Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what are the sustaining and direct cost. identify the cost drivers that have a casual relationship to the acticity cost pool calculate the cost driver

what are the sustaining and direct cost. identify the cost drivers that have a casual relationship to the acticity cost pool calculate the cost driver for each pools

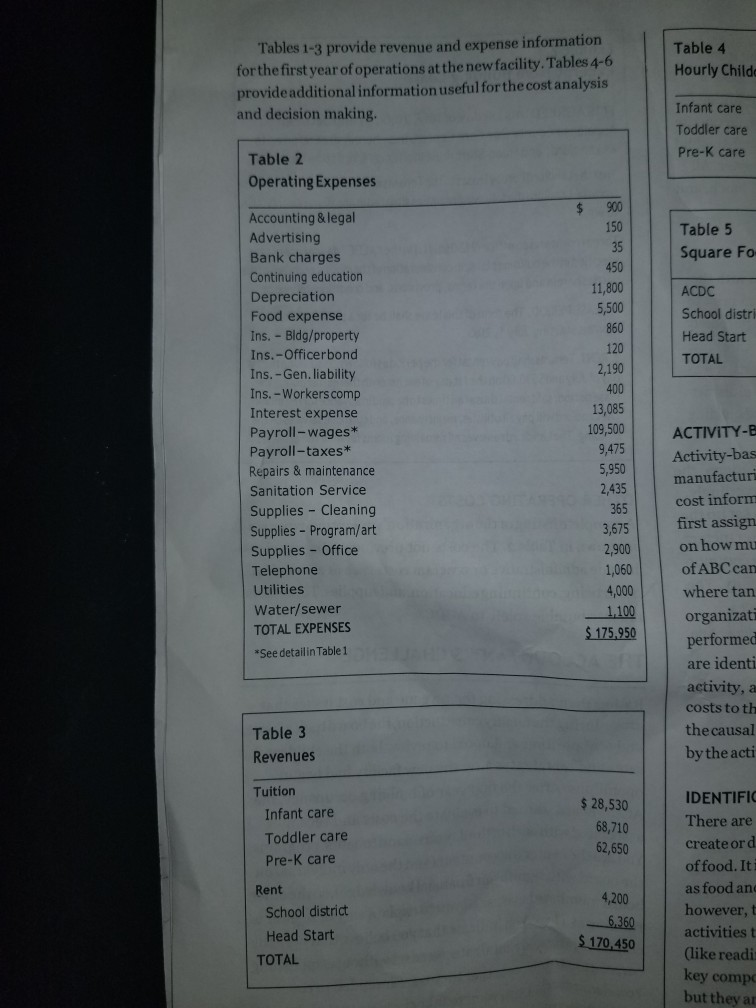

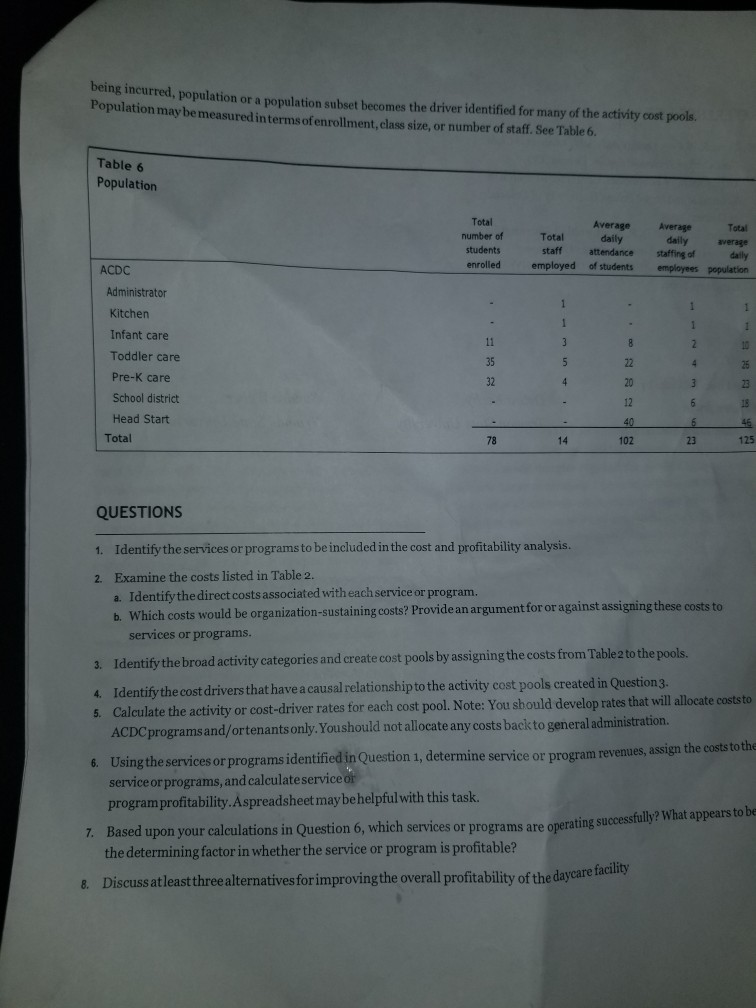

Table 4 Hourly Child Tables 1-3 provide revenue and expense information for the first year of operations at the new facility. Tables 4-6 provide additional information useful for the cost analysis and decision making. Infant care Toddler care Pre-K care Table 2 Operating Expenses 900 150 35 450 Table 5 Square Fo 11,800 5,500 860 120 ACDC School distri Head Start TOTAL 2,190 Accounting & legal Advertising Bank charges Continuing education Depreciation Food expense Ins. - Bldg/property Ins.-Officerbond Ins. -Gen. liability Ins. - Workers comp Interest expense Payroll-wages* Payroll-taxes* Repairs & maintenance Sanitation Service Supplies - Cleaning Supplies - Program/art Supplies - Office Telephone Utilities Water/sewer TOTAL EXPENSES *See detailin Table 1 400 13,085 109,500 9,475 5,950 2,435 365 3,675 2,900 1,060 4,000 1.100 $ 175.950 ACTIVITY- Activity-bas manufacturi cost inform first assign on how mu of ABC can where tan organizati performed are identi activity, a costs to th the causal by the acti Table 3 Revenues Tuition Infant care Toddler care Pre-K care $ 28,530 68,710 62,650 Rent School district Head Start TOTAL 4,200 6.360 IDENTIFIC There are create ord of food. It as food and however, t activities t (like readi: key compc but they ar $ 170,450 being incurred, population or a population subset becomes the driver identified for many of the activity cost pools. Population may be measured in terms of enrollment, class size, or number of staff. See Table 6. Table 6 Population Total number of students enrolled Total staff employed Average daily attendance of students Average Total daily average staffing of daily employees population ACDC Administrator 1 Kitchen 1 11 3 8 2 35 un 22 4 25 Infant care Toddler care Pre-K care School district Head Start Total 32 4 20 3 23 12 6 6 23 18 46 78 14 102 125 QUESTIONS 1. Identify the services or programs to be included in the cost and profitability analysis. 2. Examine the costs listed in Table 2. a. Identify the direct costs associated with each service or program. b. Which costs would be organization-sustaining costs? Provide an argument for or against assigning these costs to services or programs. 3. Identify the broad activity categories and create cost pools by assigning the costs from Table 2 to the pools. 4. Identify the cost drivers that have a causal relationship to the activity cost pools created in Question 3. 5. Calculate the activity or cost-driver rates for each cost pool. Note: You should develop rates that will allocate coststo ACDC programs and/ortenants only. Youshould not allocate any costs back to general administration. 6. Using the services or programs identified in Question 1, determine service or program revenues, assign the costs to the service or programs, and calculate service of program profitability.Aspreadsheet may be helpful with this task. 7. Based upon your calculations in Question 6, which services or programs are the determining factor in whether the service or program is profitable? 