Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.Prepare a cash budget for the months of July through September 2019. 2.Will Slopes be in a position to pay off the 30,000 one-year note

1.Prepare a cash budget for the months of July through September 2019.

2.Will Slopes be in a position to pay off the 30,000 one-year note that is due on October 1, 2019? If not, what actions would you recommend to Slopes management?

3.Suppose Slopes is interested in maintaining a minimum cash balance of 10,000. Will the company be able to maintain such a balance during all three months analysed? If not, suggest a suitable cash management strategy.

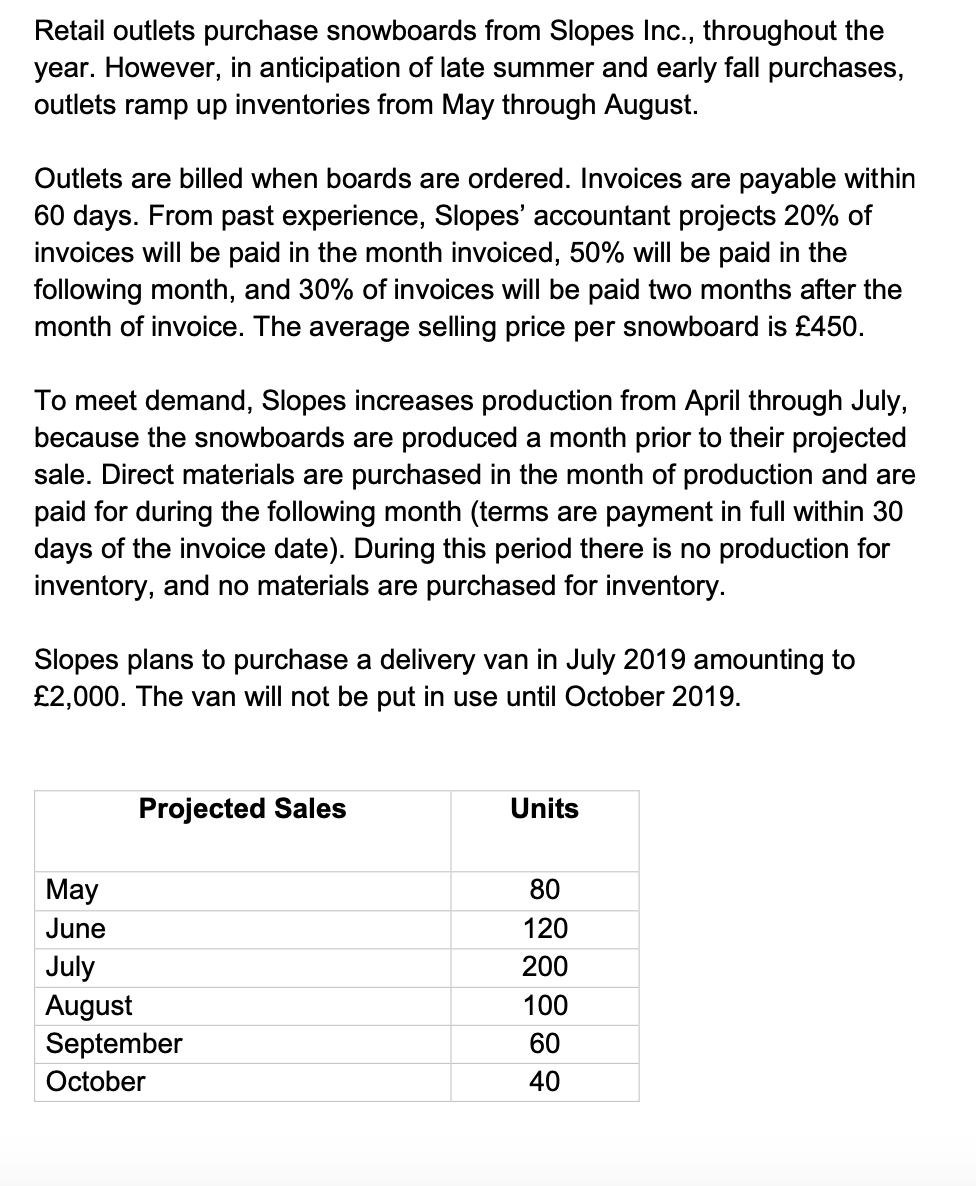

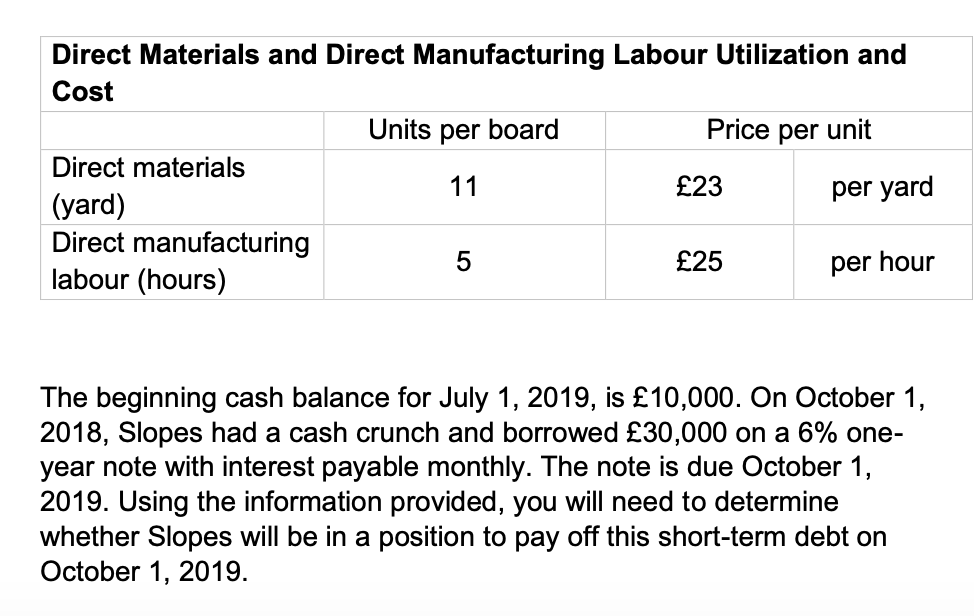

Retail outlets purchase snowboards from Slopes Inc., throughout the year. However, in anticipation of late summer and early fall purchases, outlets ramp up inventories from May through August. Outlets are billed when boards are ordered. Invoices are payable within 60 days. From past experience, Slopes' accountant projects 20% of invoices will be paid in the month invoiced, 50% will be paid in the following month, and 30% of invoices will be paid two months after the month of invoice. The average selling price per snowboard is 450. To meet demand, Slopes increases production from April through July, because the snowboards are produced a month prior to their projected sale. Direct materials are purchased in the month of production and are paid for during the following month (terms are payment in full within 30 days of the invoice date). During this period there is no production for inventory, and no materials are purchased for inventory. Slopes plans to purchase a delivery van in July 2019 amounting to 2,000. The van will not be put in use until October 2019. Projected Sales Units 80 120 May June July August September October 200 100 60 40 Direct Materials and Direct Manufacturing Labour Utilization and Cost Units per board Price per unit Direct materials 11 23 (yard) per yard Direct manufacturing 5 25 labour (hours) per hour The beginning cash balance for July 1, 2019, is 10,000. On October 1, 2018, Slopes had a cash crunch and borrowed 30,000 on a 6% one- year note with interest payable monthly. The note is due October 1, 2019. Using the information provided, you will need to determine whether Slopes will be in a position to pay off this short-term debt on October 1, 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started