Question: 1.Identify the services or programs to be included in the cost and profitability analysis. Examine the costs listed in Table 2. Identify the direct costs

-

1.Identify the services or programs to be included in the cost and profitability analysis.

1.Identify the services or programs to be included in the cost and profitability analysis. - Examine the costs listed in Table 2.

- Identify the direct costs associated with each service or program.

- Which costs would be organization-sustaining costs? Provide an argument for or against assigning these costs to services or programs.

- Identify the broad activity categories and create cost pools by assigning the costs from Table 2 to the pools.

- Identify the cost drivers that have a causal relationship to the activity cost pools created in Question 3.

- Calculate the activity or cost-driver rates for each cost pool. Note: You should develop rates that will allocate costs to ACDC programs and/or tenants only. You should not allocate any costs back to general administration.

- Using the services or programs identified in Question 1, determine service or program revenues, assign the costs to the service or programs, and calculate service or program profitability. A spreadsheet may be helpful with this task.

- Based upon your calculations in Question 6, which services or programs are operating successfully? What appears to be the determining factor in whether the service or program is profitable?

- Discuss at least three alternatives for improving the overall profitability of the daycare facility

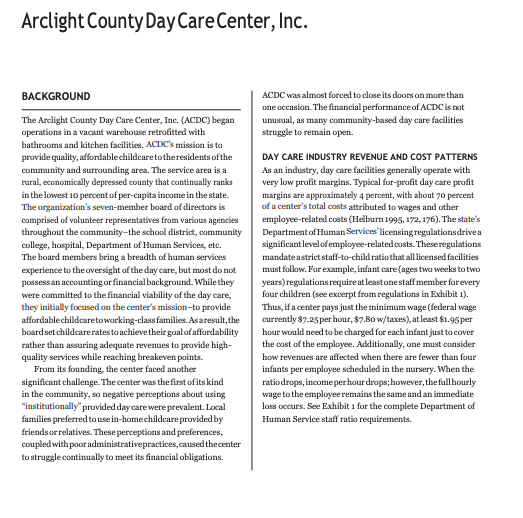

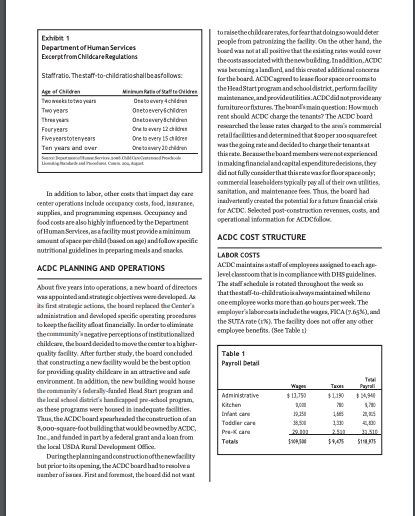

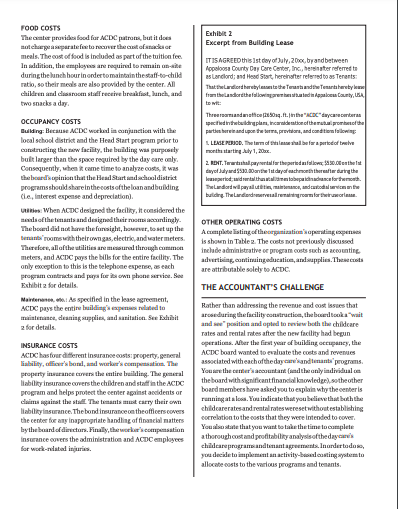

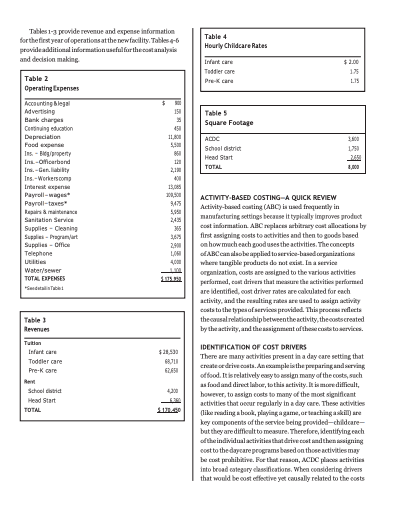

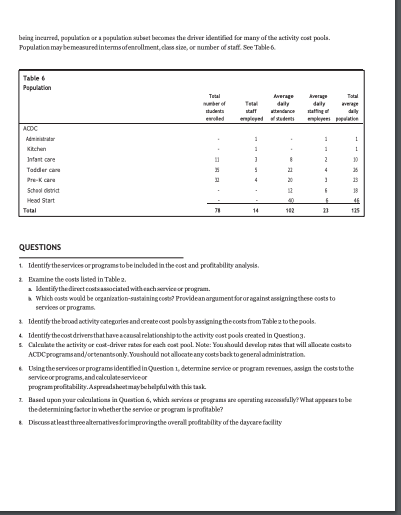

Arclight County Day Care Center, Inc. BACKGROUND The Arclight County Day Care Center, Inc. (ACDC) began operations in a vacant warehouse retrofitted with bathrooms and kitchen facilities. ACDC's mission is to provide quality, affordable childcare to the residents of the community and surrounding area. The service area is a rural, economically depressed county that continually ranks in the lowest 10 percent of per-capita income in the state. The organization's seven-member board of directors is comprised of volunteer representatives from various agencies throughout the community-the school district, community college, hospital, Department of Human Services, etc. The board members bring a breadth of human services experience to the oversight of the day care, but most do not possess an accounting or financial background. While they were committed to the financial viability of the day care, they initially focused on the center's mission to provide affordable childcaretoworking-class families. Asaresult, the board set childcare rates to achieve their goal of affordability rather than assuring adequate revenues to provide high- quality services while reaching breakeven points. From its founding the center faced another significant challenge. The center was the first of its kind in the community, so negative perceptions about using "institutionally provided day care were prevalent. Local families preferred to use in-homechildcare provided by friends or relatives. These perceptions and preferences, coupled with poor administrativepractices,caused the center to struggle continually to meet its financial obligations. ACDC was almost forced to close its doors on more than one occasion. The financial performance of ACDC is not unusual, as many community-based day care facilities struggle to remain open. DAY CARE INDUSTRY REVENUE AND COST PATTERNS As an industry, day care facilities generally operate with very low profit margins. Typical for-profit day care profit margins are approximately 4 percent, with about 70 percent of a center's total costs attributed to wages and other employee-related costs (Helburn 1995, 172,176). The state's Department of Human Services "licensing regulations drive a significant level of employee-related costs. These regulations mandate astrict staff-to-child ratio that all licensed facilities must follow. For example, infant care (ages two weeks to two years)regulations require at leastonestaff member for every four children (see excerpt from regulations in Exhibit 1). Thus, if a center pays just the minimum wage (federal wage currently $7-25 per hour, $7.Bow/taxes), at least $1.95 per hour would need to be charged