Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1less than or equal to or greater than 2) less than or equal to or greater than 3)decrease or increase 4) decrease increase 5)added to

1less than

1less than

or equal to

or greater than

2) less than

or equal to

or greater than

3)decrease

or increase

4) decrease

increase

5)added to

subtracted from

in the denominators of

in the numerators of

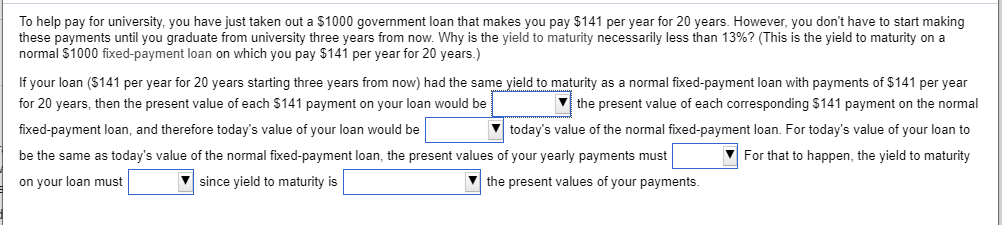

To help pay for university, you have just taken out a $1000 government loan that makes you pay $141 per year for 20 years. However, you don't have to start making these payments until you graduate from university three years from now. Why is the yield to maturity necessarily less than 13%? (This is the yield to maturity on a normal $1000 fixed-payment loan on which you pay $141 per year for 20 years.) If your loan (S141 per year for 20 years starting three years from now) had the same yield to maturity as a normal fixed-payment loan with payments of $141 per year for 20 years, then the present value of each $141 payment on your loan would be the present value of each corresponding $141 payment on the normal fixed-payment loan, and therefore today's value of your loan would be today's value of the normal fixed-payment loan. For today's value of your loan to be the same as today's value of the normal fixed-payment loan, the present values of your yearly payments must For that to happen, the yield to maturity on your loan must since yield to maturity is the present values of your paymentsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started