Question

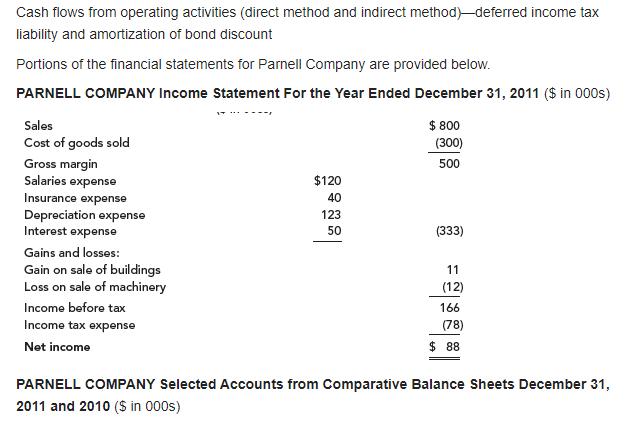

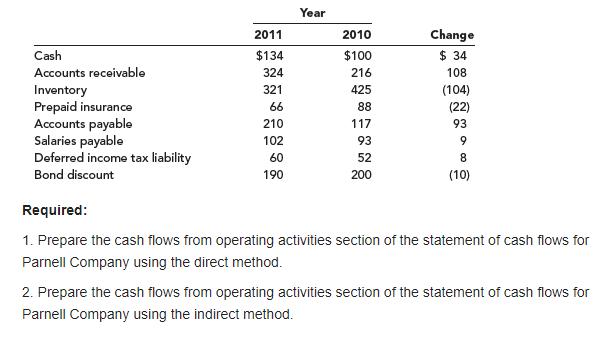

Image caption Cash flows from operating activities (direct method and indirect method)-deferred income tax liability and amortization of bond discount Portions of the financial statements

Image caption

Image caption Cash flows from operating activities (direct method and indirect method)-deferred income tax liability and amortization of bond discount Portions of the financial statements for Parnell Company are provided below. PARNELL COMPANY Income Statement For the Year Ended December 31, 2011 ($ in 000s) Sales $ 800 Cost of goods sold (300) Gross margin Salaries expense Insurance expense Depreciation expense Interest expense 500 $120 40 123 50 (333) Gains and losses: Gain on sale of buildings Loss on sale of machinery 11 (12) Income before tax 166 Income tax expense (78) Net income $ 88 PARNELL COMPANY Selected Accounts from Comparative Balance Sheets December 31, 2011 and 2010 (S in 000s)

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

step...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management Principles and Applications

Authors: Sheridan Titman, Arthur J. Keown, John H. Martin

13th edition

134417216, 978-0134417509, 013441750X, 978-0134417219

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App