Answered step by step

Verified Expert Solution

Question

1 Approved Answer

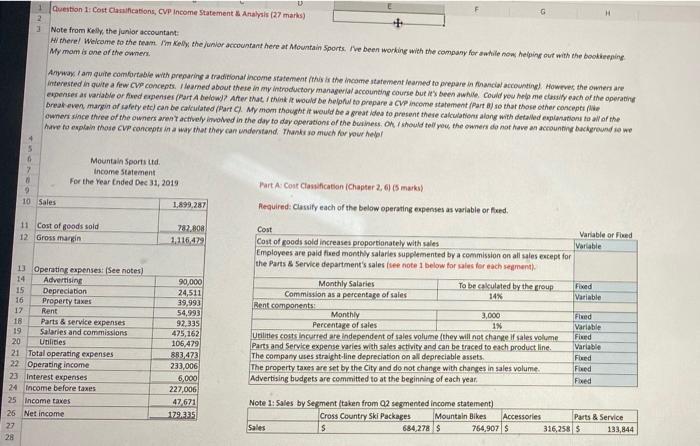

S676910 10 Sales 11 Cost of goods sold 12 Gross margin 13 Operating expenses: (See notes) 14 Advertising 15 Depreciation 16 Property taxes 17

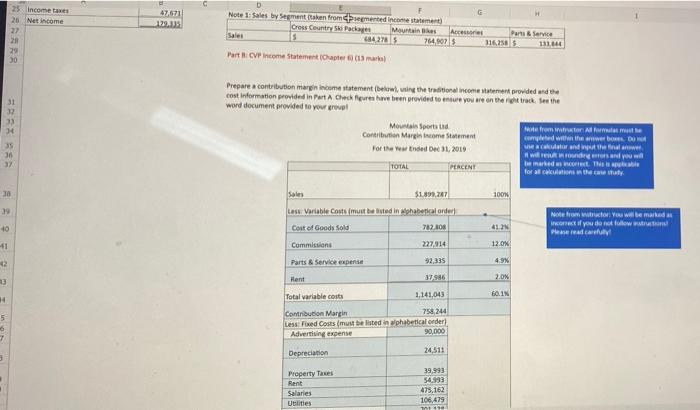

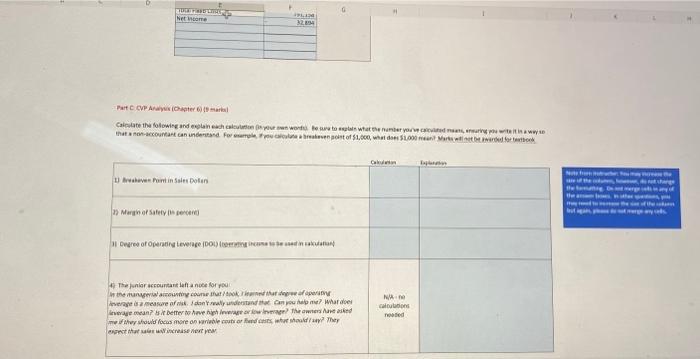

S676910 10 Sales 11 Cost of goods sold 12 Gross margin 13 Operating expenses: (See notes) 14 Advertising 15 Depreciation 16 Property taxes 17 Rent Parts & service expenses 19 Salaries and commissions 20 Utilities 21 Total operating expenses 22 Operating income 23 Interest expenses 24 Income before taxes 25 Income taxes 26 Net income 27 18 28 AMSCAS22 1 Question 1: Cost Classifications, CVP Income Statement & Analysis (27 marks) G 2 3 Note from Kelly, the junior accountant Hi there! Welcome to the team. Im Kelly, the junior accountant here at Mountain Sports. I've been working with the company for awhile now, helping out with the bookkeeping My mom is one of the owners. Anyway, I am quite comfortable with preparing a traditional income statement (this is the income statement learned to prepare in financial accounting). However, the owners are interested in quite a few CVP concepts. I learned about these in my introductory managerial accounting course but it's been awhile. Could you help me classify each of the operating expenses as variable or fixed expenses (Part A below)? After that, I think it would be helpful to prepare a CVP income statement (Part 8) so that those other concepts (ke break even, margin of safety etc) can be calculated (Part C). My mom thought it would be a great idea to present these calculations along with detailed explanations to all of the owners since three of the owners aren't actively involved in the day to day operations of the business. Oh I should tell you, the owners do not have an accounting background so we have to explain those CVP concepts in a way that they can understand. Thanks so much for your help! Mountain Sports Ltd. Income Statement For the Year Ended Dec 31, 2019- Part A: Cost Classification (Chapter 2, 6) (5 marks) Required: Classify each of the below operating expenses as variable or fixed. Cost Variable or Fixed Variable Cost of goods sold increases proportionately with sales Employees are paid fixed monthly salaries supplemented by a commission on all sales except for the Parts & Service department's sales (see note 1 below for sales for each segment). To be calculated by the group Monthly Salaries Commission as a percentage of sales Fixed Variable 14% Rent components: Monthly Percentage of sales 3,000 1% Fixed Variable Fixed Variable Utilities costs incurred are independent of sales volume (they will not change if sales volume Parts and Service expense varies with sales activity and can be traced to each product line. The company uses straight-line depreciation on all depreciable assets. Fixed Fixed The property taxes are set by the City and do not change with changes in sales volume. Advertising budgets