for each infant just to cover the cast of the employee. Additionally, one must consider how revenues are affected when there are fewer than four infants per employee scheduled in the nursery. When the ratio drops, income per hour drops; however, the full hourly wage to the employee remains the same and an immediate loss occurs. See Exhibit 1 for the complete Department of Human Service staff ratio requirements. Exhibit Department of Human Services Excerpt fromChildcareRegulations Staffatio. The staff-to-childratio shall beasfollows: Minares To store years Orato every children Two years Oneto every children Three years On toevery children Four years Onetowych Five yearstotenyears One to every children Ten years and over Orta very children Spildhoo to raise the childcare rates for fear that doing so would deter people from patronizing the facility. On the other hand, the bed was wat all positive that the single would cover the costs associated with thenewbuilding. In addition, ACDC was betoningaland, and this cristal additional como for the board ACDC to floarea roto the Head Startprogram and school distrikt perform facility maintenance and providestilities. ACDC diaproxidery fumiturearfixtures. The lard's main question: How much rent should ACDC charge the tenants? The ACDC board reached the sale curged to the commascial retallfacilities and determined that per square feet was the going ratesand decided to change their tenantsat this rate. Becamatheboard members were experime Inmakingtinandaland capital expenditure decisions they did not fully consider that this was forospaceonly commercial leaseholders typkally pay all of their own utilities sanitation, and maintenance fees. Thus, the board had inailarterly created the pebemtial for a future financial crisis for ACDC, Selected post constructions, costs, and operational information for ACDfollo ACDC COST STRUCTURE LABOR COSTS ACDC maittaire staff of comployees and teachage Jewel classroom that is incompliance with Disguidelines. The stal schedule is rotated throughout the works that the all-to-chuldetaisalwaysmaisia whileno one employee works more than go hours per week. The employer's laberostsin dudetheways, FICA (9.65%), and the SUTA rate(13) The facility does not offer any other employee benefits. (See Table 1) In addition to labor, other the impact day care center operations include occupancy costs, food, insurance, supplies, and programming expense Occupancy and food costs are also highly influenced by the Department of Human Services sa facility must provide minimum amount of space per childunge) and follow specific nutritional guidelines in preparing meals and snacks ACDC PLANNING AND OPERATIONS Table 1 Payroll Detail About five years into operations, a new board of directores was appointed and strategic objectives Wiese developed. As its first strategies, the bird replaced the Centers suministration and developed piletine procedure to keep the facility allout financially. In order to diminatie the community negative perceptions of institutionalized child, the board decided to move the center toshigher- quality facility. After further study, the board concluded that constructing a new facility would be the best option for providing quality childcare in an active anale environment. In addition, the new building would house the community's federal-Saaled Head Start program and the local school distries indicapped pre-school program, as these programs were found in deque facilities Thus, the band sprealed the construction dan 8000-square-footballding that would beowned by ACIC, Inc., and funded in part by a federal grant and a loan from the local USDA Rural Development During the planningand constructionofthenewclity but price to its opening the ACDC board had tools umber of bus. First and fresco, the board did not want Te $11.750 $1.190 $14, Administrative Kitchen Incare Tadder care Pre-K care Tatals $9.05 5115 Exhibit Excerpt from Building Lease ITIS AGREED this Ist day of July, 200x, band between Appaloosa County Day Care Center, Inc., hereinater referred to as Landlord; and Head Start, hereinafter referred to as Terents: That the Lardiorderbyltethe Termasband the Tearshereby fra heladordelighted to my to : Threesomandate 2009.Ft.In the day care center pacted in the buildingplan, nocardention of them prometo the parte bereand upon the bors, protams, and condition slowing L LEASE PERIOD. The termostal befar apertedo trele 