Question

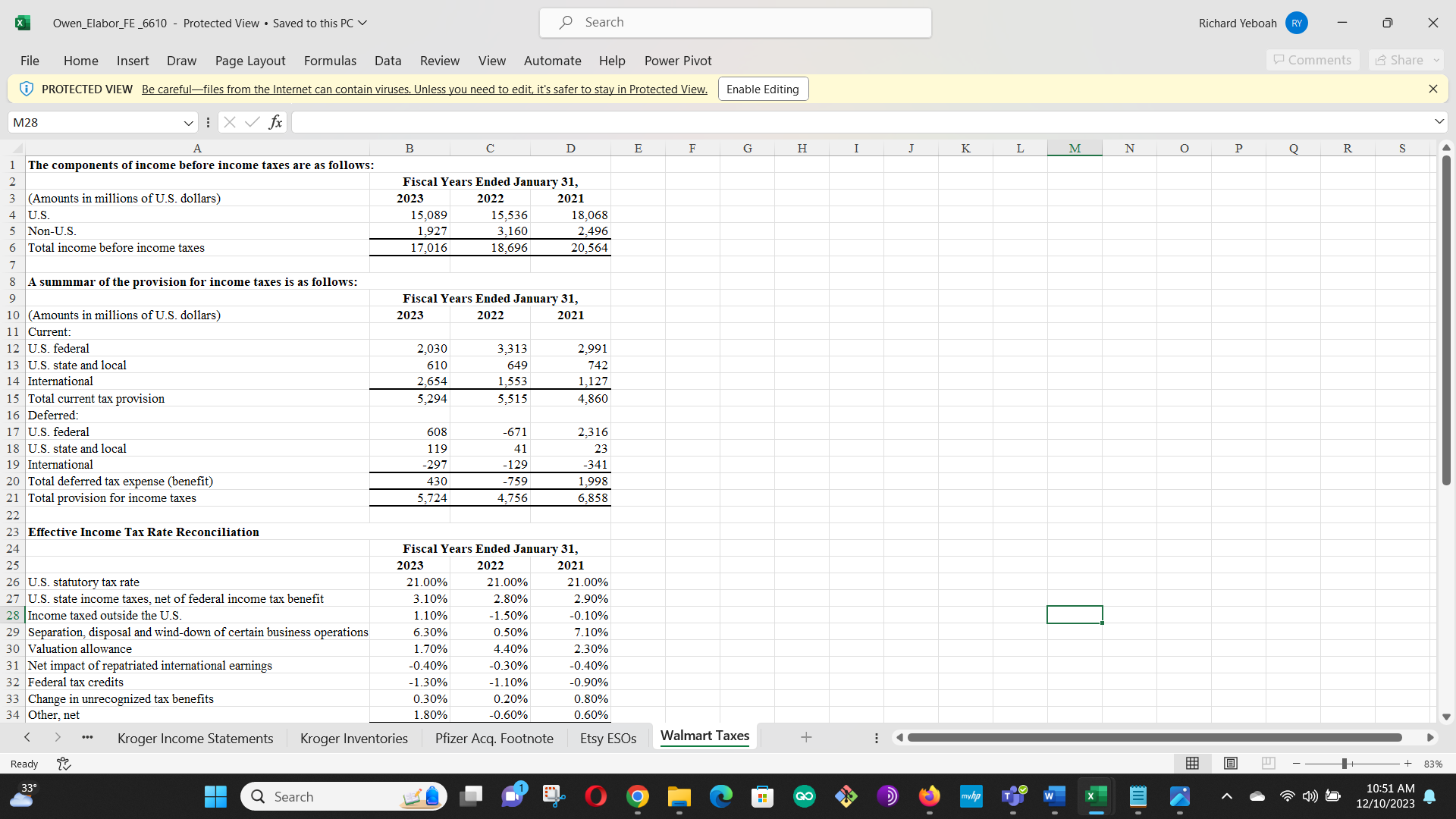

1.For the fiscal year that ended on January 31, 2023, estimate Walmarts taxable income per its U.S. federal tax return. If Walmart had taxable income

1.For the fiscal year that ended on January 31, 2023, estimate Walmarts taxable income per its U.S. federal tax return. If Walmart had taxable income (a tax loss), you should enter your answer as a positive (negative) amount. Your answer should be in millions of dollars. It should be an integer and you should omit the dollar sign.

