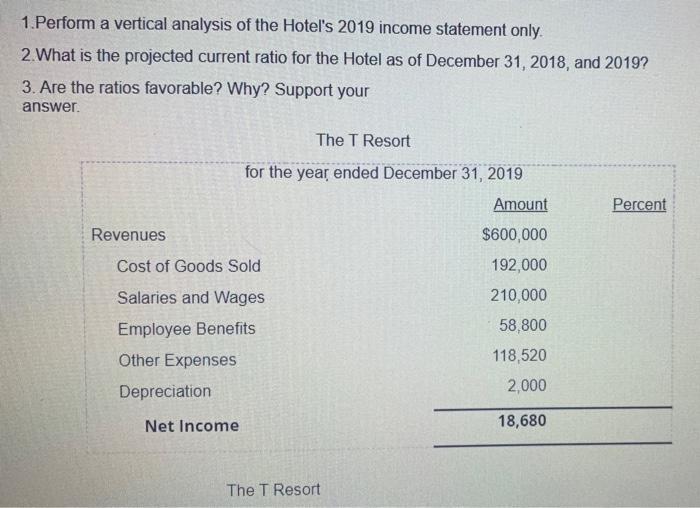

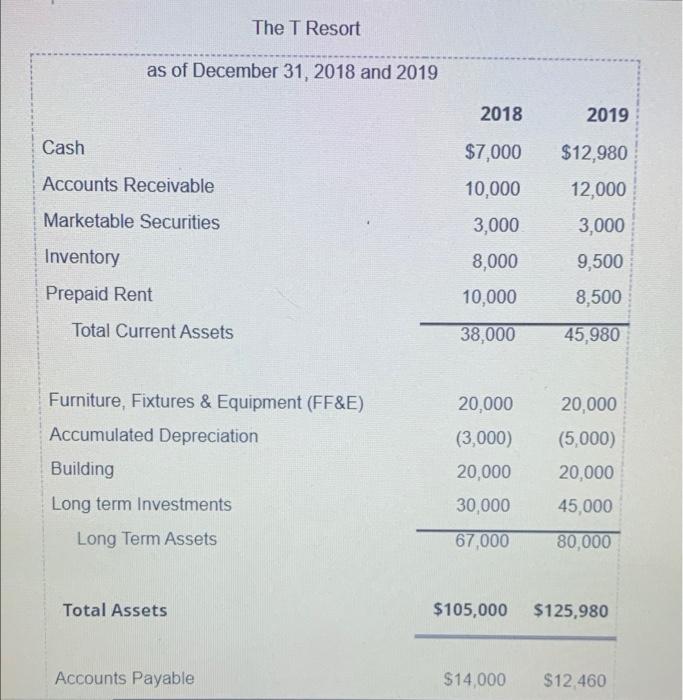

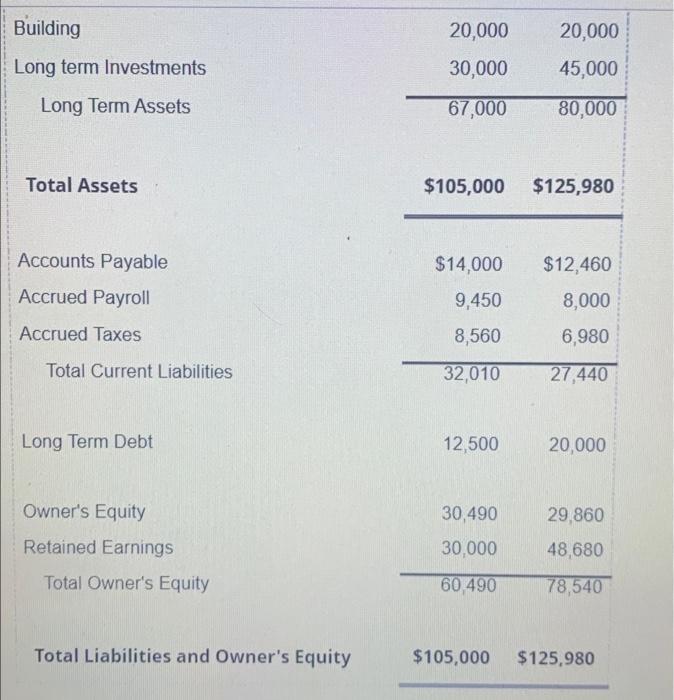

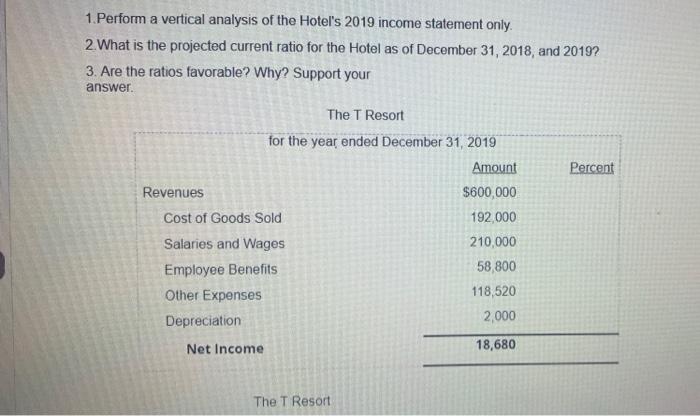

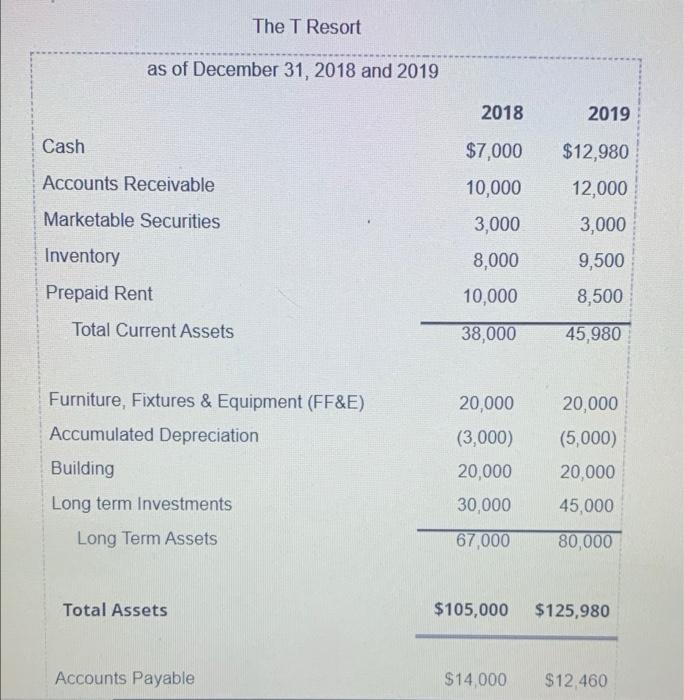

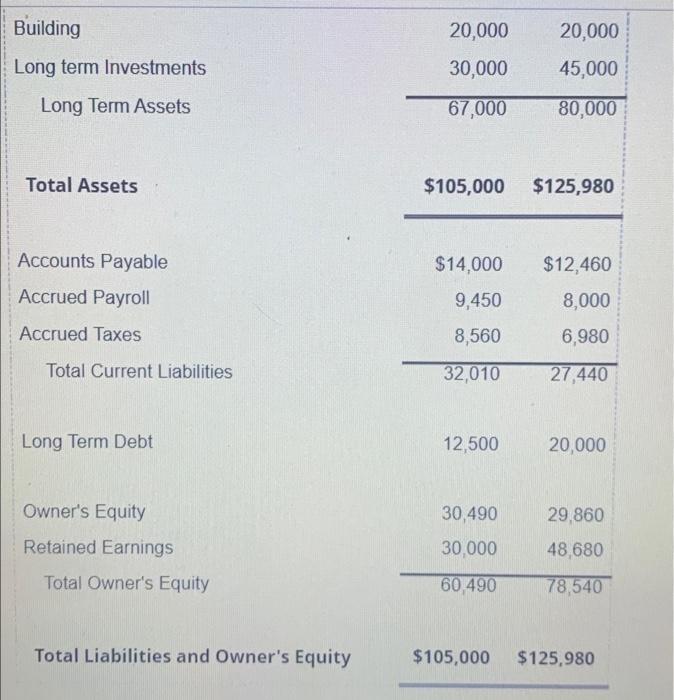

1.Perform a vertical analysis of the Hotel's 2019 income statement only. 2. What is the projected current ratio for the Hotel as of December 31, 2018, and 2019? 3. Are the ratios favorable? Why? Support your answer. The T Resort for the year ended December 31, 2019 Amount Percent Revenues Cost of Goods Sold Salaries and Wages Employee Benefits Other Expenses Depreciation Net Income $600,000 192,000 210,000 58,800 118,520 2,000 18,680 The T Resort The T Resort as of December 31, 2018 and 2019 2018 2019 Cash $12,980 Accounts Receivable $7,000 10,000 3,000 12,000 Marketable Securities 3,000 Inventory 8,000 9,500 8,500 Prepaid Rent 10,000 Total Current Assets 38,000 45,980 20,000 (3,000) Furniture, Fixtures & Equipment (FF&E) Accumulated