1question5parts thank you!

1question5parts thank you!

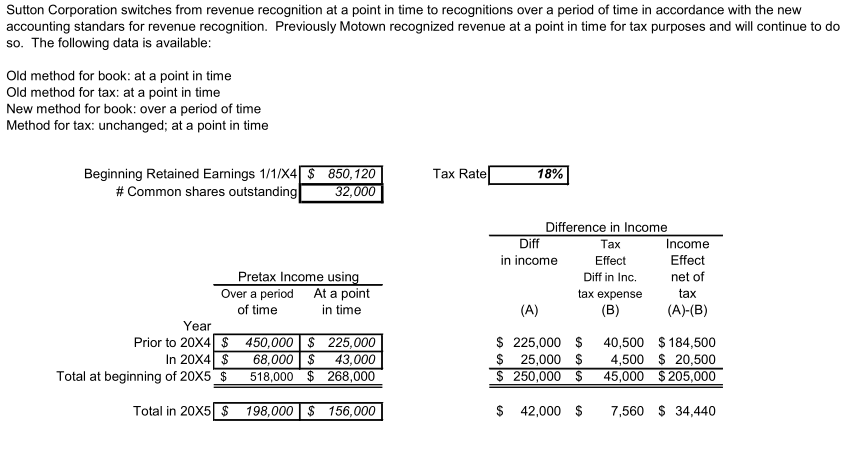

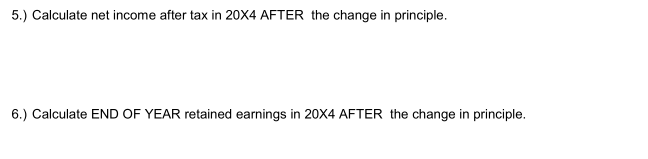

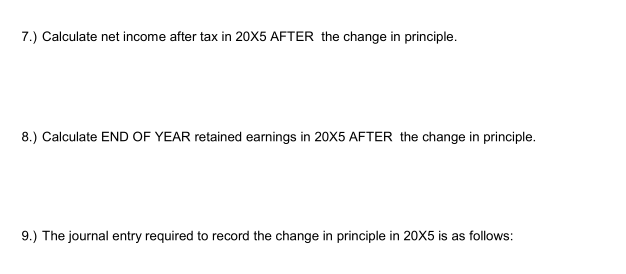

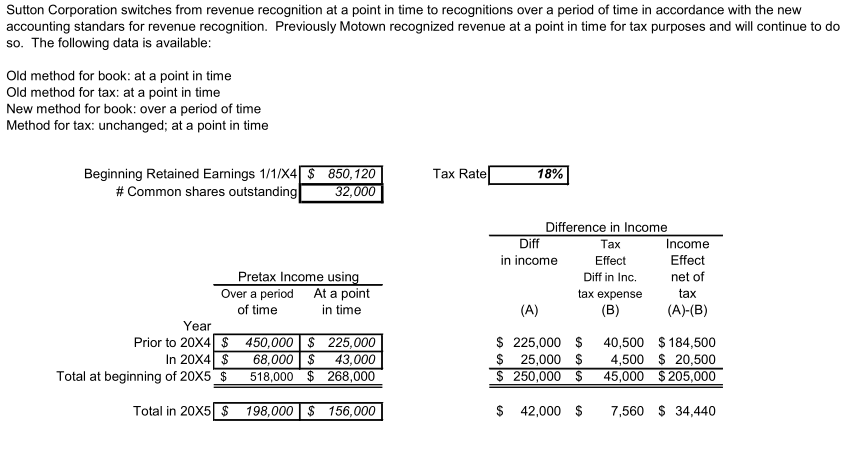

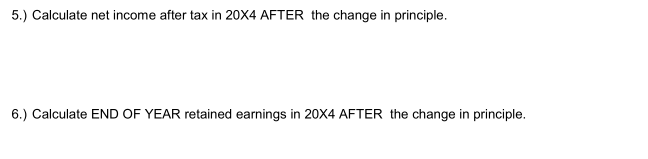

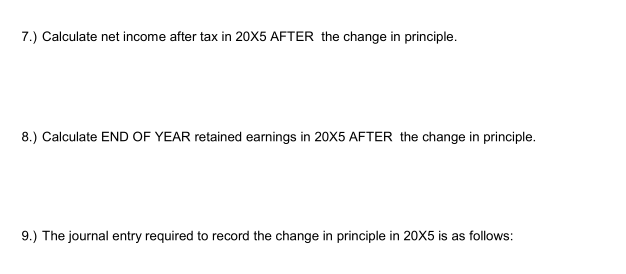

Sutton Corporation switches from revenue recognition at a point in time to recognitions over a period of time in accordance with the new accounting standars for revenue recognition. Previously Motown recognized revenue at a point in time for tax purposes and will continue to do so. The following data is available: Old method for book: at a point in time Old method for tax: at a point in time New method for book: over a period of time Method for tax: unchanged; at a point in time Beginning Retained Earnings 1/1/24 $ 850,120 # Common shares outstanding 32,000 Tax Rate 18% Difference in Income Diff Tax Income in income Effect Effect Diff in Inc. net of tax expense tax (B) (A)-(B) (A) Pretax Income using Over a period At a point of time in time Year Prior to 20x4 $ 450,000 $ 225,000 In 20X4 $ 68,000 $ 43,000 Total at beginning of 20x5 $ 518,000 $ 268,000 $ 225,000 $ $ 25,000 $ $ 250,000 $ 40,500 $ 184,500 4,500 $ 20,500 45,000 $ 205,000 Total in 20x5 S 198,000 $ 156,000 $ 42,000 $ 7,560 $ 34,440 5.) Calculate net income after tax in 20X4 AFTER the change in principle. 6.) Calculate END OF YEAR retained earnings in 20X4 AFTER the change in principle. 7.) Calculate net income after tax in 20X5 AFTER the change in principle. 8.) Calculate END OF YEAR retained earnings in 20x5 AFTER the change in principle. 9.) The journal entry required to record the change in principle in 20X5 is as follows: Sutton Corporation switches from revenue recognition at a point in time to recognitions over a period of time in accordance with the new accounting standars for revenue recognition. Previously Motown recognized revenue at a point in time for tax purposes and will continue to do so. The following data is available: Old method for book: at a point in time Old method for tax: at a point in time New method for book: over a period of time Method for tax: unchanged; at a point in time Beginning Retained Earnings 1/1/24 $ 850,120 # Common shares outstanding 32,000 Tax Rate 18% Difference in Income Diff Tax Income in income Effect Effect Diff in Inc. net of tax expense tax (B) (A)-(B) (A) Pretax Income using Over a period At a point of time in time Year Prior to 20x4 $ 450,000 $ 225,000 In 20X4 $ 68,000 $ 43,000 Total at beginning of 20x5 $ 518,000 $ 268,000 $ 225,000 $ $ 25,000 $ $ 250,000 $ 40,500 $ 184,500 4,500 $ 20,500 45,000 $ 205,000 Total in 20x5 S 198,000 $ 156,000 $ 42,000 $ 7,560 $ 34,440 5.) Calculate net income after tax in 20X4 AFTER the change in principle. 6.) Calculate END OF YEAR retained earnings in 20X4 AFTER the change in principle. 7.) Calculate net income after tax in 20X5 AFTER the change in principle. 8.) Calculate END OF YEAR retained earnings in 20x5 AFTER the change in principle. 9.) The journal entry required to record the change in principle in 20X5 is as follows

1question5parts thank you!

1question5parts thank you!