Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.L.G. Co. consigned 100 A.C. to Surat Trading Co. on 1-1-2010. The invoice price was Rs. 20,000 per A.C. But proforma invoice price was

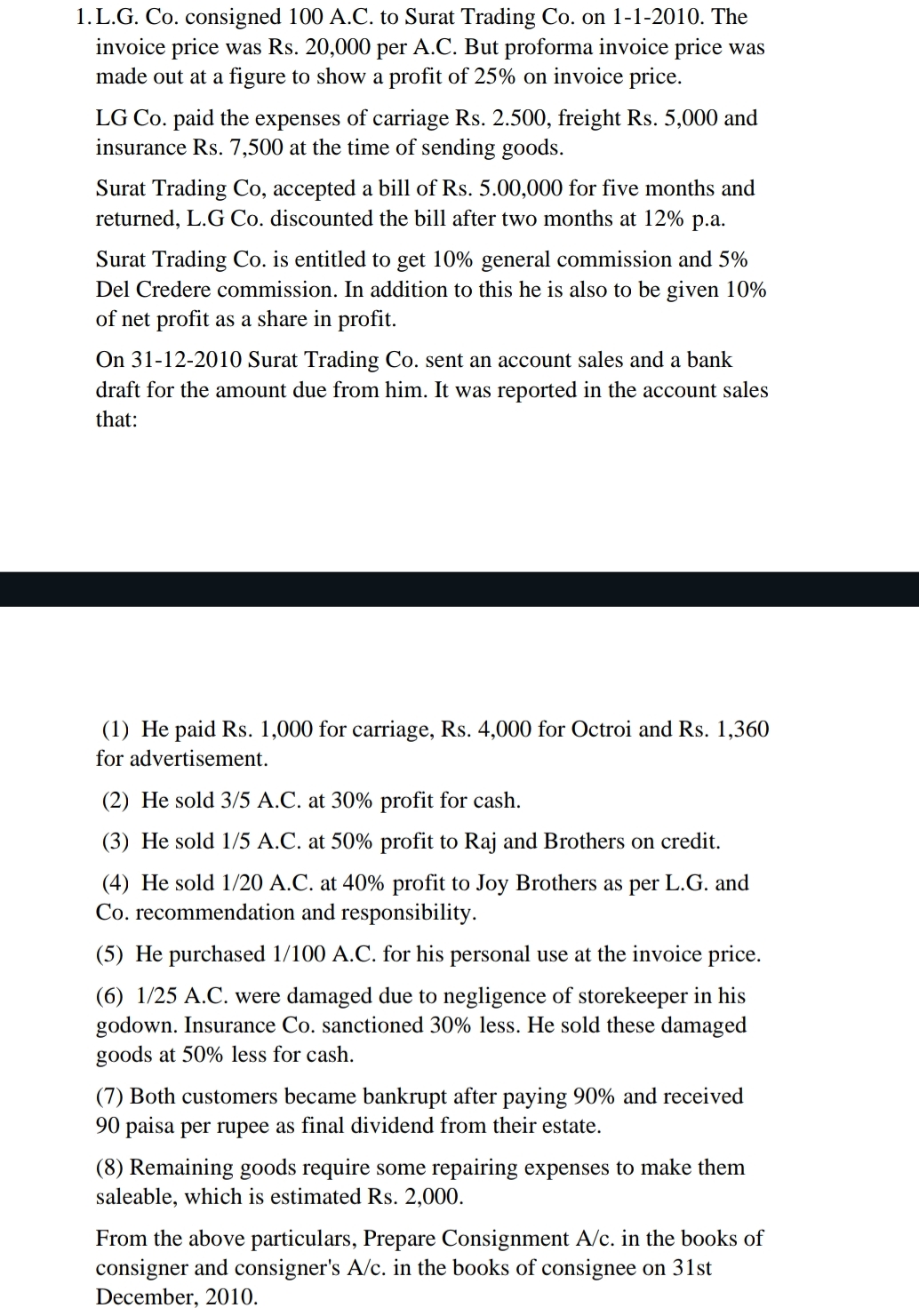

1.L.G. Co. consigned 100 A.C. to Surat Trading Co. on 1-1-2010. The invoice price was Rs. 20,000 per A.C. But proforma invoice price was made out at a figure to show a profit of 25% on invoice price. LG Co. paid the expenses of carriage Rs. 2.500, freight Rs. 5,000 and insurance Rs. 7,500 at the time of sending goods. Surat Trading Co, accepted a bill of Rs. 5.00,000 for five months and returned, L.G Co. discounted the bill after two months at 12% p.a. Surat Trading Co. is entitled to get 10% general commission and 5% Del Credere commission. In addition to this he is also to be given 10% of net profit as a share in profit. On 31-12-2010 Surat Trading Co. sent an account sales and a bank draft for the amount due from him. It was reported in the account sales that: (1) He paid Rs. 1,000 for carriage, Rs. 4,000 for Octroi and Rs. 1,360 for advertisement. (2) He sold 3/5 A.C. at 30% profit for cash. (3) He sold 1/5 A.C. at 50% profit to Raj and Brothers on credit. (4) He sold 1/20 A.C. at 40% profit to Joy Brothers as per L.G. and Co. recommendation and responsibility. (5) He purchased 1/100 A.C. for his personal use at the invoice price. (6) 1/25 A.C. were damaged due to negligence of storekeeper in his godown. Insurance Co. sanctioned 30% less. He sold these damaged goods at 50% less for cash. (7) Both customers became bankrupt after paying 90% and received 90 paisa per rupee as final dividend from their estate. (8) Remaining goods require some repairing expenses to make them saleable, which is estimated Rs. 2,000. From the above particulars, Prepare Consignment A/c. in the books of consigner and consigner's A/c. in the books of consignee on 31st December, 2010.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started