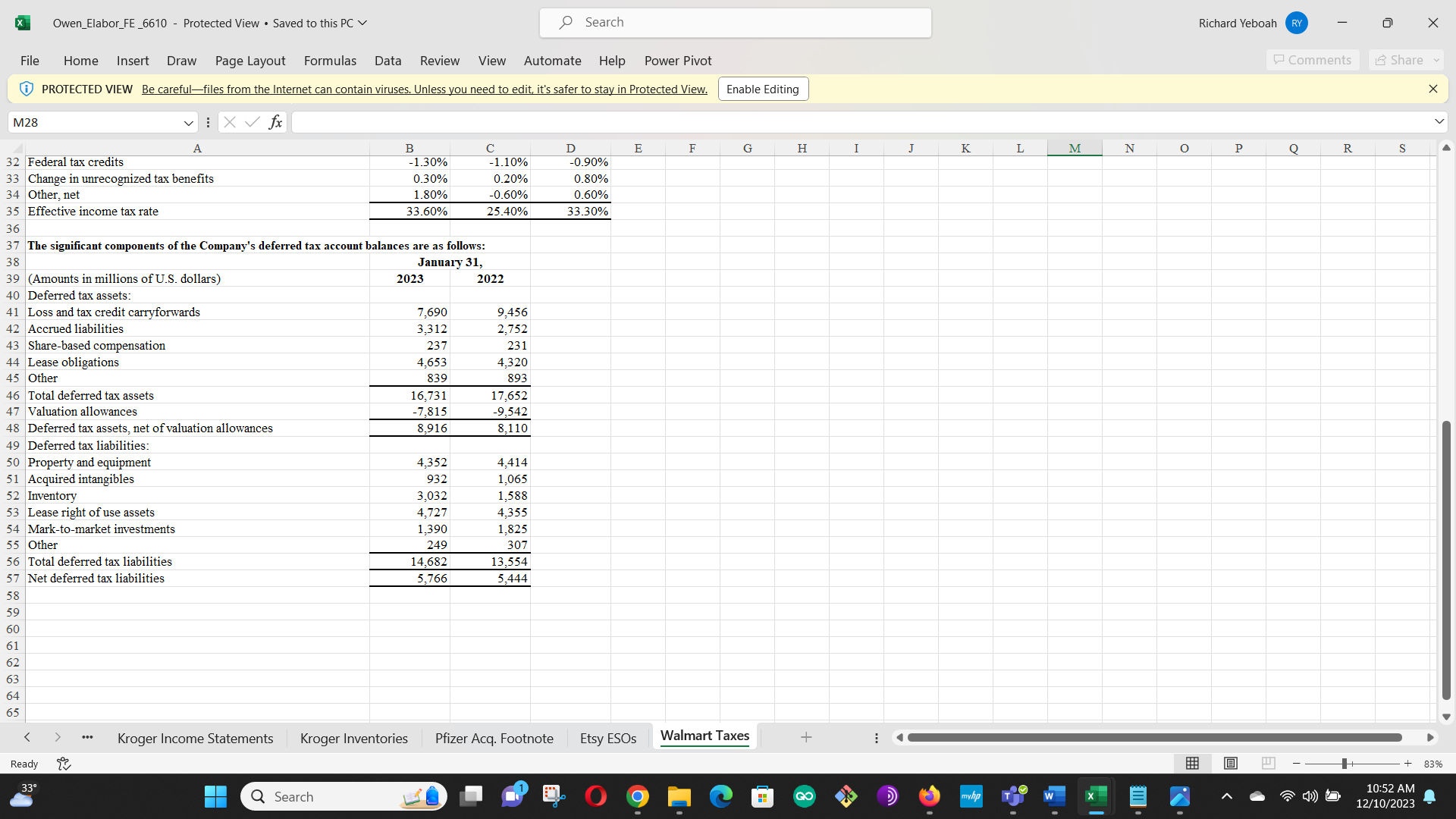

| 2.Use the information in the schedule of the components of Walmarts deferred tax assets and liabilities to estimate the difference on January 31, 2023 between the net book value of Walmarts property and equipment for financial reporting (i.e., GAAP) purposes and for tax purposes. If the net book value for GAAP is greater than (less than) the net book value for tax, you should enter your answer as a positive (negative) amount. Your answer should be in millions of dollars. It should be an integer and you should omit the dollar sign.

|

| Question 36 2.5 pts |

| 3.Use the information in the schedule of the components of Walmarts deferred tax assets and liabilities to estimate the difference in depreciation expense taken for financial reporting (i.e., GAAP) purposes and for tax purposes during the fiscal year that ended on January 31, 2023. If depreciation for GAAP purposes is greater than (less than) depreciation for tax purposes, you should enter your answer as a positive (negative) amount. Your answer should be in millions of dollars. It should be an integer and you should omit the dollar sign.

