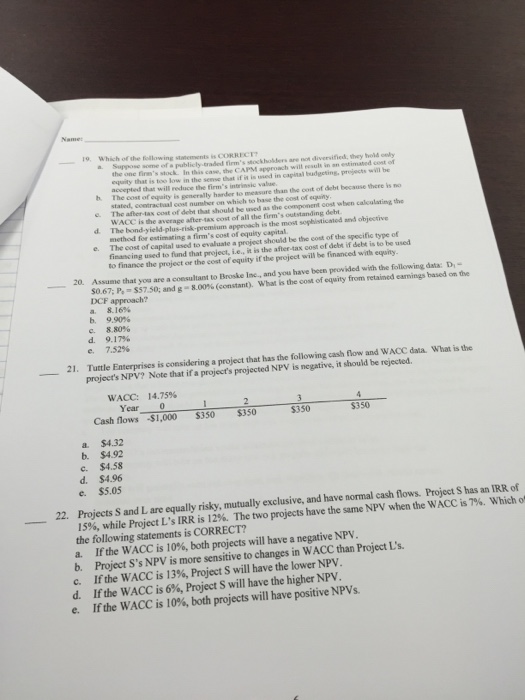

1o, Which of the following stements is CORRI CT pose some of a publicly-traded finn's stockholders are not diversified, they hold cely a. the one finm's stock In this case, the CAPM approach will result in an estimated cost of equity that is too low in the senve that if in is used in capital budgcting, prejects will be accepted that will reduce the firm's intrinsic value h. The cost of eqaity is generally hander to measure than the cost of debt because there is no stated, coetractaal cost number on which to base the cost of equiny e. The after-tax cost ofdebt that should be saved as the component oost when calculating the WACC is the average after-tax cost of all the firm's outstanding debt d. The bond-yield-plus-risk-premium approach is the most sophisticated and objestive method for estimating a firm's cost of equity capital e. The cost of capital used to evaluate a project should be the cost of the specific type of financing used to fund that project, i.e., it is the after-tax cost of debt if debt is to be used to finance the project or the cost of equity if the project will be financed with equity 20. and yes have been provided with defollowing date D- Assume thatyou are a consultant to Briske lae so 67; P-sso; and g-u o% (constant) What is the cost of eqity from retained earnings l nsed on the DCF approach? a. 8.16% b. 9.90% d. e. 8.80% 9.17% 7.52% 21. Tuttle Enterprises is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that if a projects projected NPV is negative, it should be rejected WACC: 14.75% Year 0 Cash flows-$1,000 $350 $350 $350 $350 a. $4.32 b. $4.92 c. $4.58 d. $4.96 e. $5.05 22. Projects S and L are equally risky, mutually exclusive, and have normal cash flows. Project S has an IRR of The two projects have the same NPV when the wACC ism which o 15%, while Project L's IRR is 12%. the following statements is CORRECT? If the WACC is 10%, both projects will have a negative NPV b. Project S's NPV is more sensitive to changes in WACC than Project L's c. If the WACC is 13%, Project S will have the lower NPV d. If the WACC is 6%, Project S will have the higher NPV e. If the WACC is 10%, both projects will have positive NPVs