1.Prepare journal entries for the years transactions. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

2.Prepare a T-account for each account in the companys trial balance, and enter the opening balances given above. Post your journal entries to the T-accounts. Prepare new T-accounts as needed. Compute the ending balance in each account.

4.Prepare an income statement for the year. (Do not prepare a statement of cost of goods manufactured; all of the information needed for the income statement is available in the T-accounts.)

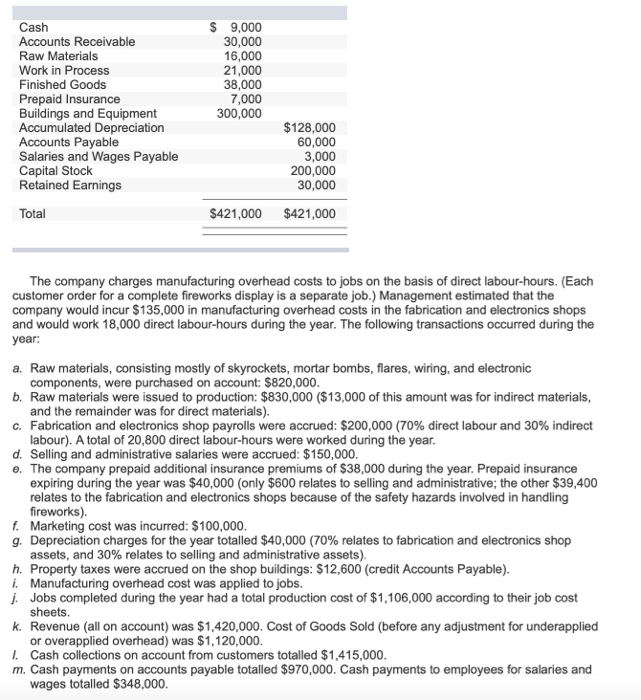

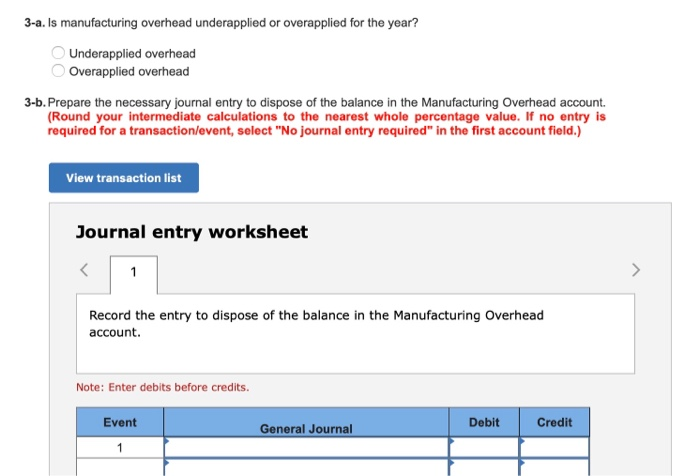

Cash Accounts Receivable Raw Materials Work in Process Finished Goods Prepaid Insurance Buildings and Equipment Accumulated Depreciation Accounts Payable Salaries and Wages Payable Capital Stock Retained Earnings S 9,000 30,000 16,000 21,000 38,000 7,000 300,000 $128,000 60,000 3,000 200,000 30,000 Total $421,000 $421,000 The company charges manufacturing overhead costs to jobs on the basis of direct labour-hours. (Each customer order for a complete fireworks display is a separate job.) Management estimated that the company would incur $135,000 in manufacturing overhead costs in the fabrication and electronics shops and would work 18,000 direct labour-hours during the year. The following transactions occurred during the year a. Raw materials, consisting mostly of skyrockets, mortar bombs, flares, wiring, and electronic components, were purchased on account: $820,000 b. Raw materials were issued to production: $830,000 ($13,000 of this amount was for indirect materials, and the remainder was for direct materials). c. Fabrication and electronics shop payrolls were accrued: $200,000 (70% direct labour and 30% indirect labour). A total of 20,800 direct labour-hours were worked during the year d. Selling and administrative salaries were accrued: $150,000 e. The company prepaid additional insurance premiums of $38,000 during the year. Prepaid insurance expiring during the year was $40,000 (only $600 relates to selling and administrative; the other $39,400 relates to the fabrication and electronics shops because of the safety hazards involved in handling fireworks). f Marketing cost was incurred: $100,000 g. Depreciation charges for the year totalled $40,000 (70% relates to fabrication and electronics shop assets, and 30% relates to selling and administrative assets). h. Property taxes were accrued on the shop buildings: $12,600 (credit Accounts Payable). i. Manufacturing overhead cost was applied to jobs. j. Jobs completed during the year had a total production cost of $1,106,000 according to their job cost sheets. Revenue (all on account) was $1,420,000. Cost of Goods Sold (before any adjustment for underapplied or overapplied overhead) was $1,120,000 k. I. Cash collections on account from customers totalled $1,415,000 m. Cash payments on accounts payable totalled $970,000. Cash payments to employees for salaries and wages totalled $348,000. 3-a. Is manufacturing overhead underapplied or overapplied for the year? Underapplied overhead Overapplied overhead 3-b. Prepare the necessary journal entry to dispose of the balance in the Manufacturing Overhead account. (Round your intermediate calculations to the nearest whole percentage value. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the entry to dispose of the balance in the Manufacturing Overhead account. Note: Enter debits before credits. Event Debit Credit General Journal