Answered step by step

Verified Expert Solution

Question

1 Approved Answer

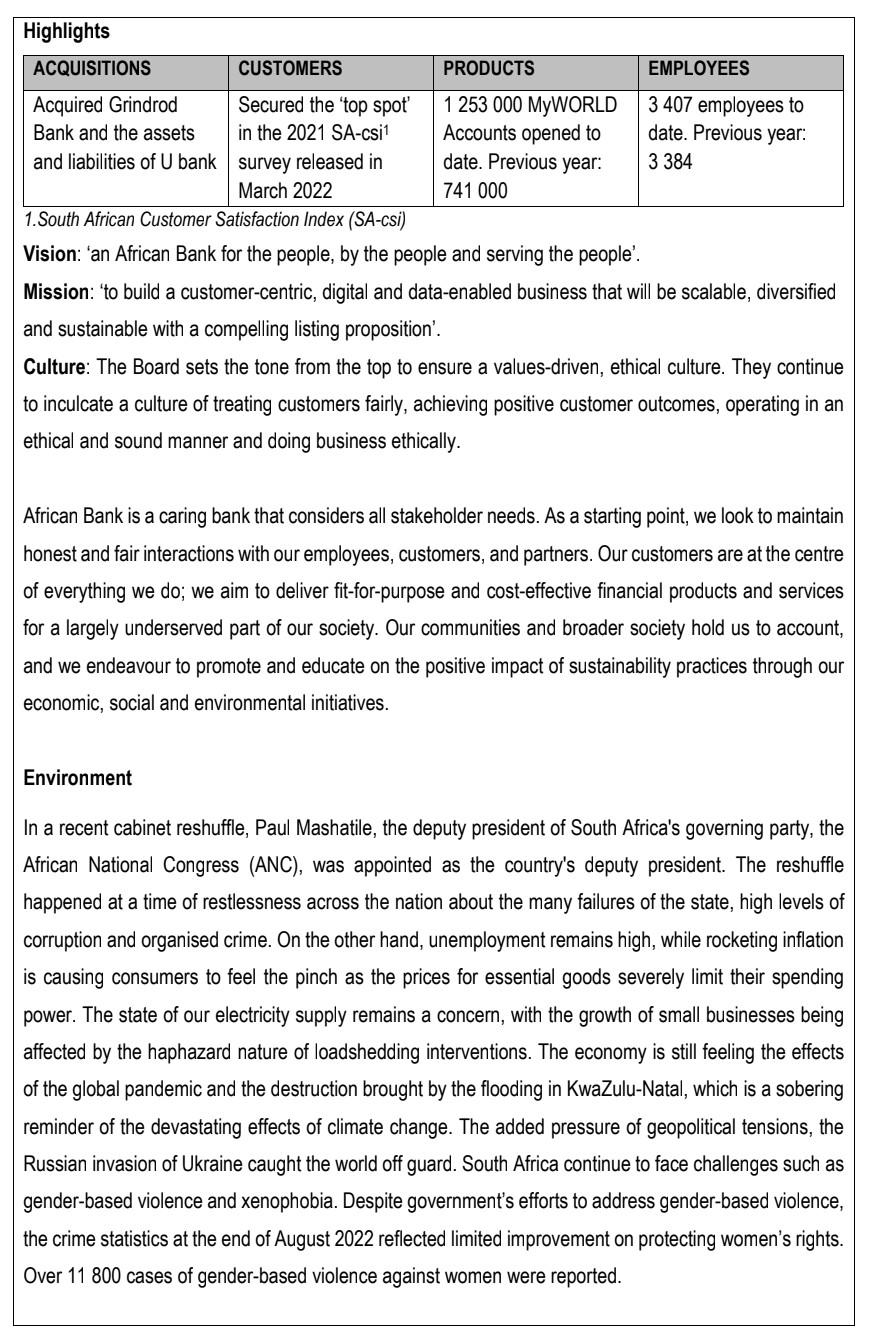

1.South African Customer Satisfaction Index (SA-csi) Vision: 'an African Bank for the people, by the people and serving the people'. Mission: 'to build a customer-centric,

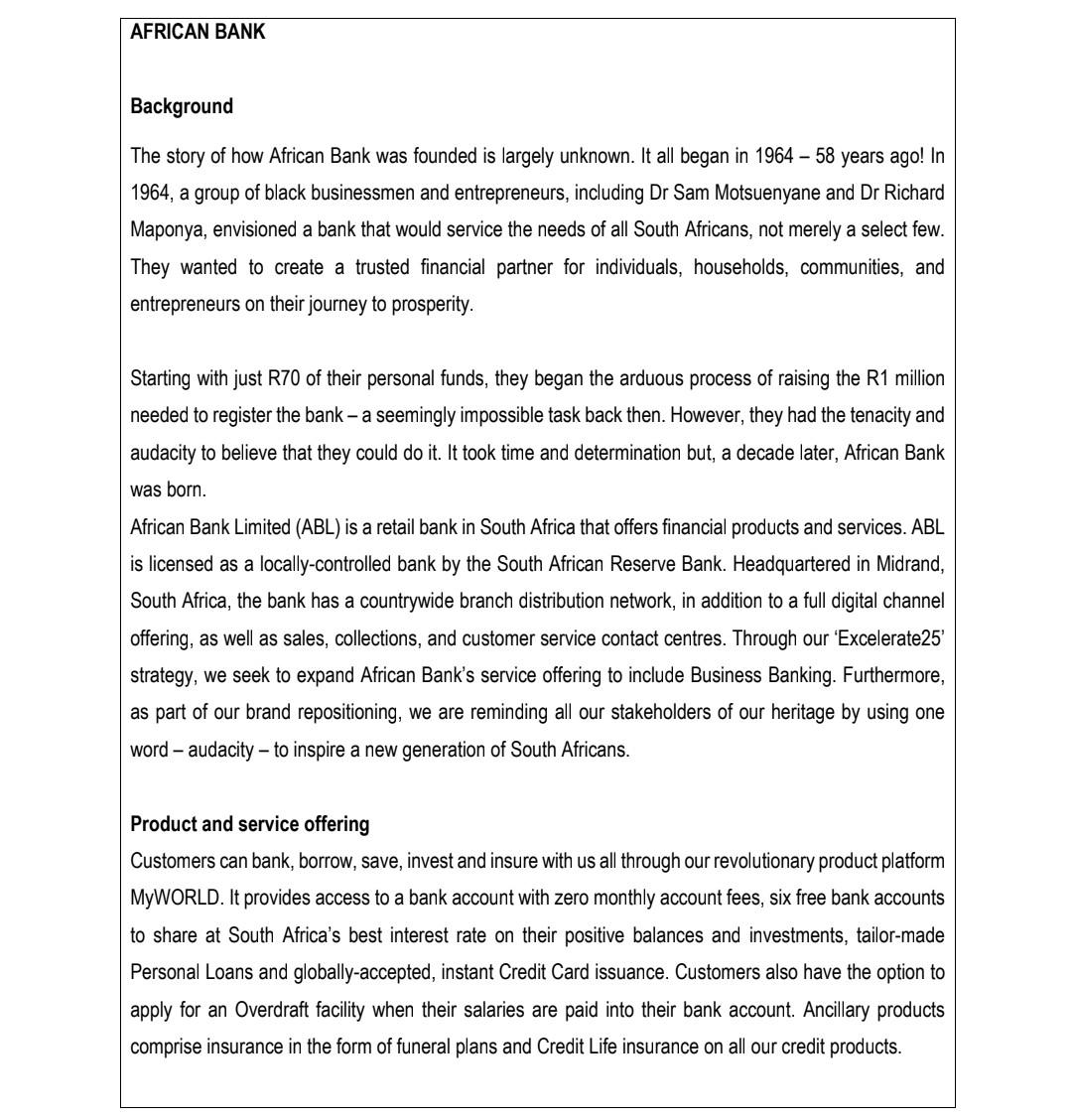

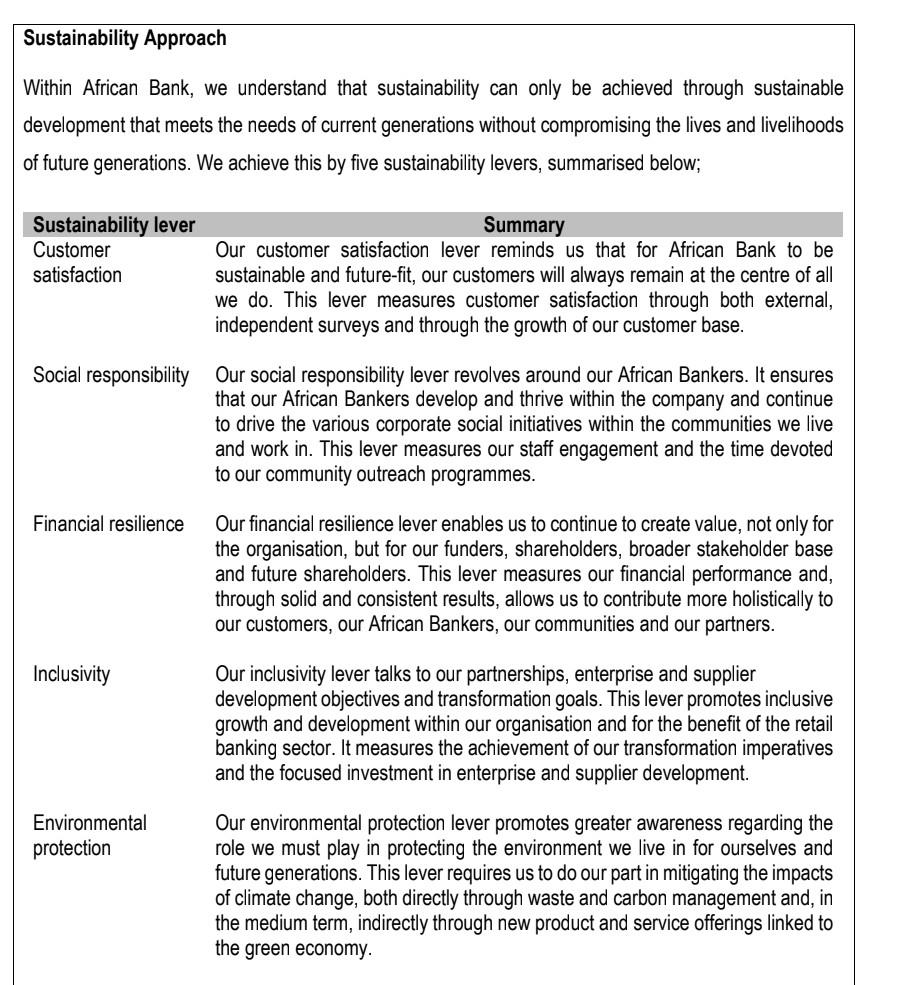

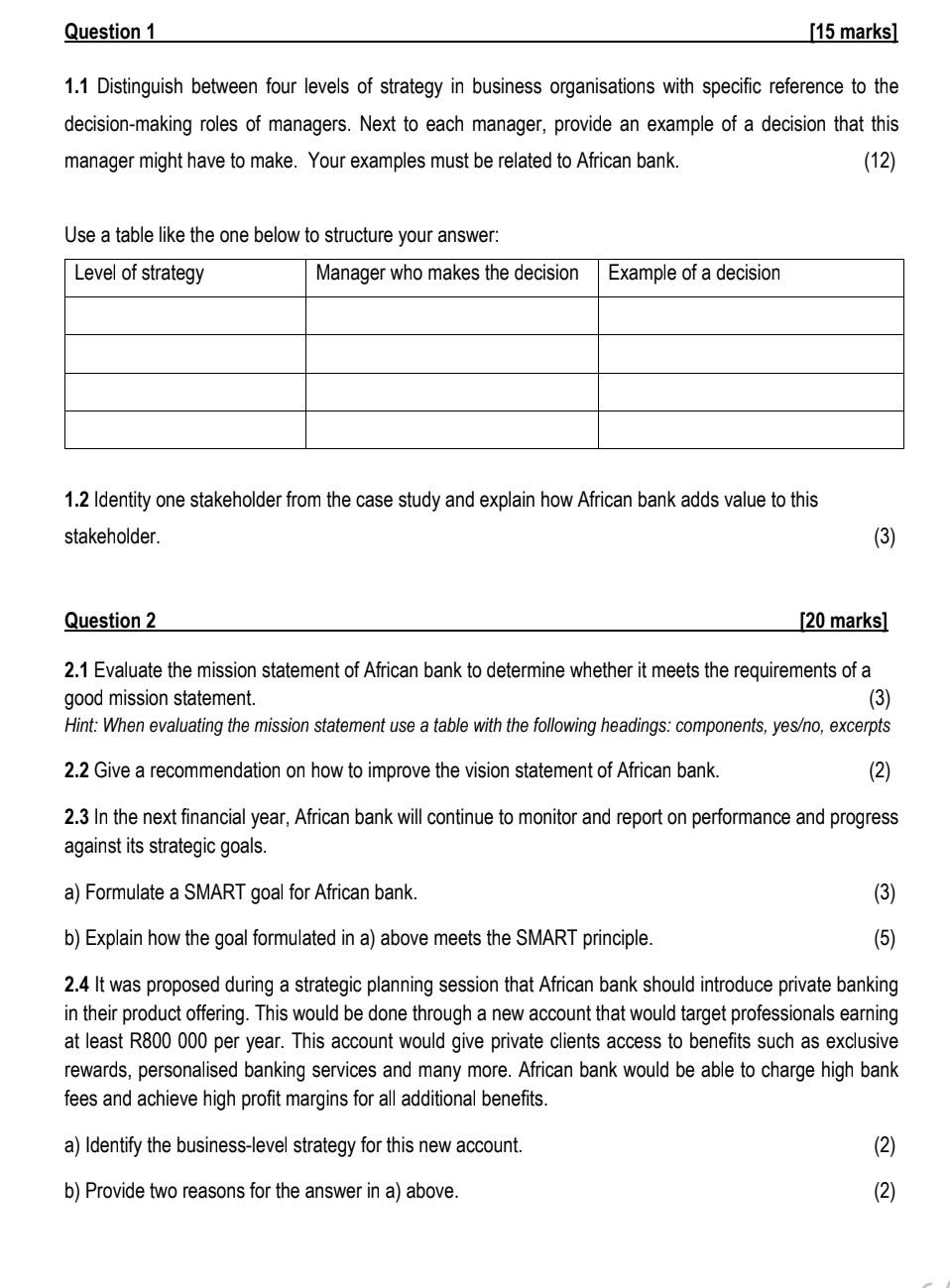

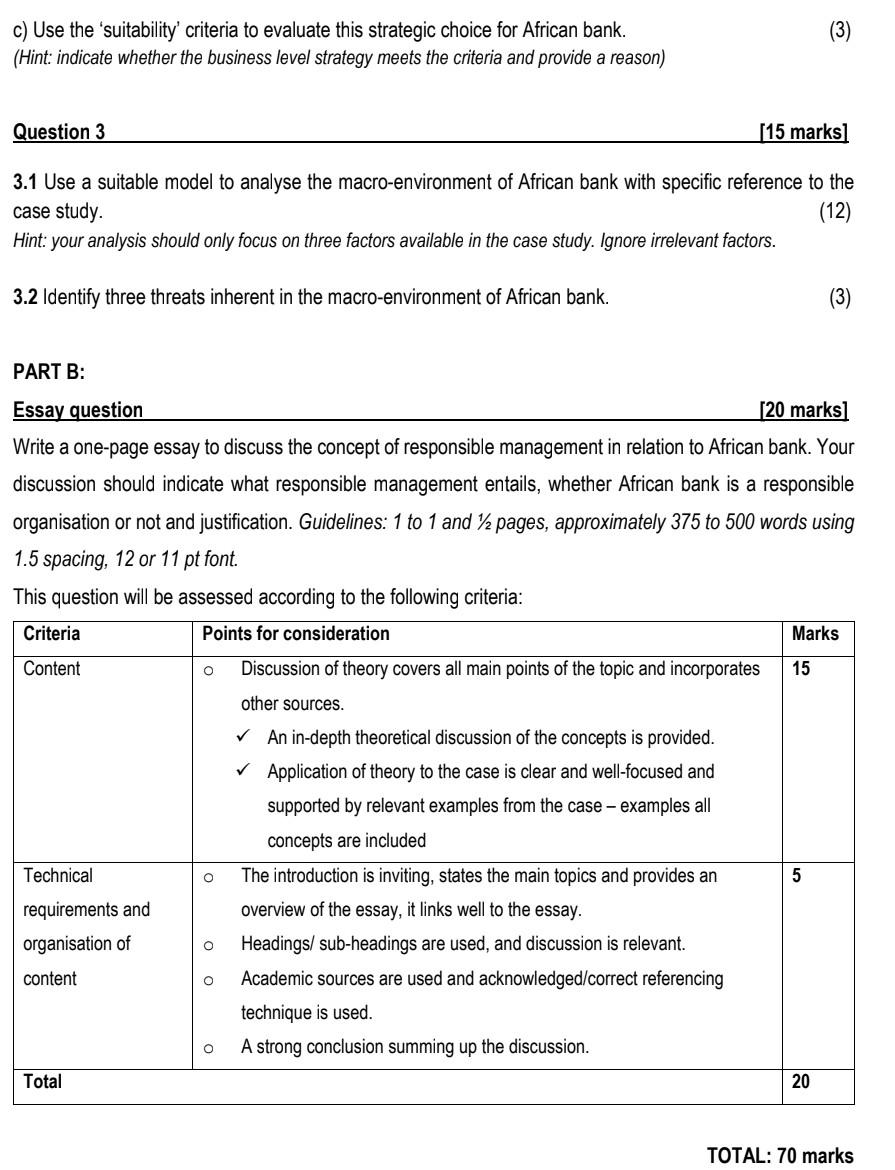

1.South African Customer Satisfaction Index (SA-csi) Vision: 'an African Bank for the people, by the people and serving the people'. Mission: 'to build a customer-centric, digital and data-enabled business that will be scalable, diversified and sustainable with a compelling listing proposition'. Culture: The Board sets the tone from the top to ensure a values-driven, ethical culture. They continue to inculcate a culture of treating customers fairly, achieving positive customer outcomes, operating in an ethical and sound manner and doing business ethically. African Bank is a caring bank that considers all stakeholder needs. As a starting point, we look to maintain honest and fair interactions with our employees, customers, and partners. Our customers are at the centre of everything we do; we aim to deliver fit-for-purpose and cost-effective financial products and services for a largely underserved part of our society. Our communities and broader society hold us to account, and we endeavour to promote and educate on the positive impact of sustainability practices through our economic, social and environmental initiatives. Environment In a recent cabinet reshuffle, Paul Mashatile, the deputy president of South Africa's governing party, the African National Congress (ANC), was appointed as the country's deputy president. The reshuffle happened at a time of restlessness across the nation about the many failures of the state, high levels of corruption and organised crime. On the other hand, unemployment remains high, while rocketing inflation is causing consumers to feel the pinch as the prices for essential goods severely limit their spending power. The state of our electricity supply remains a concern, with the growth of small businesses being affected by the haphazard nature of loadshedding interventions. The economy is still feeling the effects of the