Question

1.Find Apple Inc.s 10-K filings that will give you their financial data for the past 5 years. Note: You could find it on Apple, Inc.s

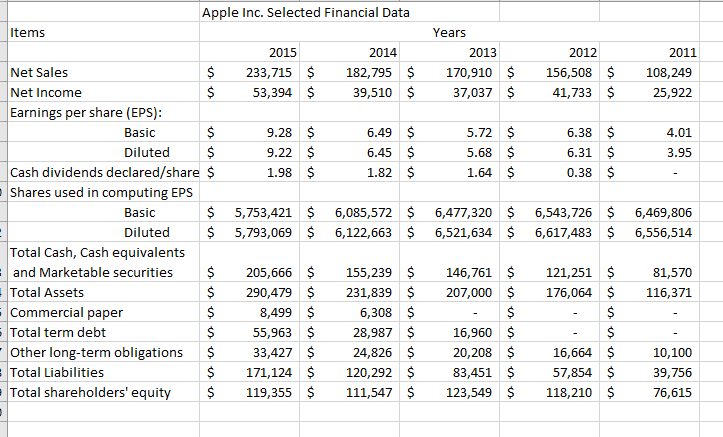

1.Find Apple Inc.s 10-K filings that will give you their financial data for the past 5 years. Note: You could find it on Apple, Inc.s investor relations website: http://investor.apple.com/financials.cfm, or in EDGAR. 2.Create a spreadsheet where you will enter the 5-year data from the report (from page 24 of Apples 2015 10-K report). 3.In your spreadsheet, build a similar set-up with the column in the left showing all the lines, e.g. from Net Sales down to Total Shareholders Equity. 4.Then create columns for the 5 years of historical data (2011) to (2015) you will note that their fiscal year ends in September. 5.Using this year-by-year historical data, calculate your 3, 5, and 10-year forecasts for each of the rows (i.e. Net Sales, etc., down to Total Shareholders Equity). You can choose which forecasting method you want to use, (remember your undergraduate statistics course) and there are refresher of various methods on the Internet. For example, here are some helpful videos and webpages on time-series analysis if you chose that method and need a refresher: a.https://www.youtube.com/watch?v=gHdYEZA50KE b.http://www.cimaglobal.com/Thought-leadership/Newsletters/Insight-e-magazine/Insight-2010/Insight-November-2010/Spreadsheet-skills-trendy-forecasting-in-Excel/ c.http://jcflowers1.iweb.bsu.edu/rlo/trendlines.htm 6.After you have completed your forecast, in a Word document, state the type of forecasting method you chose and why. Then write a brief statement as to why Apples Board of Directors should be confident in these forecasts (for the 3, 5, and 10 years). Remember that hundreds of millions of dollars are at stake. Only one page is necessary for this written statement. PLEASE SEE ATTACHED HISTORICAL DATA INSTEAD FOR APPLE INC.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started