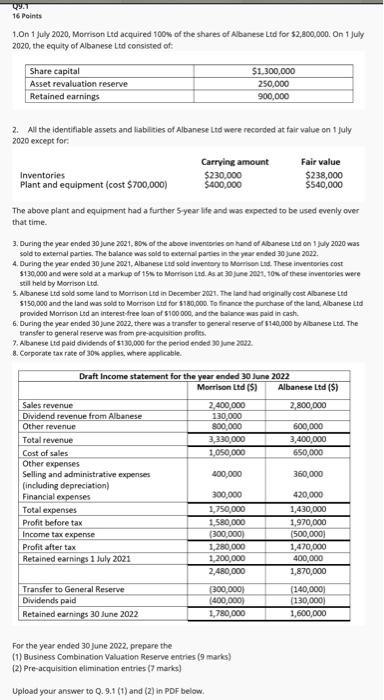

1.On 1 July 2020, Morrison Ltd acquired 100w of the shares of Abunese Ltd for 52,800,000. On 1 july 2020, the equily of Albanese Itd consisted of: 2. All the identitiable assets and liablities of Albanese Ltd were recorded at fair value on 1 fuly 2020 except for: The above plant and equipment had a further Syear life and was expected to be used evenly over that time. 3, During the year ended 30 June 2521, 80w of the above inventories on hand of Abanese Ltd on 1/Hly2020 was sold to external parties. The balance was sold to external parties in the year ended 30 june 2022. 4. During the year ended 30 lune 2021, Albanese Lod sold inventory to Momison tos, These inventeries cost. 51 30,000 and were seld at a markup of 15w to Morrisen ind. As at 30 junt 2021, 10N af these imenteeies were still held by Morrison ttd. 5. Abunese Ltd sold some land to Morrison Lta in December 2021. The land thad originally cont Abanese Lth 5150,000 and the land was sold to Morrison Litd for 5180,000. To france the purchase of the land, Abanese Ltd provided Morrison Ltd an interest-free loun of 1100000 , and the balunce was paid in cash. 6. During the year ended 30 june 2022, there was a tranater to general resenve of 5140,000 by Albanese Ltd. The transler to general reserve was trom pre-atquisitien profth. 7. Abanese ttd paid dimisends of 1139,000 for the period ended 10 Jane 2az2. 8. Corporate tak rate of 30% applies, where applicable. For the year ended 30 June 2022, prepare the (1) Business Combination Valuation Reserve entries ( 9 marks) (2) Pre-acquisition elimination entries (7 marks) Upload your answer to Q.9.1(1) and (2) in PDF below. Q9.2 6 Points For the year ended 30 June 2022, prepare consolidation journal entries to eliminate the effects of intragroup transactions. ( 6 marks) Upload your answer to Q. 9.2 in PDF below. [ Please select file(s) Q9.3 6 Points Job Ltd is owned 50% by Dix Ltd and 50% by Fix Ltd (the founding shareholders). Both Dix Ltd and Fix Ltd have two seats on the Board of Directors and both parties do not have a casting vote. Dix Ltd appoints the managing director and is paid a management fee which is equivalent to 50% of the net profit of Job Ltd. Dix Ltd is also a holder of 100 options in Job Ltd, which are exercisable at any time at a 10% discount to the market value of the shares at the exercise date. Determine whether control exists or not and, if so, by which party in accordance with AASB10 Consolidated Financial Statements. ( 6 marks) Type your answer to Q. 9.3 in the ANSWER BOX below