Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1-Prepare the production budget in units for CJ Jewelry Company for the year 2021. Please show your work 2-Prepare the direct materials usage budget in

1-Prepare the production budget in units for CJ Jewelry Company for the year 2021. Please show your work

2-Prepare the direct materials usage budget in units and dollars for CJ Jewelry Company for the year 2021. Please show your work.

3-Prepare the budgeted income statement in dollars for CJ Jewelry Company for the year 2021. Please show your work.

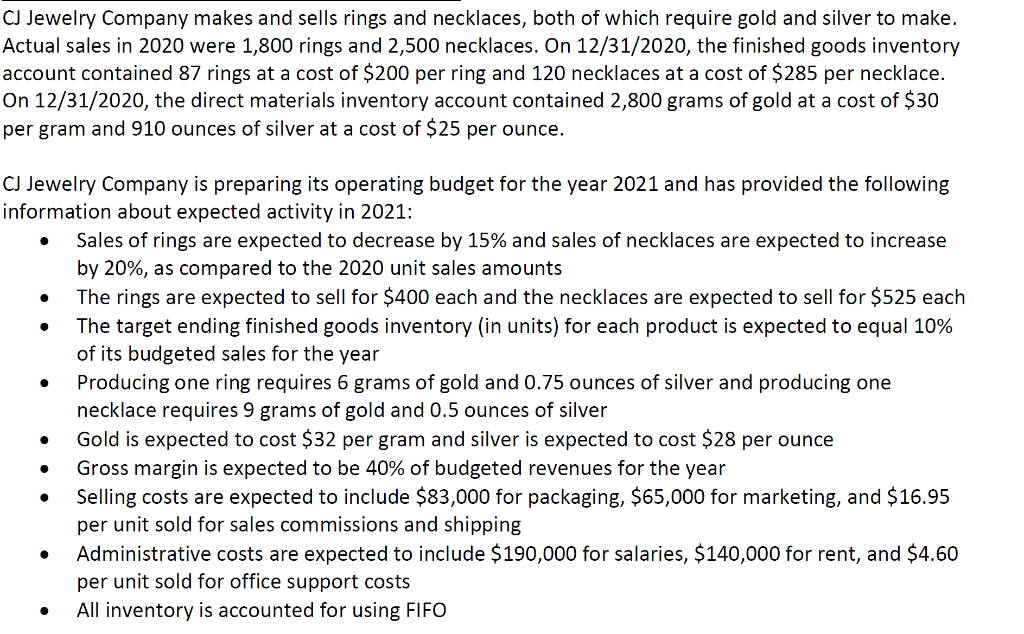

CJ Jewelry Company makes and sells rings and necklaces, both of which require gold and silver to make. Actual sales in 2020 were 1,800 rings and 2,500 necklaces. On 12/31/2020, the finished goods inventory account contained 87 rings at a cost of $200 per ring and 120 necklaces at a cost of $285 per necklace. On 12/31/2020, the direct materials inventory account contained 2,800 grams of gold at a cost of $30 per gram and 910 ounces of silver at a cost of $25 per ounce. . CJ Jewelry Company is preparing its operating budget for the year 2021 and has provided the following information about expected activity in 2021: Sales of rings are expected to decrease by 15% and sales of necklaces are expected to increase by 20%, as compared to the 2020 unit sales amounts The rings are expected to sell for $400 each and the necklaces are expected to sell for $525 each The target ending finished goods inventory (in units) for each product is expected to equal 10% of its budgeted sales for the year Producing one ring requires 6 grams of gold and 0.75 ounces of silver and producing one necklace requires 9 grams of gold and 0.5 ounces of silver Gold is expected to cost $32 per gram and silver is expected to cost $28 per ounce Gross margin is expected to be 40% of budgeted revenues for the year Selling costs are expected to include $83,000 for packaging, $65,000 for marketing, and $16.95 per unit sold for sales commissions and shipping Administrative costs are expected to include $190,000 for salaries, $140,000 for rent, and $4.60 per unit sold for office support costs All inventory is accounted for using FIFO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started