In a small open economy, net exports NX depend negatively on the real ex- change rate, which moves in line with the nominal exchange

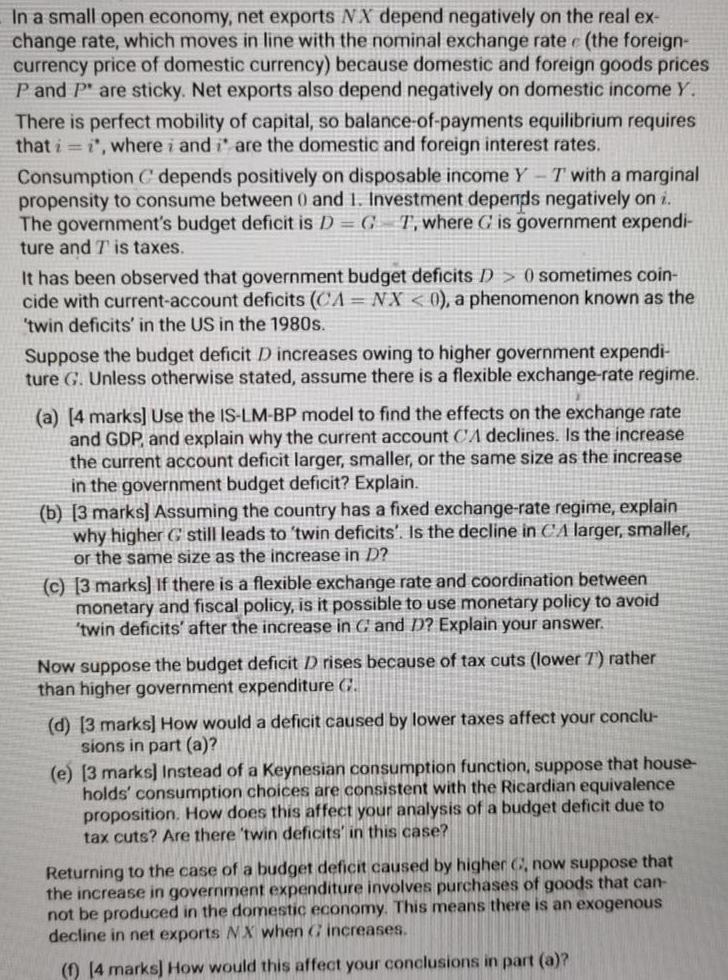

In a small open economy, net exports NX depend negatively on the real ex- change rate, which moves in line with the nominal exchange rate (the foreign- currency price of domestic currency) because domestic and foreign goods prices P and P are sticky. Net exports also depend negatively on domestic income Y. There is perfect mobility of capital, so balance-of-payments equilibrium requires that ii, where i and i are the domestic and foreign interest rates. Consumption C depends positively on disposable income Y Twith a marginal propensity to consume between 0 and 1. Investment depends negatively on i. The government's budget deficit is D=GT, where G is government expendi- ture and T is taxes. It has been observed that government budget deficits D> 0 sometimes coin- cide with current-account deficits (CA= NX < 0), a phenomenon known as the 'twin deficits' in the US in the 1980s. Suppose the budget deficit D increases owing to higher government expendi- ture G. Unless otherwise stated, assume there is a flexible exchange-rate regime. (a) [4 marks] Use the IS-LM-BP model to find the effects on the exchange rate and GDP, and explain why the current account CA declines. Is the increase the current account deficit larger, smaller, or the same size as the increase in the government budget deficit? Explain. (b) [3 marks] Assuming the country has a fixed exchange-rate regime, explain why higher G still leads to 'twin deficits'. Is the decline in CA larger, smaller, or the same size as the increase in D? (c) [3 marks] If there is a flexible exchange rate and coordination between monetary and fiscal policy, is it possible to use monetary policy to avoid 'twin deficits' after the increase in G and D? Explain your answer. Now suppose the budget deficit D rises because of tax cuts (lower 7) rather than higher government expenditure G. (d) [3 marks] How would a deficit caused by lower taxes affect your conclu- sions in part (a)? (e) [3 marks] Instead of a Keynesian consumption function, suppose that house- holds' consumption choices are consistent with the Ricardian equivalence proposition. How does this affect your analysis of a budget deficit due to tax cuts? Are there 'twin deficits' in this case? Returning to the case of a budget deficit caused by higher 6, now suppose that the increase in government expenditure involves purchases of goods that can- not be produced in the domestic economy. This means there is an exogenous decline in net exports NX when Cincreases. (1) [4 marks] How would this affect your conclusions in part (a)?

Step by Step Solution

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Solution 251 M pin support 4P8PB 8PB P2PB 16500 equa...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started