Question

1.Prepare journal entries to record each of the following four separate issuances of stock. A corporation issued 8,000 shares of $30 par value common stock

1.Prepare journal entries to record each of the following four separate issuances of stock.

- A corporation issued 8,000 shares of $30 par value common stock for $288,000 cash.

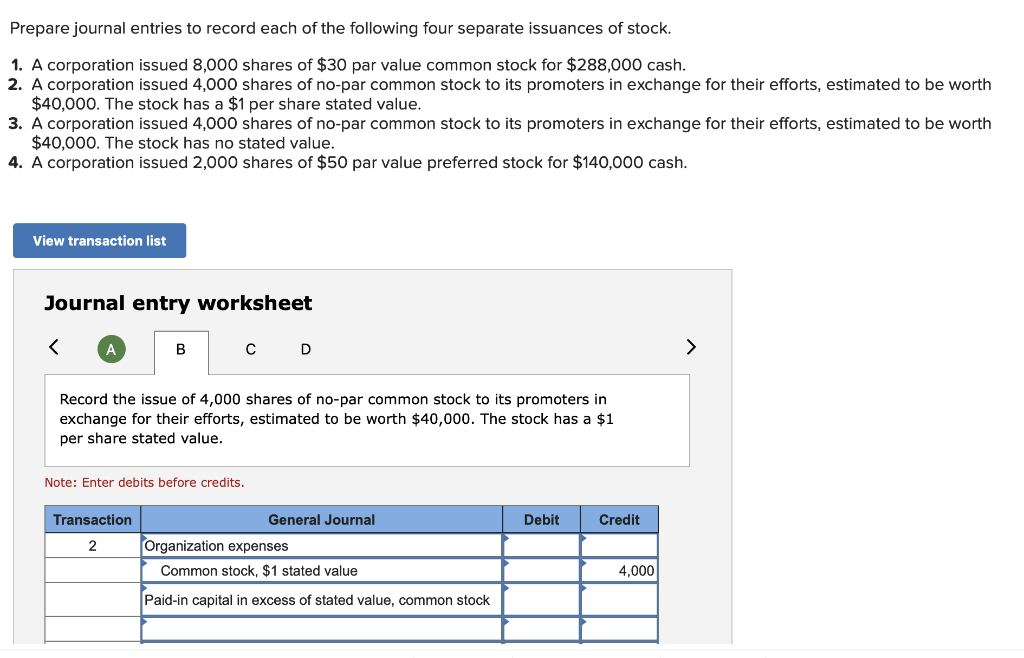

- A corporation issued 4,000 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $40,000. The stock has a $1 per share stated value.

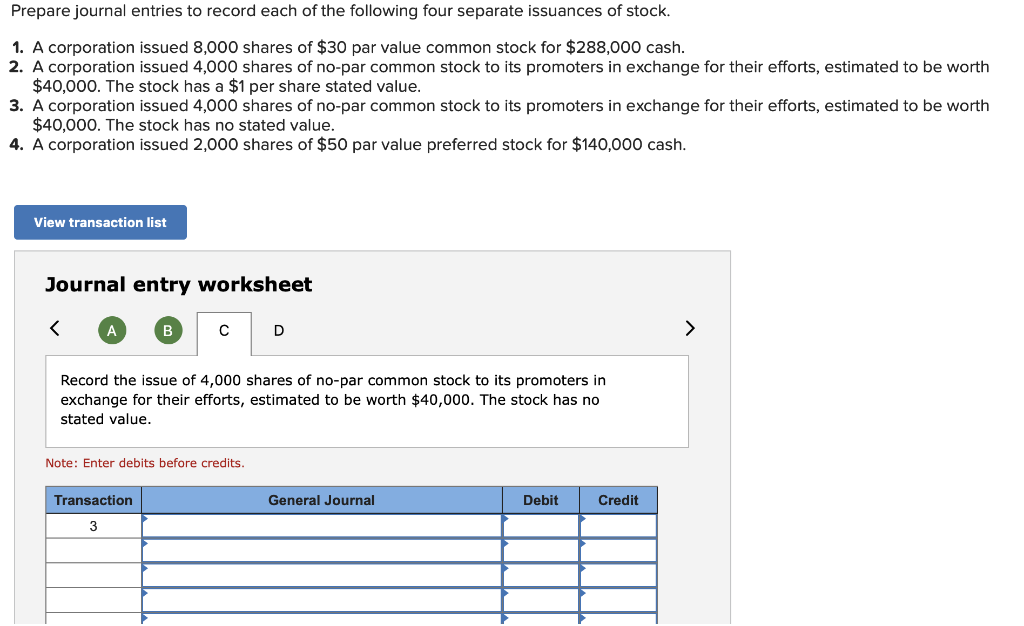

- A corporation issued 4,000 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $40,000. The stock has no stated value.

