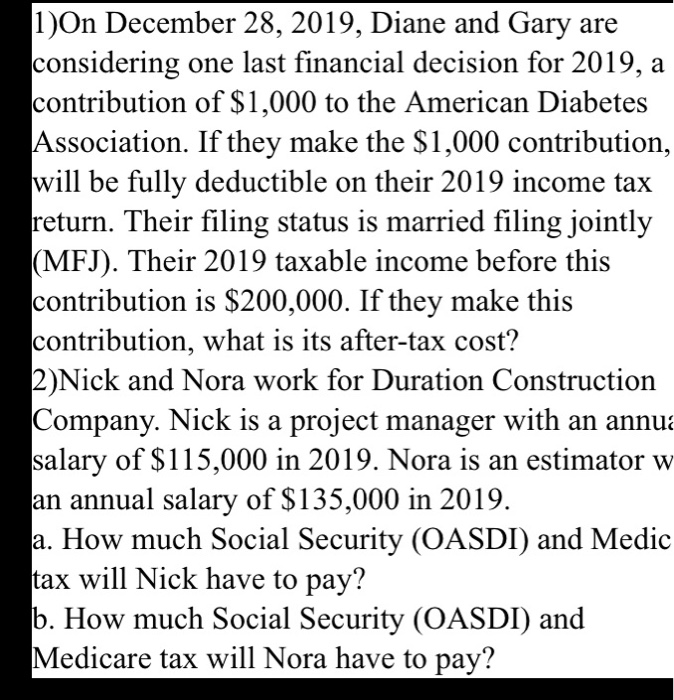

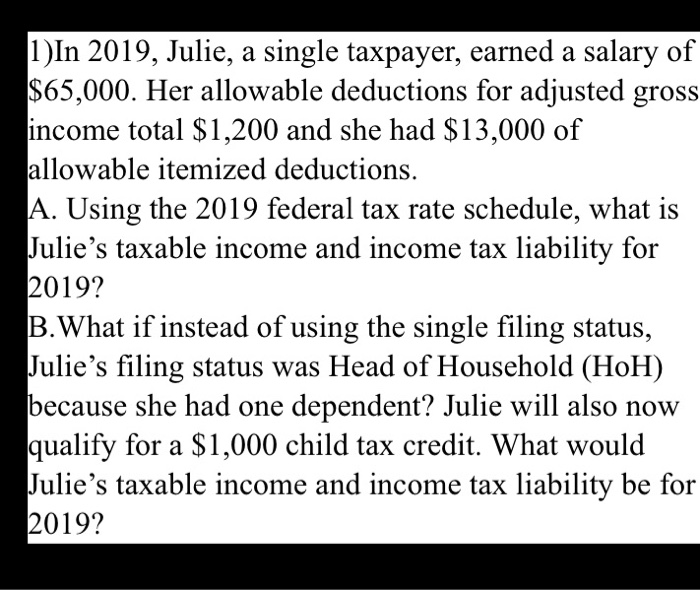

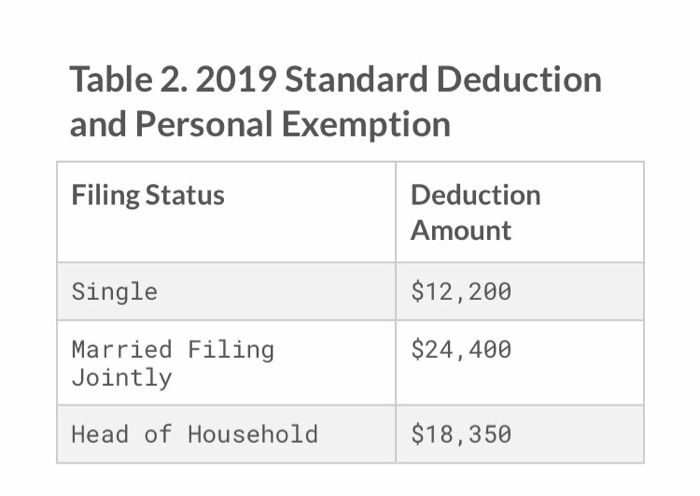

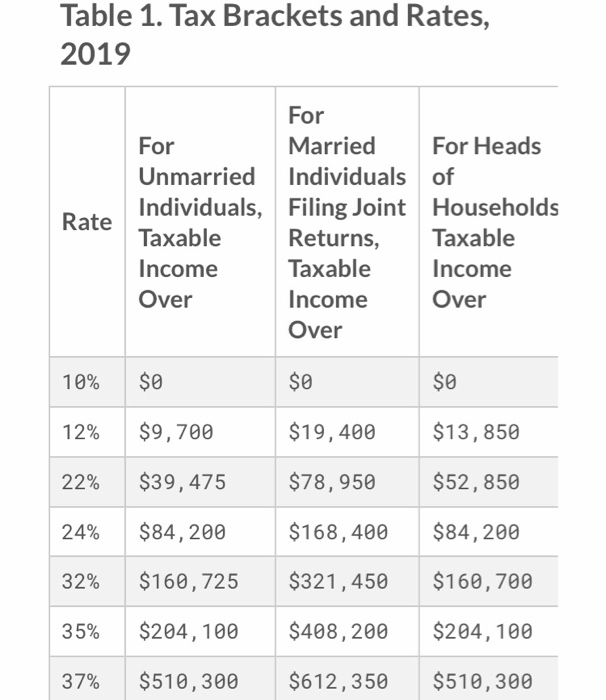

1)On December 28, 2019, Diane and Gary are considering one last financial decision for 2019, a contribution of $1,000 to the American Diabetes Association. If they make the $1,000 contribution, will be fully deductible on their 2019 income tax return. Their filing status is married filing jointly (MFJ). Their 2019 taxable income before this contribution is $200,000. If they make this contribution, what is its after-tax cost? 2)Nick and Nora work for Duration Construction Company. Nick is a project manager with an annua salary of $115,000 in 2019. Nora is an estimator w an annual salary of $135,000 in 2019. a. How much Social Security (OASDI) and Medic tax will Nick have to pay? b. How much Social Security (OASDI) and Medicare tax will Nora have to pay? 1)In 2019, Julie, a single taxpayer, earned a salary of $65,000. Her allowable deductions for adjusted gross income total $1,200 and she had $13,000 of allowable itemized deductions. A. Using the 2019 federal tax rate schedule, what is Julie's taxable income and income tax liability for 2019? B.What if instead of using the single filing status, Julie's filing status was Head of Household (HoH) because she had one dependent? Julie will also now qualify for a $1,000 child tax credit. What would Julie's taxable income and income tax liability be for 2019? Table 2. 2019 Standard Deduction and Personal Exemption Filing Status Deduction Amount Single $12,200 Married Filing Jointly $24,400 Head of Household $18,350 Table 1. Tax Brackets and Rates, 2019 For Rate For Married For Heads Unmarried Individuals of Individuals, Filing Joint Households Taxable Returns, Taxable Income Taxable Income Over Income Over Over 10% $0 $0 $0 $9,700 $19,400 $13,850 12% 22% $39, 475 $78, 950 $52,850 24% $84,200 $84,200 $168,400 $321,450 