global pandemic and the destruction brought by the flooding in KwaZulu-Natal, which is a sobering reminder of the devastating effects of climate change. The added pressure of geopolitical tensions, the Russian invasion of Ukraine caught the world off guard. South Africa continue to face challenges such as gender-based violence and xenophobia. Despite government's efforts to address gender-based violence, the crime statistics at the end of August 2022 reflected limited improvement on protecting women's rights. Over 11800 cases of gender-based violence against women were reported. c) Use the 'suitability' criteria to evaluate this strategic choice for African bank. (Hint: indicate whether the business level strategy meets the criteria and provide a reason) Question 3 [15 marks] 3.1 Use a suitable model to analyse the macro-environment of African bank with specific reference to the case study. (12) Hint: your analysis should only focus on three factors available in the case study. Ignore irrelevant factors. 3.2 Identify three threats inherent in the macro-environment of African bank. PART B: Essay question [20 marks] Write a one-page essay to discuss the concept of responsible management in relation to African bank. Your discussion should indicate what responsible management entails, whether African bank is a responsible organisation or not and justification. Guidelines: 1 to 1 and 1/2 pages, approximately 375 to 500 words using 1.5 spacing, 12 or 11 pt font. This question will be assessed according to the following criteria: AFRICAN BANK Background The story of how African Bank was founded is largely unknown. It all began in 1964 - 58 years ago! In 1964, a group of black businessmen and entrepreneurs, including Dr Sam Motsuenyane and Dr Richard Maponya, envisioned a bank that would service the needs of all South Africans, not merely a select few. They wanted to create a trusted financial partner for individuals, households, communities, and entrepreneurs on their journey to prosperity. Starting with just R70 of their personal funds, they began the arduous process of raising the R1 million needed to register the bank - a seemingly impossible task back then. However, they had the tenacity and audacity to believe that they could do it. It took time and determination but, a decade later, African Bank was