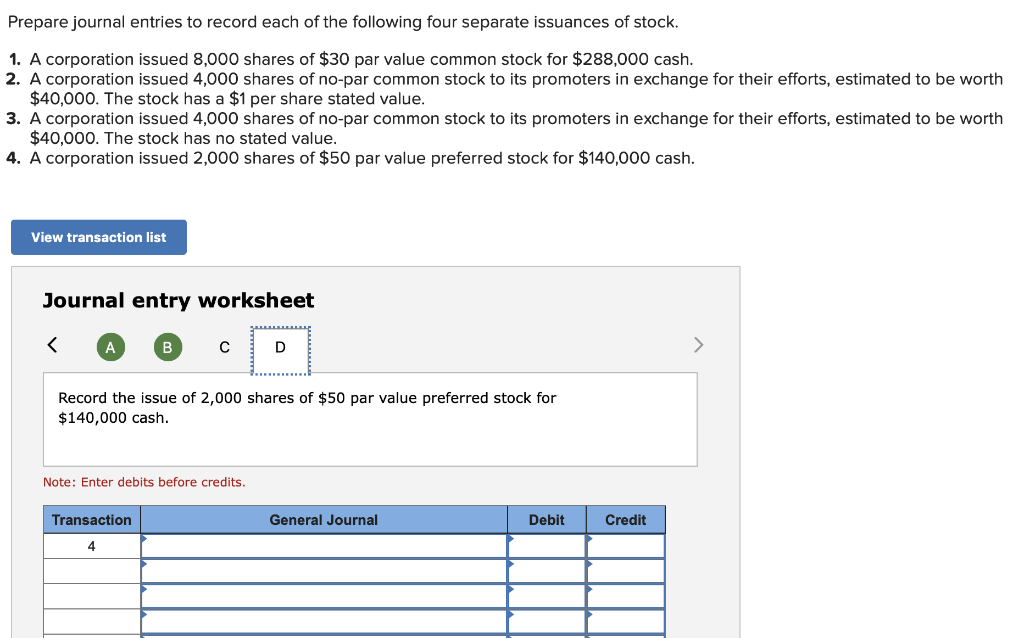

- A corporation issued 2,000 shares of $50 par value preferred stock for $140,000 cash.

2.

The stockholders equity of TVX Company at the beginning of the day on February 5 follows.

| Common stock$5 par value, 150,000 shares authorized, 58,000 shares issued and outstanding | $ | 290,000 | |

| Paid-in capital in excess of par value, common stock | 425,000 | ||

| Retained earnings | 550,000 | ||

| Total stockholders equity | $ | 1,265,000 | |

On February 5, the directors declare a 2% stock dividend distributable on February 28 to the February 15 stockholders of record. The stocks market value is $36 per share on February 5 before the stock dividend.

3.Yorks outstanding stock consists of 80,000 shares of noncumulative 6.5% preferred stock with a $5 par value and also 250,000 shares of common stock with a $1 par value. During its first four years of operation, the corporation declared and paid the following total cash dividends.

3.Yorks outstanding stock consists of 80,000 shares of noncumulative 6.5% preferred stock with a $5 par value and also 250,000 shares of common stock with a $1 par value. During its first four years of operation, the corporation declared and paid the following total cash dividends.

| Year 1 total cash dividends | $ | 15,500 |

| Year 2 total cash dividends | 24,000 | |

| Year 3 total cash dividends | 225,000 | |

| Year 4 total cash dividends | 375,000 | |

| ||

4.The equity sections for Atticus Group at the beginning of the year (January 1) and end of the year (December 31) follow.

| Stockholders Equity (January 1) | |||

| Common stock$4 par value, 100,000 shares authorized, 40,000 shares issued and outstanding | $ | 160,000 | |

| Paid-in capital in excess of par value, common stock | 120,000 | ||

| Retained earnings | 360,000 | ||

| Total stockholders equity | $ | 640,000 | |

| Stockholders Equity (December 31) | ||||

| Common stock$4 par value, 100,000 shares authorized, 47,000 shares issued, 5,000 shares in treasury | $ | 188,000 | ||

| Paid-in capital in excess of par value, common stock | 162,000 | |||

| Retained earnings ($30,000 restricted by treasury stock) | 440,000 | |||

| 790,000 | ||||

| Less cost of treasury stock | (30,000 | ) | ||

| Total stockholders equity | $ | 760,000 | ||

The following transactions and events affected its equity during the year.

| Jan. | 5 | Declared a $0.60 per share cash dividend, date of record January 10. | ||

| Mar. | 20 | Purchased treasury stock for cash. | ||

| Apr. | 5 | Declared a $0.60 per share cash dividend, date of record April 10. | ||

| July | 5 | Declared a $0.60 per share cash dividend, date of record July 10. | ||

| July | 31 | Declared a 20% stock dividend when the stocks market value was $10 per share. | ||

| Aug. | 14 | Issued the stock dividend that was declared on July 31. | ||

| Oct. | 5 | Declared a $0.60 per share cash dividend, date of record October 10. |

5.

Alexander Corporation reports the following components of stockholders equity at December 31, 2018.

| Common stock$25 par value, 60,000 shares authorized, 36,000 shares issued and outstanding | $ | 900,000 | |

| Paid-in capital in excess of par value, common stock | 72,000 | ||

| Retained earnings | 361,000 | ||

| Total stockholders equity | $ | 1,333,000 | |

During the year, the following transactions affected its stockholders equity accounts.

| Jan. | 2 | Purchased 3,600 shares of its own stock at $25 cash per share. | ||

| Jan. | 7 | Directors declared a $1.50 per share cash dividend payable on February 28 to the February 9 stockholders of record. | ||

| Feb. | 28 | Paid the dividend declared on January 7. | ||

| July | 9 | Sold 1,440 of its treasury shares at $30 cash per share. | ||

| Aug. | 27 | Sold 1,800 of its treasury shares at $20 cash per share. | ||

| Sept. | 9 | Directors declared a $2 per share cash dividend payable on October 22 to the September 23 stockholders of record. | ||

| Oct. | 22 | Paid the dividend declared on September 9. | ||

| Dec. | 31 | Closed the $58,000 credit balance (from net income) in the Income Summary account to Retained Earnings. |

Required: 1. Prepare journal entries to record each of these transactions. 2. Prepare a statement of retained earnings for the year ended December 31, 2019. 3. Prepare the stockholders equity section of the companys balance sheet as of December 31, 2019.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started