Question

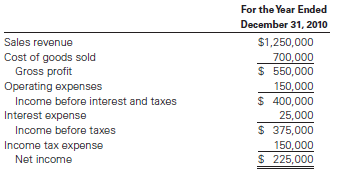

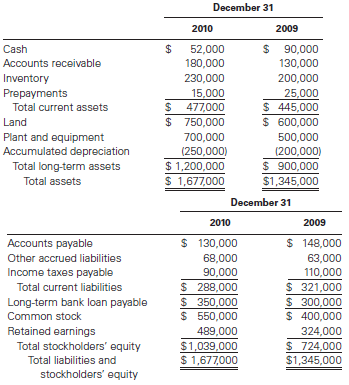

1.Prepare a statement of cash flows for 2010 using the direct method in the operating activites section....... 2. On the bases of your statement in

1.Prepare a statement of cash flows for 2010 using the direct method in the operating activites section.......

2. On the bases of your statement in (1), draft a brief memo to the president to explain why cash decreased during such a profitable year. Include in your explanation any recommendations for inproving the companys cash flow in future years.

Other information is as follows:

a. Dividends of $60,000 were declared and paid during the year.

b. Operating expenses include $50,000 of depreciation.

c. Land and plant and equipment were acquired for cash, and additional stock was issued for cash. Cash also was received from additional bank loans.

The president has asked you some questions about the year%u2019s results. She is very impressed with the profit margin of 18% (net income divided by sales revenue). She is bothered, however, by the decline in the company%u2019s cash balance during the year. One of the conditions of the existing bank loan is that the company maintains a minimum cash balance of $50,000.

Required

1. Prepare a statement of cash flows for 2012 using the direct (and indirect) method in the Operating Activities section.

2. On the basis of your statement in part (1), draft a brief memo to the president to explain why cash decreased during such a profitable year. Include in your explanation any recommendations for improving the company%u2019s cash flow in future years.

NOTE: The original answer to this is wrong/incomplete (so don't copy and paste it).

Prepare a statement of cash flows for 2010 using the direct method in the operating activities section....... On the bases of your statement in (1), draft a brief memo to the president to explain why cash decreased during such a profitable year. Include in your explanation any recommendations for improving the companies cash flow in future years. Dividends of $60,000 were declared and paid during the year. Operating expenses include $50,000 of depreciation. Land and plant and equipment were acquired for cash, and additional stock was issued for cash. Cash also was received from additional bank loans. The president has asked you some questions about the year%u2019s results. She is very impressed with the profit margin of 18% (net income divided by sales revenue). She is bothered, however, by the decline in the company%u2019s cash balance during the year. One of the conditions of the existing bank loan is that the company maintains a minimum cash balance of $50,000. Prepare a statement of cash flows for 2012 using the direct (and indirect) method in the Operating Activities section. On the basis of your statement in part (1), draft a brief memo to the president to explain why cash decreased during such a profitable year. Include in your explanation any recommendations for improving the company%u2019s cash flow in future years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started