2. RONT. Teata pantalar the period flowestheist tayot Salyand $500. On the lat day of anchmonth theretter durtry the seperiod wadunaltheatretchdance for the month The Landard wilayaluit, males, and custodial service building. The Landardeverwarm. FOOD COSTS The cont provide food for ACDC patrone, but it does mot chopparatefore the color meals. The cost of food is included as part of the tuition fee. Inition, the employs are required to main anaite during the lunchbourin order to maintain the staff-to-child ratio, so their meals are also provided by the center. Al children anal classroonstad receive breakfast, lunch, and two stacks a day OCCUPANCY COSTS Building: Because ACDC worked in conjunction with the local school district and the Head Start program prior to Catstructing the facility, the building was purposely bult larger than the space required by the day care only Consequently, when I came time to analyze costs, was the boards opinion that the Head Startsindschooldistrict programs should share in the cast of the loan and building che, interest expense and depreciation). When ACDC designed the facility, it considered the the tants and designed their soundingly The bound there the fansight, however, to set up the Bernts' rooms with their own gas, electric, and watermeters. Therefore, all the utilities are mural through comme meters and Copy the Wills for the entire facility. The only exception to this is the telephone expense, as each program contracts and perya fewn phone service. See Exhibit 2 for details. Martes, As specified in the lease agreement, ACDC pays the entire willing speed to maintenance, ceaning supplies, and sanitation. See Editbit 2 for details INSURANCE COSTS ACDC has four different insurance costs property.pl liability,'bord, and worker's comprom. The property inverance covers the entire building. The general liability Insurance covers the children and staff in the ACDC program and helps protect the center against accidents or claims against the stad The Imants mit carry their own liability insurance. The bond insurance on theofficers covers the center for any loappropriate handling of financial matters by the board of directors. Finally, the works.compensation Insurance covers the administration and ACDC employees for week-natal injuries OTHER OPERATING COSTS A compte listing of the crimization's operating experts Is shown in Table 2. The costs not previously discussed include administrative program costs such as accounting advertising, continuing education and supplies. Thesecco are attributable solely to ACDC THE ACCOUNTANT'S CHALLENGE Rather than addressing the revenue and cost issues that acceduring the facility construction, the book wait and seeposition and epled to view both the childcare rates and rental rates after the new facility had begun operaties. Aber the first year of building occupancy, the ACDC board wanted to evaluate the costs and revenues associated with eachofthedaycandante programs. You see the center'auntant (and the only individuale the board with significant fan wedge.thother board members have asked you to explain why the centers running at sco. Yus italicate that you believe that both the childcarerates and rental rates werest without establishing correlation to the costs that they were intended to cover. You state that you want to take the time to complete a thorough cost and profitability analysis ofthedaycare's childcareprogram and managements. Inorder todos, you decide to implement activity-boosting allocate costs to the various programs and tenants. Tables 1-3 provide revenue and expense information for the first year of operations at the new facility. Tables-6 pravidladditional information useful for the costanalysis and decision making Table 4 Hourly Childcare Rates $2.00 Infant care Toddler care Precare LIS $ Table 2 Operating penses Accounting bal Bank charges Continuing education Depreciation Food 11,800 Tables Square Footage ADDC School district Head Start TOTAL 3.100 1750 24 3.000 -Officerband 11 Ins-Workers.com 13/08 5.00 36 Payroll Payrolles Regimas Sanitation Service Supplies - Cleaning Sup Pragut Supplies - Telephone ulte Water/sewer TOTAL EXPENSES 2,90 LOH Table) ACTIVITY-BASED COSTING A QUICK REVIEW Activity-badcasting (ABC) is used frequently in manufacturing settings because it typically improves product confirmation ABC places by collocaties by first assigning costs to activities and then to goods based on how much each