Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jasper Metals is considering installing a new molding machine which is expected to produce operating cash flows of $58,000 per year for 7 years.

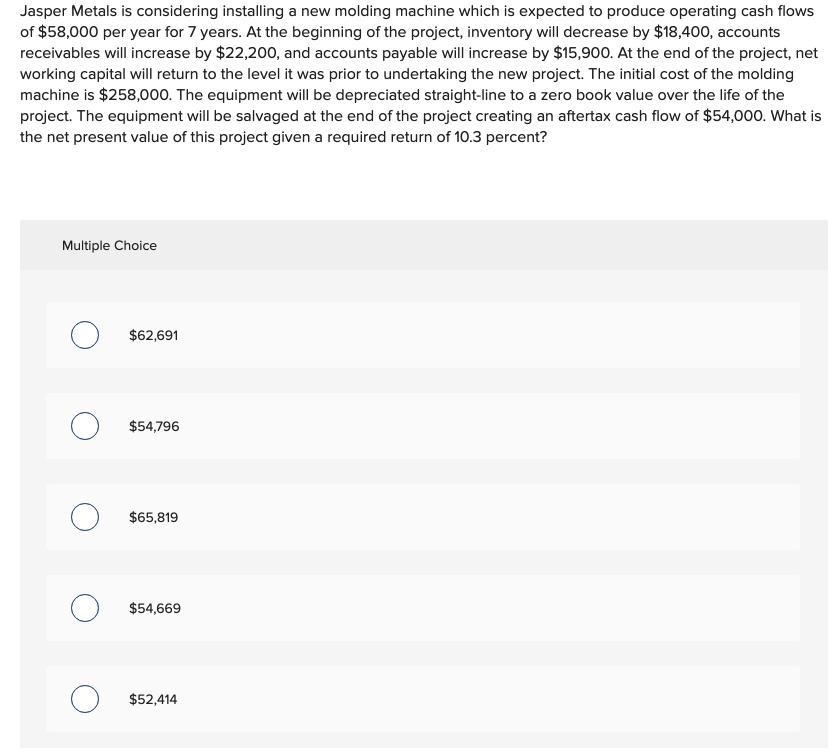

Jasper Metals is considering installing a new molding machine which is expected to produce operating cash flows of $58,000 per year for 7 years. At the beginning of the project, inventory will decrease by $18,400, accounts receivables will increase by $22,200, and accounts payable will increase by $15,900. At the end of the project, net working capital will return to the level it was prior to undertaking the new project. The initial cost of the molding machine is $258,000. The equipment will be depreciated straight-line to a zero book value over the life of the project. The equipment will be salvaged at the end of the project creating an aftertax cash flow of $54,000. What is the net present value of this project given a required return of 10.3 percent? Multiple Choice $62,691 $54,796 $65,819 $54,669 $52,414

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Initial Investment 258000 Useful Life 7 years Annual OCF 58000 Af...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started