Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1)Firm A distrubuted dividends to its shareholders for the current year according to the payout ratio of 20%. Net profit was 120 million TL.

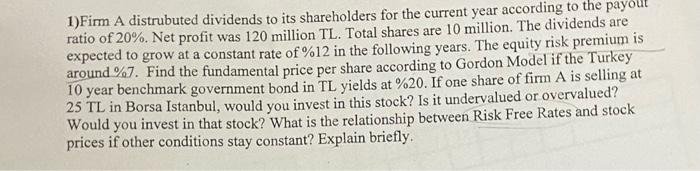

1)Firm A distrubuted dividends to its shareholders for the current year according to the payout ratio of 20%. Net profit was 120 million TL. Total shares are 10 million. The dividends are expected to grow at a constant rate of %12 in the following years. The equity risk premium is around %7. Find the fundamental price per share according to Gordon Model if the Turkey 10 year benchmark government bond in TL yields at %20. If one share of firm A is selling at 25 TL in Borsa Istanbul, would you invest in this stock? Is it undervalued or overvalued? Would you invest in that stock? What is the relationship between Risk Free Rates and stock prices if other conditions stay constant? Explain briefly.

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the fundamental price per share according to the Gordon Model we need to use the follow...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started