32% $160, 725 $160,700 35% $204,100 $408,200 $204,100 37% $510,300 $612,350 $510,300 1)On December 28, 2019, Diane and Gary are considering one last financial decision for 2019, a contribution of $1,000 to the American Diabetes Association. If they make the $1,000 contribution, will be fully deductible on their 2019 income tax return. Their filing status is married filing jointly (MFJ). Their 2019 taxable income before this contribution is $200,000. If they make this contribution, what is its after-tax cost? 2)Nick and Nora work for Duration Construction Company. Nick is a project manager with an annua salary of $115,000 in 2019. Nora is an estimator w an annual salary of $135,000 in 2019. a. How much Social Security (OASDI) and Medic tax will Nick have to pay? b. How much Social Security (OASDI) and Medicare tax will Nora have to pay? 1)In 2019, Julie, a single taxpayer, earned a salary of $65,000. Her allowable deductions for adjusted gross income total $1,200 and she had $13,000 of allowable itemized deductions. A. Using the 2019 federal tax rate schedule, what is Julie's taxable income and income tax liability for 2019? B.What if instead of using the single filing status, Julie's filing status was Head of Household (HoH) because she had one dependent? Julie will also now qualify for a $1,000 child tax credit. What would Julie's taxable income and income tax liability be for 2019? Table 2. 2019 Standard Deduction and Personal Exemption Filing Status Deduction Amount Single $12,200 Married Filing Jointly $24,400 Head of Household $18,350 Table 1. Tax Brackets and Rates, 2019 For Rate For Married For Heads Unmarried Individuals of Individuals, Filing Joint Households Taxable Returns, Taxable Income Taxable Income Over Income Over Over 10% $0 $0 $0 $9,700 $19,400 $13,850 12% 22% $39, 475 $78, 950 $52,850 24% $84,200 $84,200 $168,400 $321,450 32% $160, 725 $160,700 35% $204,100 $408,200 $204,100 37% $510,300 $612,350 $510,300