are committed to at the beginning of each year. Fixed Note 1: Sales by Segment (taken from Q2 segmented income statement) Cross Country Skil Packages $ Mountain Bikes Accessories 684,278 $ 764,907 $ Parts & Service 133,844 Sales 1,899,287 782,808 1,116,479 90,000 24,511 39,993 54,993 92,335 475,162 106,479 883,473 233,006 6,000 227,006 47,671 179.335 316,258 $ 29 30 ARRA REA 25 Income taxes 26 Net income 27 20 31 33 34 36 37 38 39 40 -41 42 13 H 5 6 7 47,671 129.115 D Note 1: Sales by Segment (taken from segmented income statement) Cross Country Ski Packages Mountain Bikes 15 684.278 5 764,907 5 Sales 316,258 5 Parts & Service 133,844 Part B: CVP Income Statement (Chapter 6) (13 marks) Prepare a contribution margin income statement (below), using the traditional income statement provided and the cost information provided in Part A Check figures have been provided to ensure you are on the right track. See the word document provided to your group! Mountain Sports Ltd. Contribution Margin Income Statement For the Year Ended Dec 31, 2019 TOTAL PERCENT Sales $1.899,247 Less: Variable Costs (must be listed in alphabetical order) Cost of Goods Sold 782,808 Commissions 227,914 Parts & Service expense 92,335 Rent 37.986 Total variable costs 1,141,043 Contribution Margin 758,244 Less: Fixed Costs (must be listed in alphabetical order) 90,000 Advertising expense Depreciation 24,511 39,993 Property Taxes 54,993 Rent 475,162 Salaries 106,479 Utilities 101 1103 Accessories 100% 41,2% 12.0% 4.9% 2.0% 60.1% Note from instructor: All formulas must be completed within the answer boxes. Do not use a calculator and input the final anwe It will result in rounding errors and you will be marked as incorrect. This is applicable for all calculations in the case study Note from instructor: You will be marked at incorrect if you do not follow astructions Please read carefully G STOREL Net Income PPLEDE 32,8 Part C CVP Analysis (Chapter 6) (9 mark Calculate the following and explain each calculation in your own words the sure to explain what the number you've calculated man, euring you writeit in ways that a non-accountant can understand. For example, y calculate a breakeven point of $1,000, what does $1,000 meant Marks will not be awarded for book Ca Explantes 1 Bahaven Point in Sales Dollar 2) Margin of Safety (percent) 11 Degree of Operating Leverage (DOL) (noming income to be su 4 The junior accountant left a note for you in the managerial accounting course that took and that idegeng leverage is a measure of risk. I don't really understand that Can you help me? What does leverage mean? Is it better to have high leverage or low leverage? The owners have asked me if they should focus more on variable couts or feed costs, what should/say? They expect that sales will increase next year NA calculations nooded

Step by Step Solution

★★★★★

3.31 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

AnsACost Classification Cost VariableFixed Cost of Goods Sold Va...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started