gooduses the activities. The concepts ABC csobe applied to service-based emissions Whawe tangible pelucta de tot exist. In a service organization, costs are signed to the various activities perdama, cast drivers that measure the activities performed are identified cost driver rates are calculated for each activity, and the resulting rides are used to sign activity costs to the types of services provided. This processes the crual relationship betweenthe activity, the costs created by the activity, and the assignment of the services. IDENTIFICATION OF COST DRIVERS There are many activities present in a day care setting that createdrive costs. An emple is the preparing and serving of food. It is relatively easy to assign many of the costs, such asfaldilabe, to this activity. It is meedifficult, however, to assign costs to many of the most significant activities that our regularly in a day care. These activities (Tilast realing a basis, playing a gume, ar kathingadi) are key components of the service being provided-childcare- but they are difficult to measure. Therefore, identifying each of the individual activities that drive contraigning cost to the daycare programs based on those activities may best prisitive. For that reason, ACDC plas activities into broad category classifications. When considering delvers that would be cost effective yet causally related to the costs Tuition Infant care Toddler care Pre-K care Rev Scholar Head Start TOTAL $21.53 68.11 4300 21.00 being incurred, population or a population about become the driver identified for many of the activity cool pools. Population may bemeasured interms of enrollment, elessle, or number of staff. See Table 8 Tablet Population Total Average wall was w wendence ACDC 1 3 3 1 1 1 2 8 Kitchen Intant care Toddler Pre-K care School district Head Start Tatal 26 13 4 3 6 5 11 78 14 102 175 QUESTIONS 1. Identify the services or programs to be included in the cost and profitability analysis. 2. Examine the costs listed in Table Wythe direcciate with eachervice program. Which costs would be veganization-sustaining costs? Providean argumentoror against assigning these costs to services or programs 2. Identify the broad activity categories and create cost pools by assigning the costs from Table za to the pools. 4. Identify the cost drivers that have avansal relationship to the activity cost pools created in Question Calculate the activity or cost-drive rates for ach cost pool. Note: You should develop rates that will allocate to ACDC programs and/orterents coly.Yashould not allocate anycosts back to general administration & Using the services or programes identified in Question determine service or program revenges assign the costs tothe service programs and calculate service program profitability. At maybelwith this task I. Based upon your calculations in Question, which wervices or programs are operating sababully? What appears to be the determining factor in whether the service de program isprofitable? & Discuss at least three alternatbestecimprovingthe overall profitability of the daycare facility Arclight County Day Care Center, Inc. BACKGROUND The Arclight County Day Care Center, Inc. (ACDC) began operations in a vacant warehouse retrofitted with bathrooms and kitchen facilities. ACDC's mission is to provide quality, affordable childcare to the residents of the community and surrounding area. The service area is a rural, economically depressed county that continually ranks in the lowest 10 percent of per-capita income in the state. The organization's seven-member board of directors is comprised of volunteer representatives from various agencies throughout the community-the school district, community college, hospital, Department of Human Services, etc. The board members bring a breadth of human services experience to the oversight of the day care, but most do not possess an accounting or financial background. While they were committed to the financial viability of the day care, they initially focused on the center's mission to provide affordable childcaretoworking-class families. Asaresult, the board set childcare rates to achieve their goal of affordability rather than assuring adequate revenues to provide high- quality services while reaching breakeven points. From its founding the center faced another significant challenge. The center was the first of its kind in the community, so negative perceptions about using "institutionally