|

X Owen_Elabor_FE_6610 - Protected View - Saved to this PC Search Richard Yeboah RY File Home Insert Draw Page Layout Formulas Data Review View Automate Help Power Pivot Comments \&) Share PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing M28 :fx A C D E F G H I J K L M N O P Q R S The components of income before income taxes are as follows: (Amounts in millions of U.S. dollars) U.S. Non-U.S Total income before income taxes \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Fiscal Years Ended January 31, } \\ \hline 2023 & 2022 & 2021 \\ \hline 15,089 & 15,536 & 18,068 \\ \hline 1,927 & 3,160 & 2,496 \\ \hline 17,016 & 18,696 & 20,564 \\ \hline \end{tabular} A summmar of the provision for income taxes is as follows: (Amounts in millions of U.S. dollars) Fiscal Years Ended January 31, Current: U.S. federal 2023 2022 2021 U.S. state and local International Total current tax provision Deferred: U.S. federal U.S. state and local International Total deferred tax expense (benefit) Total provision for income taxes \begin{tabular}{|r|r|r|} 2,030 & 3,313 & 2,991 \\ \hline 610 & 649 & 742 \\ \hline 2,654 & 1,553 & 1,127 \\ \hline 5,294 & 5,515 & 4,860 \\ \hline & & \\ \hline 608 & -671 & 2,316 \\ \hline 119 & 41 & 23 \\ \hline-297 & -129 & -341 \\ \hline 430 & -759 & 1,998 \\ \hline 5,724 & 4,756 & 6,858 \\ \hline \end{tabular} Effective Income Tax Rate Reconciliation U.S. statutory tax rate U.S. state income taxes, net of federal income tax benefit Income taxed outside the U.S. Separation, disposal and wind-down of certain business operations Valuation allowance Net impact of repatriated international earnings Federal tax credits Change in unrecognized tax benefits Other, net \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Fiscal Years Ended January 31, } \\ \hline 2023 & 2022 & 2021 \\ \hline 21.00% & 21.00% & 21.00% \\ \hline 3.10% & 2.80% & 2.90% \\ \hline 1.10% & 1.50% & 0.10% \\ \hline 6.30% & 0.50% & 7.10% \\ \hline 1.70% & 4.40% & 2.30% \\ \hline0.40% & 0.30% & 0.40% \\ \hline1.30% & 1.10% & 0.90% \\ \hline 0.30% & 0.20% & 0.80% \\ \hline 1.80% & 0.60% & 0.60% \\ \hline \end{tabular} ... Kroger Income Statements Kroger Inventories Pfizer Acq. Footnote Etsy ESOs WalmartTaxes Ready Search 10 (O) () D) mvhp w (p)) 10:51 AM 12/10/2023 X Owen_Elabor_FE_6610 - Protected View - Saved to this PC Search Richard Yeboah RY File Home Insert Draw Page Layout Formulas Data Review View Automate Help Power Pivot Comments 6 Share (i) PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing M28 : fx 32 Federal tax credit Change in unrecognized tax benefits Other, net Effective income tax rate \begin{tabular}{|c|c|c|c|} \hline B & C & D & E \\ \hline1.30% & 1.10% & 0.90% & \\ \hline 0.30% & 0.20% & 0.80% & \\ \hline 1.80% & 0.60% & 0.60% & \\ \hline 33.60% & 25.40% & 33.30% & \\ \hline \end{tabular} F G H I J K L M N o P Q R S The significant components of the Company's deferred tax account balances are as follows: (Amounts in millions of U.S. dollars) January 31, Deferred tax assets: Loss and tax credit carryforwards Accrued liabilities Share-based compensation Lease obligations Other Total deferred tax assets Valuation allowances Deferred tax assets, net of valuation allowances Deferred tax liabilities: Property and equipment Acquired intangibles Inventory Lease right of use assets Mark-to-market investments Other Total deferred tax liabilities Net deferred tax liabilities \begin{tabular}{|r|r|} \hline \multicolumn{2}{|c|}{ January 31, } \\ \hline & \multicolumn{2}{|c|}{ 2022 } \\ \hline 7,690 & 9,456 \\ \hline 3,312 & 2,752 \\ 237 & 231 \\ 4,653 & 4,320 \\ 839 & 893 \\ \hline 16,731 & 17,652 \\ \hline7,815 & 9,542 \\ \hline 8,916 & 8,110 \\ \hline & \\ \hline 4,352 & 4,414 \\ \hline 932 & 1,065 \\ \hline 3,032 & 1,588 \\ \hline 4,727 & 4,355 \\ \hline 1,390 & 1,825 \\ \hline 249 & 307 \\ \hline 14,682 & 13,554 \\ \hline 5,766 & 5,444 \\ \hline \end{tabular} 58 59 60 61 62 63 65 Kroger Income Statements Kroger Inventories Pfizer Acq. Footnote Etsy ESOs WalmartTaxes Ready is 33 Search L9 9 = c (D) muhp T w x +83% 10:52 AM 12/10/2023

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started