Depreciation Building Long term Investments Long Term Assets 20,000 (5,000) 20,000 20,000 30,000 45,000 67,000 80,000 Total Assets $105,000 $125,980 Accounts Payable $14,000 $12.460 Building 20,000 20,000 45,000 30,000 Long term Investments Long Term Assets 67,000 80,000 Total Assets $105,000 $125,980 Accounts Payable $14,000 Accrued Payroll 9,450 $12,460 8,000 6,980 Accrued Taxes 8,560 Total Current Liabilities 32,010 27,440 Long Term Debt 12,500 20,000 30,490 29,860 Owner's Equity Retained Earnings Total Owner's Equity 30,000 48,680 60,490 78,540 Total Liabilities and Owner's Equity $105,000 $125,980 1. Perform a vertical analysis of the Hotel's 2019 income statement only. 2. What is the projected current ratio for the Hotel as of December 31, 2018, and 2019? 3. Are the ratios favorable? Why? Support your answer. The T Resort for the year ended December 31, 2019 Amount Percent Revenues $600,000 Cost of Goods Sold 192.000 Salaries and Wages 210,000 Employee Benefits 58,800 Other Expenses 118,520 Depreciation 2,000 Net Income 18,680 The T Resort The T Resort as of December 31, 2018 and 2019 2018 2019 Cash $7,000 Accounts Receivable $12,980 12,000 3,000 Marketable Securities 10,000 3,000 8,000 10,000 Inventory 9,500 8,500 Prepaid Rent Total Current Assets 38,000 45,980 20,000 Furniture, Fixtures & Equipment (FF&E) Accumulated Depreciation Building Long term Investments Long Term Assets 20,000 (3,000) 20,000 (5,000) 20.000 30,000 45,000 67,000 80,000 Total Assets $105,000 $125,980 Accounts Payable $14.000 $12,460 Building 20,000 30,000 20,000 45,000 Long term Investments Long Term Assets 67,000 80,000 Total Assets $105,000 $125,980 Accounts Payable $14,000 Accrued Payroll 9,450 $12,460 8,000 6,980 Accrued Taxes 8,560 Total Current Liabilities 32,010 27,440 Long Term Debt 12,500 20,000 30,490 29,860 Owner's Equity Retained Earnings Total Owner's Equity 30,000 48,680 60,490 78,540 Total Liabilities and Owner's Equity $105,000 $125,980