provided day care were prevalent. Local families preferred to use in-homechildcare provided by friends or relatives. These perceptions and preferences, coupled with poor administrativepractices,caused the center to struggle continually to meet its financial obligations. ACDC was almost forced to close its doors on more than one occasion. The financial performance of ACDC is not unusual, as many community-based day care facilities struggle to remain open. DAY CARE INDUSTRY REVENUE AND COST PATTERNS As an industry, day care facilities generally operate with very low profit margins. Typical for-profit day care profit margins are approximately 4 percent, with about 70 percent of a center's total costs attributed to wages and other employee-related costs (Helburn 1995, 172,176). The state's Department of Human Services "licensing regulations drive a significant level of employee-related costs. These regulations mandate astrict staff-to-child ratio that all licensed facilities must follow. For example, infant care (ages two weeks to two years)regulations require at leastonestaff member for every four children (see excerpt from regulations in Exhibit 1). Thus, if a center pays just the minimum wage (federal wage currently $7-25 per hour, $7.Bow/taxes), at least $1.95 per hour would need to be charged for each infant just to cover the cast of the employee. Additionally, one must consider how revenues are affected when there are fewer than four infants per employee scheduled in the nursery. When the ratio drops, income per hour drops; however, the full hourly wage to the employee remains the same and an immediate loss occurs. See Exhibit 1 for the complete Department of Human Service staff ratio requirements. Exhibit Department of Human Services Excerpt fromChildcareRegulations Staffatio. The staff-to-childratio shall beasfollows: Minares To store years Orato every children Two years Oneto every children Three years On toevery children Four years Onetowych Five yearstotenyears One to every children Ten years and over Orta very children Spildhoo to raise the childcare rates for fear that doing so would deter people from patronizing the facility. On the other hand, the bed was wat all positive that the single would cover the costs associated with thenewbuilding. In addition, ACDC was betoningaland, and this cristal additional como for the board ACDC to floarea roto the Head Startprogram and school distrikt perform facility maintenance and providestilities. ACDC diaproxidery fumiturearfixtures. The lard's main question: How much rent should ACDC charge the tenants? The ACDC board reached the sale curged to the commascial retallfacilities and determined that per square feet was the going ratesand decided to change their tenantsat this rate. Becamatheboard members were experime Inmakingtinandaland capital expenditure decisions they did not fully consider that this was forospaceonly commercial leaseholders typkally pay all of their own utilities sanitation, and maintenance fees. Thus, the board had inailarterly created the pebemtial for a future financial crisis for ACDC, Selected post constructions, costs, and operational information for ACDfollo ACDC COST STRUCTURE LABOR COSTS ACDC maittaire staff of comployees and teachage Jewel classroom that is incompliance with Disguidelines. The stal schedule is rotated throughout the works that the all-to-chuldetaisalwaysmaisia whileno one employee works more than go hours per week. The employer's laberostsin dudetheways, FICA (9.65%), and the SUTA rate(13) The facility does not offer any other employee benefits. (See Table 1) In addition to labor, other the impact day care center operations include occupancy costs, food, insurance, supplies, and programming expense Occupancy and food costs are also highly influenced by the Department of Human Services sa facility must provide minimum amount of space per childunge) and follow specific nutritional guidelines in preparing meals and snacks ACDC PLANNING AND OPERATIONS Table 1 Payroll Detail About five years into operations, a new board of directores was appointed and strategic objectives Wiese developed. As its first strategies, the bird replaced the Centers suministration and developed piletine procedure to keep the facility allout financially. In order to diminatie the community negative perceptions of institutionalized child, the board decided to move the center toshigher- quality facility. After further study, the