Question

1-How can Aynur explain that modified IRRis a more realistic method when it is necessary to make decisions for simultaneous projects? No calculation is necessary.

1-How can Aynur explain that modified IRRis a more realistic method when it is necessary to make decisions for simultaneous projects? No calculation is necessary.

2-Calculate the profitability index. Can this solve Aynur's problem?

3-Looking at both cash flows, the ARAGON team's estimates show that it is a bit more pessimisticthan the APOCH team. What effect could this have on the analysis?

4-In the documents prepared by both project teams, ARAGON technology initially requires a seriousR&D, while APOCH technology is almost ready. What effect does this have on your analysis?Would it lead to a change in your calculations? Would it lead to a change in your decision making analysis?

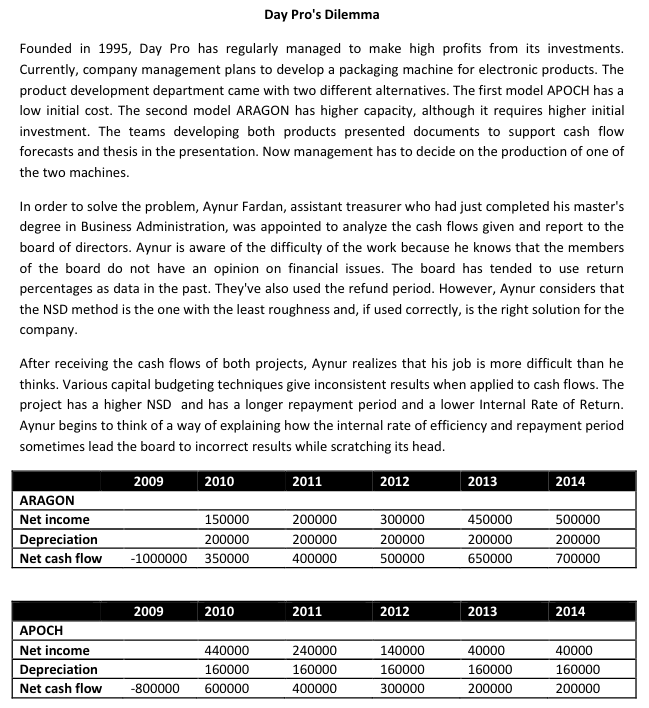

Day Pro's Dilemma Founded in 1995, Day Pro has regularly managed to make high profits from its investments. Currently, company management plans to develop a packaging machine for electronic products. The product development department came with two different alternatives. The first model APOCH has a low initial cost. The second model ARAGON has higher capacity, although it requires higher initial investment. The teams developing both products presented documents to support cash flow forecasts and thesis in the presentation. Now management has to decide on the production of one of the two machines. In order to solve the problem, Aynur Fardan, assistant treasurer who had just completed his master's degree in Business Administration, was appointed to analyze the cash flows given and report to the board of directors. Aynur is aware of the difficulty of the work because he knows that the members of the board do not have an opinion on financial issues. The board has tended to use return percentages as data in the past. They've also used the refund period. However, Aynur considers that the NSD method is the one with the least roughness and, if used correctly, is the right solution for the company. After receiving the cash flows of both projects, Aynur realizes that his job is more difficult than he thinks. Various capital budgeting techniques give inconsistent results when applied to cash flows. The project has a higher NSD and has a longer repayment period and a lower Internal Rate of Return. Aynur begins to think of a way of explaining how the internal rate of efficiency and repayment period sometimes lead the board to incorrect results while scratching its head. 2009 2010 2011 2012 2013 2014 ARAGON Net income Depreciation Net cash flow 150000 200000 -1000000 350000 200000 200000 400000 300000 200000 500000 450000 200000 650000 500000 200000 700000 2009 2010 2011 2012 2013 2014 APOCH Net income Depreciation Net cash flow 440000 160000 600000 240000 160000 400000 140000 160000 300000 40000 160000 200000 40000 160000 200000 -800000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started