Answered step by step

Verified Expert Solution

Question

1 Approved Answer

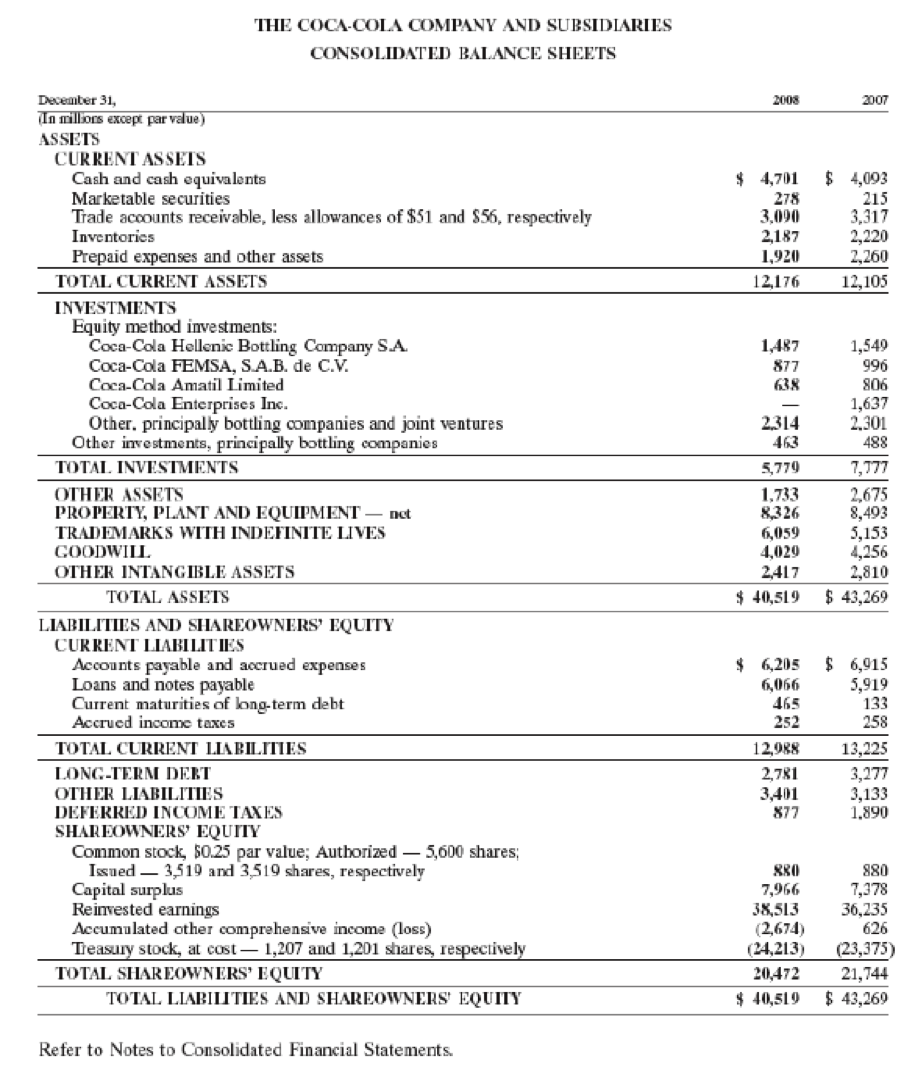

1.Review Coke Colas financial statements and answer the following questions: What is Cokes percent of current assets to total assets on its December 31, 2008

1.Review Coke Colas financial statements and answer the following questions:

What is Cokes percent of current assets to total assets on its December 31, 2008 balance sheet?

What is Cokes percentage of current liabilities to total stockholders equity on its December 31, 2008 balance sheet?

What is the percentage increase in cash and cash equivalents from 2007 to 2008?

What percentage did total assets decrease from 2007 to 2008?

THE COCA-COLA COMPANY AND SUESIDIARIES CONSOLIDATED BALANCE SHEETS 2008 2007 excepr par value SSETS CURRENT ASSETS 4,701 278 Cash and cash equivalents Marketable securities Trade accounts receivable, less allowances of $51 and 856, respectively Inventorics Prepaid expenses and other assets 4,093 3.317 2,260 12,105 1,920 12,176 TOTAL CURRENT ASSETS INVESTMENTS Equity method investments: 1,487 877 638 1,549 996 806 1,637 Coca-Cola Hellenic Bottling Company S.A Coca-Cola FEMSA, S.A.B. de C.V. Coca-Cola Amatil Limited Coca-Cola Enterprises Inc, Other. principally bottling companies and joint ventures 488 Other investments, principally bottling companies TOTAI. INVESTMENT OTHER ASSETS PROPERTY, PLANT AND EQUIPMENT nct GOODWILL OTHER INTANGIBLE ASSETS 2,675 8,493 5,153 4,256 2,810 $40,519 43,269 5,779 1,733 8326 6,059 4,029 2417 TRADEMARKS WITH INDEFINITE LIVES TOTAL ASSETS LIABILITIES AND SHAREOWNERS' EQUITY CURRENT LIABILITIES 6,205 6,915 5,919 133 258 Accounts payable and accrued expenses 6,066 465 Loans and notes payable Current maturities of long-term debt Accrued income taxes TOTAL CURRENT LIABILITIES LONG-TERMM DERT OTHER LIABILITIES DEFERRED INCOME TAXES SHAREOWNERS' EQUITY 12,988 13,225 2,781 3,277 3,133 1.890 877 Common stock, 50.25 par value: Authorized-5,600 shares; Issued3519 and 3519 shares, respectively Capital surplus Reinvested earnings Accumulated other comprehensive income (loss) Treasury stock, at cost 1,207 and 1,201 shares, respectively 880 7,9667,378 38,513 36,235 626 24,213) 23.375) 20,472 21,744 40,519 43,269 s80 (2,674) TOTAL SHAREOWNERS' EQUITY TOTAL LIABILITIES AND SHAREOWNERS EQUITY Refer to Notes to Consolidated Financial StatementsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started