board concluded that constructing a new facility would be the best option for providing quality childcare in an active anale environment. In addition, the new building would house the community's federal-Saaled Head Start program and the local school distries indicapped pre-school program, as these programs were found in deque facilities Thus, the band sprealed the construction dan 8000-square-footballding that would beowned by ACIC, Inc., and funded in part by a federal grant and a loan from the local USDA Rural Development During the planningand constructionofthenewclity but price to its opening the ACDC board had tools umber of bus. First and fresco, the board did not want Te $11.750 $1.190 $14, Administrative Kitchen Incare Tadder care Pre-K care Tatals $9.05 5115 Exhibit Excerpt from Building Lease ITIS AGREED this Ist day of July, 200x, band between Appaloosa County Day Care Center, Inc., hereinater referred to as Landlord; and Head Start, hereinafter referred to as Terents: That the Lardiorderbyltethe Termasband the Tearshereby fra heladordelighted to my to : Threesomandate 2009.Ft.In the day care center pacted in the buildingplan, nocardention of them prometo the parte bereand upon the bors, protams, and condition slowing L LEASE PERIOD. The termostal befar apertedo trele 2. RONT. Teata pantalar the period flowestheist tayot Salyand $500. On the lat day of anchmonth theretter durtry the seperiod wadunaltheatretchdance for the month The Landard wilayaluit, males, and custodial service building. The Landardeverwarm. FOOD COSTS The cont provide food for ACDC patrone, but it does mot chopparatefore the color meals. The cost of food is included as part of the tuition fee. Inition, the employs are required to main anaite during the lunchbourin order to maintain the staff-to-child ratio, so their meals are also provided by the center. Al children anal classroonstad receive breakfast, lunch, and two stacks a day OCCUPANCY COSTS Building: Because ACDC worked in conjunction with the local school district and the Head Start program prior to Catstructing the facility, the building was purposely bult larger than the space required by the day care only Consequently, when I came time to analyze costs, was the boards opinion that the Head Startsindschooldistrict programs should share in the cast of the loan and building che, interest expense and depreciation). When ACDC designed the facility, it considered the the tants and designed their soundingly The bound there the fansight, however, to set up the Bernts' rooms with their own gas, electric, and watermeters. Therefore, all the utilities are mural through comme meters and Copy the Wills for the entire facility. The only exception to this is the telephone expense, as each program contracts and perya fewn phone service. See Exhibit 2 for details. Martes, As specified in the lease agreement, ACDC pays the entire willing speed to maintenance, ceaning supplies, and sanitation. See Editbit 2 for details INSURANCE COSTS ACDC has four different insurance costs property.pl liability,'bord, and worker's comprom. The property inverance covers the entire building. The general liability Insurance covers the children and staff in the ACDC program and helps protect the center against accidents or claims against the stad The Imants mit carry their own liability insurance. The bond insurance on theofficers covers the center for any loappropriate handling of financial matters by the board of directors. Finally, the works.compensation Insurance covers the administration and ACDC employees for week-natal injuries OTHER OPERATING COSTS A compte listing of the crimization's operating experts Is shown in Table 2. The costs not previously discussed include administrative program costs such as accounting advertising, continuing education and supplies. Thesecco are attributable solely to ACDC THE ACCOUNTANT'S CHALLENGE Rather than addressing the revenue and cost issues that acceduring the facility construction, the book wait and seeposition and epled to view both the childcare rates and rental rates after the new facility had begun operaties. Aber the first year of building occupancy, the ACDC board wanted to evaluate the costs and revenues associated with eachofthedaycandante programs. You see the center'auntant (and the only individuale the board with significant fan wedge.thother board members have asked you to explain why the centers running at sco. Yus italicate