born. African Bank Limited (ABL) is a retail bank in South Africa that offers financial products and services. ABL is licensed as a locally-controlled bank by the South African Reserve Bank. Headquartered in Midrand, South Africa, the bank has a countrywide branch distribution network, in addition to a full digital channel offering, as well as sales, collections, and customer service contact centres. Through our 'Excelerate25' strategy, we seek to expand African Bank's service offering to include Business Banking. Furthermore, as part of our brand repositioning, we are reminding all our stakeholders of our heritage by using one word - audacity - to inspire a new generation of South Africans. Product and service offering Customers can bank, borrow, save, invest and insure with us all through our revolutionary product platform MyWORLD. It provides access to a bank account with zero monthly account fees, six free bank accounts to share at South Africa's best interest rate on their positive balances and investments, tailor-made Personal Loans and globally-accepted, instant Credit Card issuance. Customers also have the option to apply for an Overdraft facility when their salaries are paid into their bank account. Ancillary products comprise insurance in the form of funeral plans and Credit Life insurance on all our credit products. Sustainability Approach Within African Bank, we understand that sustainability can only be achieved through sustainable development that meets the needs of current generations without compromising the lives and livelihoods of future generations. We achieve this by five sustainability levers, summarised below; \begin{tabular}{ll} Sustainability lever & \multicolumn{1}{c}{ Summary } \\ Customer & Our customer satisfaction lever reminds us that for African Bank to be \\ satisfaction & sustainable and future-fit, our customers will always remain at the centre of all \\ we do. This lever measures customer satisfaction through both external, \\ independent surveys and through the growth of our customer base. \end{tabular} 1.1 Distinguish between four levels of strategy in business organisations with specific reference to the decision-making roles of managers. Next to each manager, provide an example of a decision that this manager might have to make. Your examples must be related to African bank. Use a table like the one below to structure your answer: 1.2 Identity one stakeholder from the case study and explain how African bank adds value to this stakeholder. Question 2 [20 marks] 2.1 Evaluate the mission statement of African bank to determine whether it meets the requirements of a good mission statement. (3) Hint: When evaluating the mission statement use a table with the following headings: components, yeso, excerpts 2.2 Give a recommendation on how to improve the vision statement of African bank. 2.3 In the next financial year, African bank will continue to monitor and report on performance and progress against its strategic goals. a) Formulate a SMART goal for African bank. b) Explain how the goal formulated in a) above meets the SMART principle. 2.4 It was proposed during a strategic planning session that African bank should introduce private banking in their product offering. This would be done through a new account that would target professionals earning at least R800 000 per year. This account would give private clients access to benefits such as exclusive rewards, personalised banking services and many more. African bank would be able to charge high bank fees and achieve high profit margins for all additional benefits. a) Identify the business-level strategy for this new account. b) Provide two reasons for the answer in a) above. 1.South African Customer Satisfaction Index (SA-csi) Vision: 'an African Bank for the people, by the people and serving the people'. Mission: 'to build a customer-centric, digital and data-enabled business that will be scalable, diversified and sustainable with a compelling listing proposition'. Culture: The Board sets the tone from the top to ensure a values-driven, ethical culture. They continue to inculcate a culture of treating customers fairly, achieving positive customer outcomes, operating in an ethical and sound manner and doing business ethically. African Bank is a caring bank that considers all stakeholder needs. As a starting point, we look to maintain honest and fair interactions with our employees, customers, and partners. Our customers are at the centre of everything we do; we aim to deliver fit-for-purpose and cost-effective financial products and services for a largely underserved part of our society. Our communities and broader society hold us to account, and we endeavour to promote and educate on the positive impact of sustainability practices through our economic, social and environmental initiatives. Environment In a recent cabinet reshuffle, Paul Mashatile, the deputy president of South Africa's governing party, the African National Congress (ANC), was appointed as the country's deputy president. The reshuffle happened at a time of restlessness across the nation about the many failures of the state, high levels of corruption and organised crime. On the other hand, unemployment remains high, while rocketing inflation is causing consumers to feel the pinch as the prices for essential goods severely limit their spending power. The state of our electricity supply remains a concern, with the growth of small businesses being affected by the haphazard nature of loadshedding interventions. The economy is still feeling the effects of the global pandemic and the destruction brought by the flooding in KwaZulu-Natal, which is a sobering reminder of the devastating effects of climate change. The added pressure of geopolitical tensions, the Russian invasion of Ukraine caught the world off guard. South Africa continue to face challenges such as gender-based violence and xenophobia. Despite government's efforts to address gender-based violence, the crime statistics at the end of August 2022 reflected limited improvement on protecting women's rights. Over 11800 cases of gender-based violence against women were reported. c) Use the 'suitability' criteria to evaluate this strategic choice for African bank. (Hint: indicate whether the business level strategy meets the criteria and provide a reason) Question 3 [15 marks] 3.1 Use a suitable model to analyse the macro-environment of African bank with specific reference to the case study. (12) Hint: your analysis should only focus on three factors available in the case study. Ignore irrelevant factors. 3.2 Identify three threats inherent in the macro-environment of African bank. PART B: Essay question [20 marks] Write a one-page essay to discuss the concept of responsible management in relation to African bank. Your discussion should indicate what responsible management entails, whether African bank is a responsible organisation or not and justification. Guidelines: 1 to 1 and 1/2 pages, approximately 375 to 