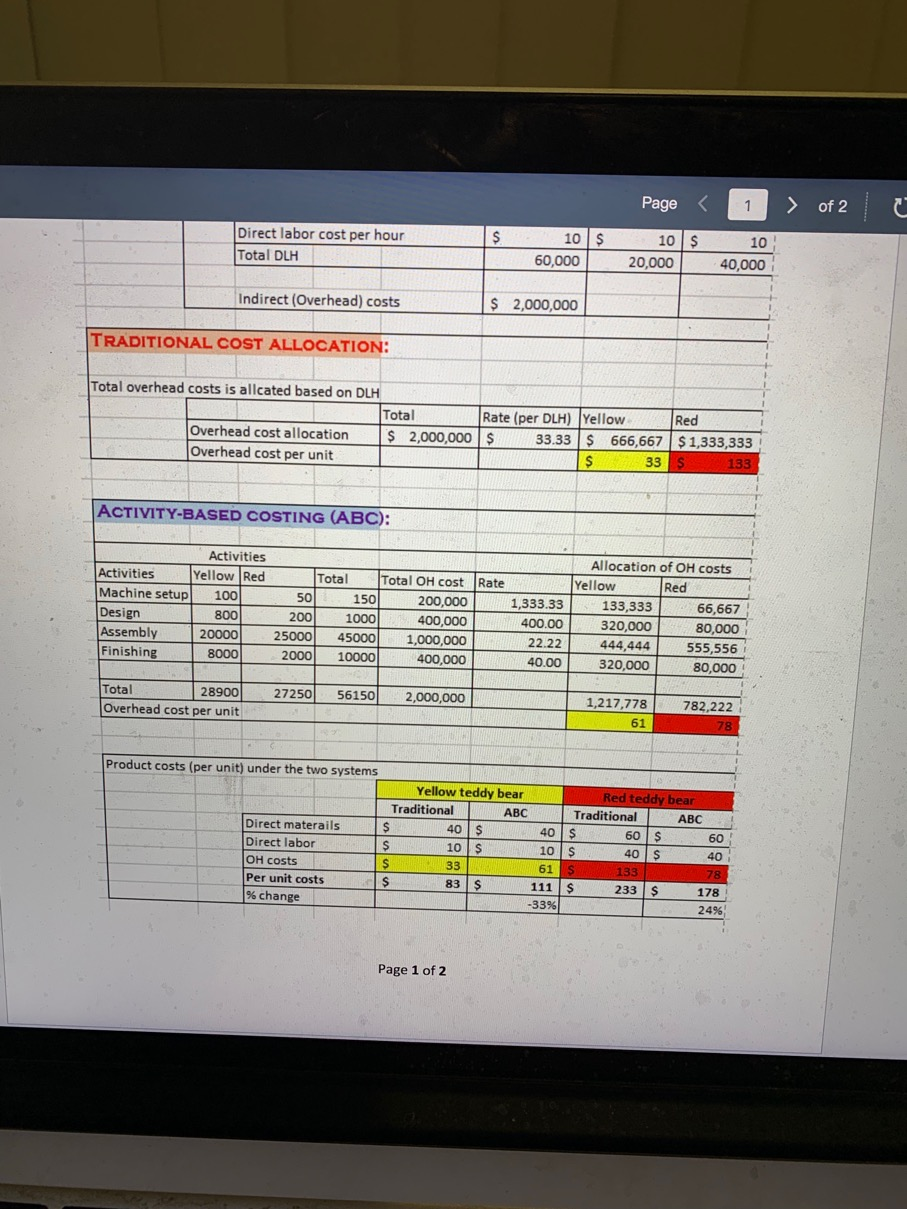

Page of 2 Question 1 Adelaide Company sells two types of teddy bears: Yellow teddy and Red teddy. The yellow teddy is simple with no costume, while the red teddy includes costumes. Data regarding the two teddy types are as follows: Basic data Total Yellow Red Output 30,000 20,000 10,000 Direct materials $ 40 $ 60 Direct labor hour (DLH) per output Direct labor cost per hour Total DLH 60,000 20,000 40,000 105 10 S Indirect (Overhead) costs $ 2,000,000 TRADITIONAL COST ALLOCATION: Total overhead costs is allcated based on DLH Total Rate (per DLH) Yellow Red Overhead cost allocation $ 2,000,000 $ 33.33 $ 666,667 $ 1,333,333 Overhead cost per unit $ 33 $ 133 ACTIVITY-BASED COSTING (ABC): Activities Yellow Red Machine setup 100 Design 800 Assembly 20000 Finishing 8000 Total Total OH cost Ra 150 200,000 1000 400,000 250001 45000 1,000,000 2000 10000 400,000 1,333.33 400.00 22.22 40.00 Allocation of OH costs Yellow Red 133,333 66,667 320,000 80,000 444,444 555,556 320,000 80,000 Total 28900 Overhead cost per unit 2 7250 56150 2,000,000 1,217,778 782,222 61 Product costs (per unit) under the two systems Yellow teddy bear Traditional ABC Direct materails $ 40$ Direct labor 10 $ Red teddy bear Traditional ABC 40 $ 60 $ 10 $ 40 $ Page of 2 | $ $ Direct labor cost per hour Total DLH 10 60,000 10 $ 20,000 10 40,000 Indirect (Overhead) costs $ 2,000,000 TRADITIONAL COST ALLOCATION: Total overhead costs is allcated based on DLH Total $ 2,000,000 Overhead cost allocation Overhead cost per unit Rate (per DLH) Yellow Red $ 33.33 $ 666,667 $ 1,333,333 S 33 S 133 ACTIVITY-BASED COSTING (ABC): Activities Activities Yellow Red Machine setup 100 Design 800 Assembly 20000 Finishing 8000 Total Total OH cost Rate 5 0 150 200,000 200 10001 400,000 25000 45000 1,000,000 2000 10000 400,000 Allocation of OH costs Yellow Red 133,333 66,667 320,000 80,000 444,444 555,556 320,000 80,000 1,333.33 400.00 22.22 40.00 5 RON 2 7250 56150 2,000,000 782,222 Total 28900 Overhead cost per unit 1,217,778 61 ABC Product costs (per unit) under the two systems Yellow teddy bear Traditional ABC Direct materails $ 40 S 40 Direct labore $ 105 10 OH costs $ 33 61 Per unit costs $ 83 111 % change -33% Red teddy bear Traditional $ 60 $ $ 40 $ S $ 233 $ 133 Page 1 of 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started