that you believe that both the childcarerates and rental rates werest without establishing correlation to the costs that they were intended to cover. You state that you want to take the time to complete a thorough cost and profitability analysis ofthedaycare's childcareprogram and managements. Inorder todos, you decide to implement activity-boosting allocate costs to the various programs and tenants. Tables 1-3 provide revenue and expense information for the first year of operations at the new facility. Tables-6 pravidladditional information useful for the costanalysis and decision making Table 4 Hourly Childcare Rates $2.00 Infant care Toddler care Precare LIS $ Table 2 Operating penses Accounting bal Bank charges Continuing education Depreciation Food 11,800 Tables Square Footage ADDC School district Head Start TOTAL 3.100 1750 24 3.000 -Officerband 11 Ins-Workers.com 13/08 5.00 36 Payroll Payrolles Regimas Sanitation Service Supplies - Cleaning Sup Pragut Supplies - Telephone ulte Water/sewer TOTAL EXPENSES 2,90 LOH Table) ACTIVITY-BASED COSTING A QUICK REVIEW Activity-badcasting (ABC) is used frequently in manufacturing settings because it typically improves product confirmation ABC places by collocaties by first assigning costs to activities and then to goods based on how much each gooduses the activities. The concepts ABC csobe applied to service-based emissions Whawe tangible pelucta de tot exist. In a service organization, costs are signed to the various activities perdama, cast drivers that measure the activities performed are identified cost driver rates are calculated for each activity, and the resulting rides are used to sign activity costs to the types of services provided. This processes the crual relationship betweenthe activity, the costs created by the activity, and the assignment of the services. IDENTIFICATION OF COST DRIVERS There are many activities present in a day care setting that createdrive costs. An emple is the preparing and serving of food. It is relatively easy to assign many of the costs, such asfaldilabe, to this activity. It is meedifficult, however, to assign costs to many of the most significant activities that our regularly in a day care. These activities (Tilast realing a basis, playing a gume, ar kathingadi) are key components of the service being provided-childcare- but they are difficult to measure. Therefore, identifying each of the individual activities that drive contraigning cost to the daycare programs based on those activities may best prisitive. For that reason, ACDC plas activities into broad category classifications. When considering delvers that would be cost effective yet causally related to the costs Tuition Infant care Toddler care Pre-K care Rev Scholar Head Start TOTAL $21.53 68.11 4300 21.00 being incurred, population or a population about become the driver identified for many of the activity cool pools. Population may bemeasured interms of enrollment, elessle, or number of staff. See Table 8 Tablet Population Total Average wall was w wendence ACDC 1 3 3 1 1 1 2 8 Kitchen Intant care Toddler Pre-K care School district Head Start Tatal 26 13 4 3 6 5 11 78 14 102 175 QUESTIONS 1. Identify the services or programs to be included in the cost and profitability analysis. 2. Examine the costs listed in Table Wythe direcciate with eachervice program. Which costs would be veganization-sustaining costs? Providean argumentoror against assigning these costs to services or programs 2. Identify the broad activity categories and create cost pools by assigning the costs from Table za to the pools. 4. Identify the cost drivers that have avansal relationship to the activity cost pools created in Question Calculate the activity or cost-drive rates for ach cost pool. Note: You should develop rates that will allocate to ACDC programs and/orterents coly.Yashould not allocate anycosts back to general administration & Using the services or programes identified in Question determine service or program revenges assign the costs tothe service programs and calculate service program profitability. At maybelwith this task I. Based upon your calculations in Question, which wervices or programs are operating sababully? What appears to be the determining factor in whether the service de program isprofitable? & Discuss at least three alternatbestecimprovingthe overall profitability of the daycare facility

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts