Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1)Find the IRR of the difference between the base alternative and the second-choice alternative: IRR ( II - III ) = ??% (Round to one

1)Find the IRR of the difference between the base alternative and the second-choice alternative:

IRR ( II - III ) = ??% (Round to one decimal place.)

2)Find the IRR of the difference between the current base alternative and the third-choice alternative:

IRR ( ?? - ?? ) = ??% (Round to one decimal place.)

3)Which alternative should be chosen?

A. Alternative I

B. Alternative II

C.Alternative III

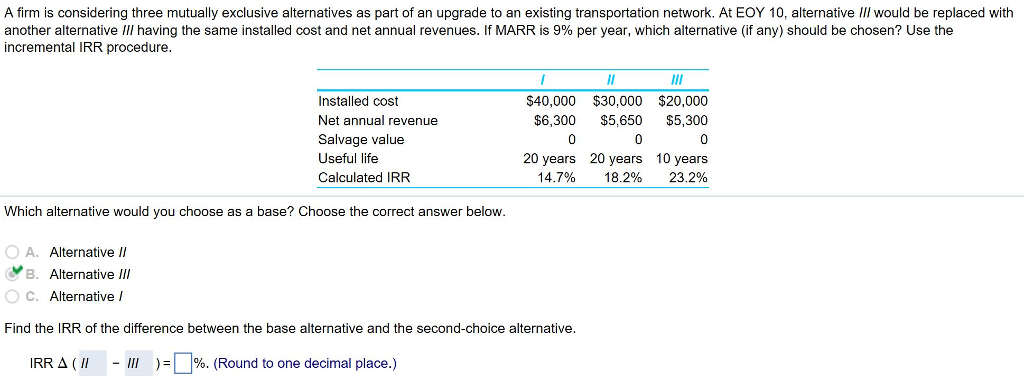

A firm is considering three mutually exclusive alternatives as part of an upgrade to an existing transportation network. At EOY 10, alternative I// would be replaced with another alternative /// having the same installed cost and net annual revenues. If MARR is 9% per year, which alternative (if any) should be chosen? Use the incremental IRR procedure Installed cost Net annual revenue Salvage value Useful life Calculated IRR $40,000 $30,000 $20,000 $6,300 $5,650 $5,300 20 years 14.7% 20 years 18.2% 10 years 23.2% Which alternative would you choose as a base? Choose the correct answer below O A. Alternative I B. AlternativeI O C. Alternative Find the IRR of the difference between the base alternative and the second-choice alternative IRR ( Il IRR ( // -m )=96, (Round to one decimal place.) )= | - /// %. (Round to one decimal place.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started