8. Discuss at least three alternatives for improving the overall profitability of the daycare facility operating successfully? What appears to be Table 4 Hourly Child Tables 1-3 provide revenue and expense information for the first year of operations at the new facility. Tables 4-6 provide additional information useful for the cost analysis and decision making. Infant care Toddler care Pre-K care Table 2 Operating Expenses 900 150 35 450 Table 5 Square Fo 11,800 5,500 860 120 ACDC School distri Head Start TOTAL 2,190 Accounting & legal Advertising Bank charges Continuing education Depreciation Food expense Ins. - Bldg/property Ins.-Officerbond Ins. -Gen. liability Ins. - Workers comp Interest expense Payroll-wages* Payroll-taxes* Repairs & maintenance Sanitation Service Supplies - Cleaning Supplies - Program/art Supplies - Office Telephone Utilities Water/sewer TOTAL EXPENSES *See detailin Table 1 400 13,085 109,500 9,475 5,950 2,435 365 3,675 2,900 1,060 4,000 1.100 $ 175.950 ACTIVITY- Activity-bas manufacturi cost inform first assign on how mu of ABC can where tan organizati performed are identi activity, a costs to th the causal by the acti Table 3 Revenues Tuition Infant care Toddler care Pre-K care $ 28,530 68,710 62,650 Rent School district Head Start TOTAL 4,200 6.360 IDENTIFIC There are create ord of food. It as food and however, t activities t (like readi: key compc but they ar $ 170,450 being incurred, population or a population subset becomes the driver identified for many of the activity cost pools. Population may be measured in terms of enrollment, class size, or number of staff. See Table 6. Table 6 Population Total number of students enrolled Total staff employed Average daily attendance of students Average Total daily average staffing of daily employees population ACDC Administrator 1 Kitchen 1 11 3 8 2 35 un 22 4 25 Infant care Toddler care Pre-K care School district Head Start Total 32 4 20 3 23 12 6 6 23 18 46 78 14 102 125 QUESTIONS 1. Identify the services or programs to be included in the cost and profitability analysis. 2. Examine the costs listed in Table 2. a. Identify the direct costs associated with each service or program. b. Which costs would be organization-sustaining costs? Provide an argument for or against assigning these costs to services or programs. 3. Identify the broad activity categories and create cost pools by assigning the costs from Table 2 to the pools. 4. Identify the cost drivers that have a causal relationship to the activity cost pools created in Question 3. 5. Calculate the activity or cost-driver rates for each cost pool. Note: You should develop rates that will allocate coststo ACDC programs and/ortenants only. Youshould not allocate any costs back to general administration. 6. Using the services or programs identified in Question 1, determine service or program revenues, assign the costs to the service or programs, and calculate service of program profitability.Aspreadsheet may be helpful with this task. 7. Based upon your calculations in Question 6, which services or programs are the determining factor in whether the service or program is profitable? 8. Discuss at least three alternatives for improving the overall profitability of the daycare facility operating successfully? What appears to beStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started