500 words using 1.5 spacing, 12 or 11 pt font. This question will be assessed according to the following criteria: AFRICAN BANK Background The story of how African Bank was founded is largely unknown. It all began in 1964 - 58 years ago! In 1964, a group of black businessmen and entrepreneurs, including Dr Sam Motsuenyane and Dr Richard Maponya, envisioned a bank that would service the needs of all South Africans, not merely a select few. They wanted to create a trusted financial partner for individuals, households, communities, and entrepreneurs on their journey to prosperity. Starting with just R70 of their personal funds, they began the arduous process of raising the R1 million needed to register the bank - a seemingly impossible task back then. However, they had the tenacity and audacity to believe that they could do it. It took time and determination but, a decade later, African Bank was born. African Bank Limited (ABL) is a retail bank in South Africa that offers financial products and services. ABL is licensed as a locally-controlled bank by the South African Reserve Bank. Headquartered in Midrand, South Africa, the bank has a countrywide branch distribution network, in addition to a full digital channel offering, as well as sales, collections, and customer service contact centres. Through our 'Excelerate25' strategy, we seek to expand African Bank's service offering to include Business Banking. Furthermore, as part of our brand repositioning, we are reminding all our stakeholders of our heritage by using one word - audacity - to inspire a new generation of South Africans. Product and service offering Customers can bank, borrow, save, invest and insure with us all through our revolutionary product platform MyWORLD. It provides access to a bank account with zero monthly account fees, six free bank accounts to share at South Africa's best interest rate on their positive balances and investments, tailor-made Personal Loans and globally-accepted, instant Credit Card issuance. Customers also have the option to apply for an Overdraft facility when their salaries are paid into their bank account. Ancillary products comprise insurance in the form of funeral plans and Credit Life insurance on all our credit products. Sustainability Approach Within African Bank, we understand that sustainability can only