Question

1.Manchester plc is expected to pay annual dividends of 1.50, 1.75 and 2.00 per share at the end of each of the next three years

1.Manchester plc is expected to pay annual dividends of 1.50, 1.75 and 2.00 per share at the end of each of the next three years (i.e., from t=1 to t=3). After year 3, annual dividends are expected to grow at a rate of 2% forever. Assuming that shareholders of Manchester plc. require a rate of return equal to 4% per year, what is the fair value for the share of Manchester plc.?

63.48

64.70

97.37

95.52

2.

You have invested only in the BlueChip Fund, a mutual fund that invests mainly in stocks. At the moment, the BlueChip Fund has an expected return of 24% and a volatility of 32%. Your broker suggests you to consider adding the Platinum Fund to your current portfolio. The Platinum Fund has an expected return of 20%, a volatility of 35%, and a correlation of -0.10 with the BlueChip Fund. Risk-free interest rate is equal to 5%. The difference between the expected return and the required return on the Platinum Fund is closest to:

0.074

0.306

0.109

0.171

3.

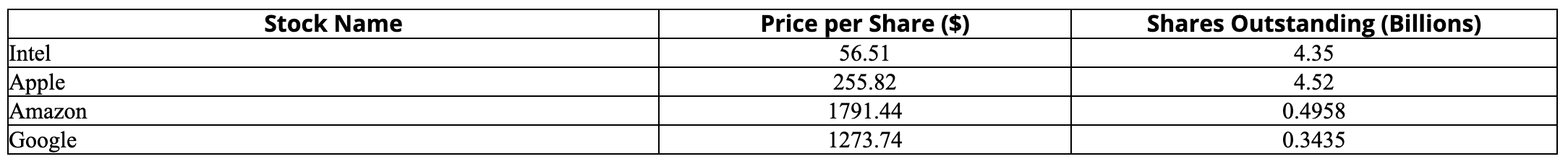

Consider the following stock prices and shares outstanding data:

Assuming that you are interested in creating a value-weighted portfolio of these four stocks, then the percentage amount that you would invest in Intel is closest to:

| 16.04% | ||

| 18.01% | ||

| 9.01% | ||

| 42.39% |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started