Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.In your Cash Flows From Operations what is your ATCF in year 4? 2.In your Reversion Cash Flow what is your Gross Sales Price? Your

1.In your Cash Flows From Operations what is your ATCF in year 4?

2.In your Reversion Cash Flow what is your Gross Sales Price?

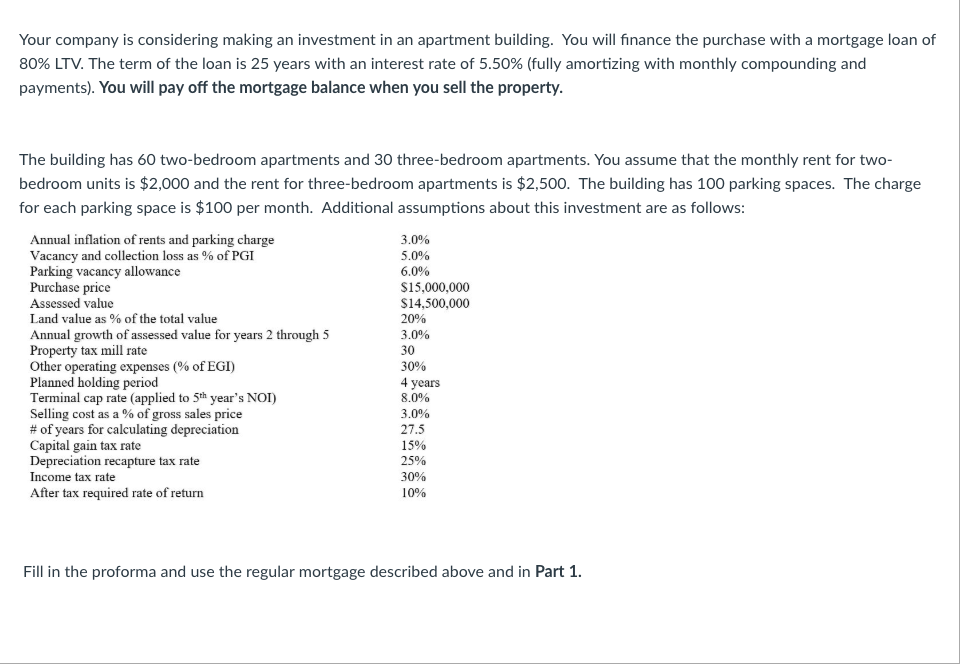

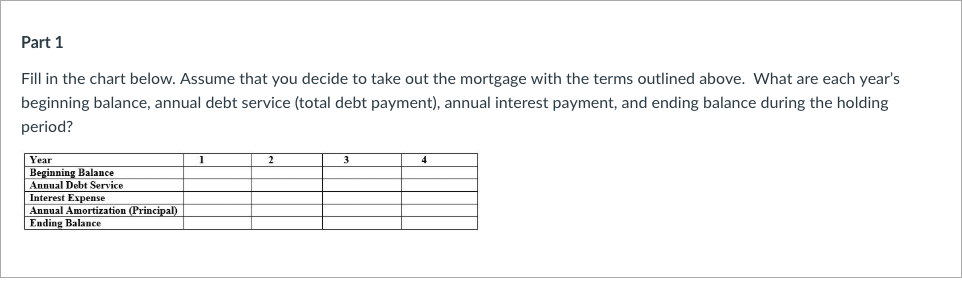

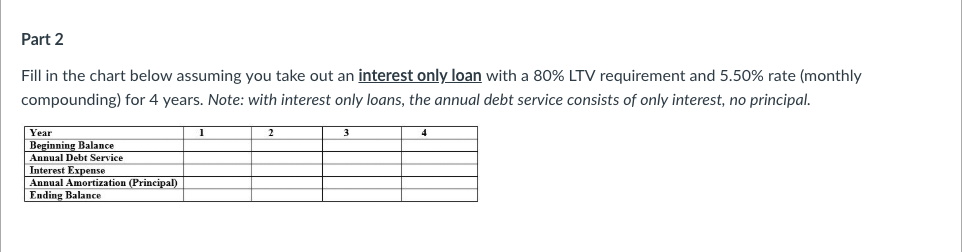

Your company is considering making an investment in an apartment building. You will finance the purchase with a mortgage loan of 80% LTV. The term of the loan is 25 years with an interest rate of 5.50% (fully amortizing with monthly compounding and payments). You will pay off the mortgage balance when you sell the property. The building has 60 two-bedroom apartments and 30 three-bedroom apartments. You assume that the monthly rent for two- bedroom units is $2,000 and the rent for three-bedroom apartments is $2,500. The building has 100 parking spaces. The charge for each parking space is $100 per month. Additional assumptions about this investment are as follows Annual inflation of rents and parking charge Vacancy and collection loss as % of PGI Parking vacancy allowance Purchase price Assessed valuc Land value as % of the total value Annual growth of assessed value for years 2 through 5 Property tax mill rate Other operating expenses of EGI) Planned holding period Terminal cap rate (applied to 5th year's NOI) Selling cost as a % of gross sales price # of years for calculating depreciation Capital gain tax rate Depreciation recapture tax rate Income tax rate After tax required rate of return 3.0% 5.0% 6.0% $15,000,000 S14,500,000 20% 3.0% 30 3090 4 years 8.000 3.0% 27.5 15% 2590 30% 10% Fill in the proforma and use the regular mortgage described above and inStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started