be achieved through sustainable development that meets the needs of current generations without compromising the lives and livelihoods of future generations. We achieve this by five sustainability levers, summarised below; \begin{tabular}{ll} Sustainability lever & \multicolumn{1}{c}{ Summary } \\ Customer & Our customer satisfaction lever reminds us that for African Bank to be \\ satisfaction & sustainable and future-fit, our customers will always remain at the centre of all \\ we do. This lever measures customer satisfaction through both external, \\ independent surveys and through the growth of our customer base. \end{tabular} 1.1 Distinguish between four levels of strategy in business organisations with specific reference to the decision-making roles of managers. Next to each manager, provide an example of a decision that this manager might have to make. Your examples must be related to African bank. Use a table like the one below to structure your answer: 1.2 Identity one stakeholder from the case study and explain how African bank adds value to this stakeholder. Question 2 [20 marks] 2.1 Evaluate the mission statement of African bank to determine whether it meets the requirements of a good mission statement. (3) Hint: When evaluating the mission statement use a table with the following headings: components, yeso, excerpts 2.2 Give a recommendation on how to improve the vision statement of African bank. 2.3 In the next financial year, African bank will continue to monitor and report on performance and progress against its strategic goals. a) Formulate a SMART goal for African bank. b) Explain how the goal formulated in a) above meets the SMART principle. 2.4 It was proposed during a strategic planning session that African bank should introduce private banking in their product offering. This would be done through a new account that would target professionals earning at least R800 000 per year. This account would give private clients access to benefits such as exclusive rewards, personalised banking services and many more. African bank would be able to charge high bank fees and achieve high profit margins for all additional benefits. a) Identify the business-level strategy for this new account. b) Provide two reasons for the answer in a) above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started