Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Safe Pharmaceutical Company is engaged in manufacturing of life saving medicines. In order to avoid multiple panels of wholesale dealers for distribution of its

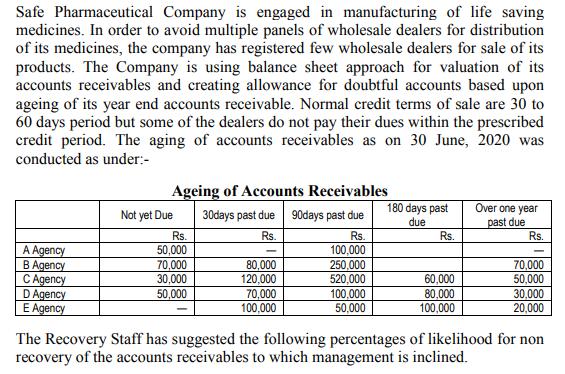

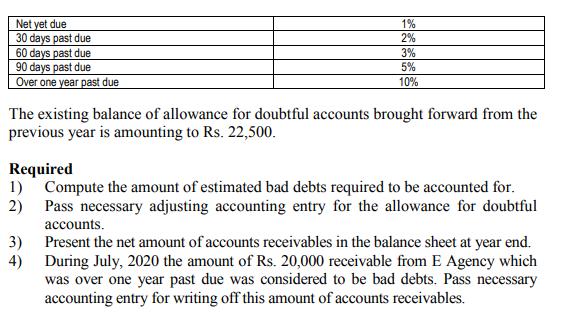

Safe Pharmaceutical Company is engaged in manufacturing of life saving medicines. In order to avoid multiple panels of wholesale dealers for distribution of its medicines, the company has registered few wholesale dealers for sale of its products. The Company is using balance sheet approach for valuation of its accounts receivables and creating allowance for doubtful accounts based upon ageing of its year end accounts receivable. Normal credit terms of sale are 30 to 60 days period but some of the dealers do not pay their dues within the prescribed credit period. The aging of accounts receivables as on 30 June, 2020 was conducted as under:- A Agency B Agency C Agency D Agency E Agency Ageing of Accounts Receivables 30days past due Rs. Not yet Due Rs. 50,000 70,000 30,000 50,000 80,000 120,000 70,000 100,000 90days past due Rs. 100,000 250,000 520,000 100,000 50,000 180 days past due Rs. 60,000 80,000 100,000 Over one year past due Rs. 70,000 50,000 30,000 20,000 The Recovery Staff has suggested the following percentages of likelihood for non recovery of the accounts receivables to which management is inclined. Net yet due 30 days past due 60 days past due 90 days past due Over one year past due 1% 2% 3% 5% 10% The existing balance of allowance for doubtful accounts brought forward from the previous year is amounting to Rs. 22,500. Required 1) Compute the amount of estimated bad debts required to be accounted for. 2) Pass necessary adjusting accounting entry for the allowance for doubtful 3) 4) accounts. Present the net amount of accounts receivables in the balance sheet at year end. During July, 2020 the amount of Rs. 20,000 receivable from E Agency which was over one year past due was considered to be bad debts. Pass necessary accounting entry for writing off this amount of accounts receivables.

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 Compute the amount of estimated bad debts required to be accounted for A Agency 50000 x 1 500 B Ag...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started