Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1st blank: increase/decrease 2nd blank:increase/decrease 3rd blank: slower /faster 5. Impact of budget deficits The following graph shows the loanable funds market in the united

1st blank: increase/decrease

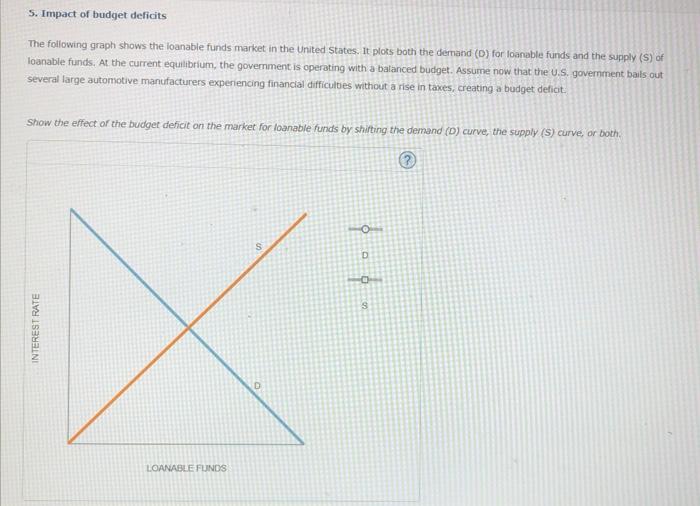

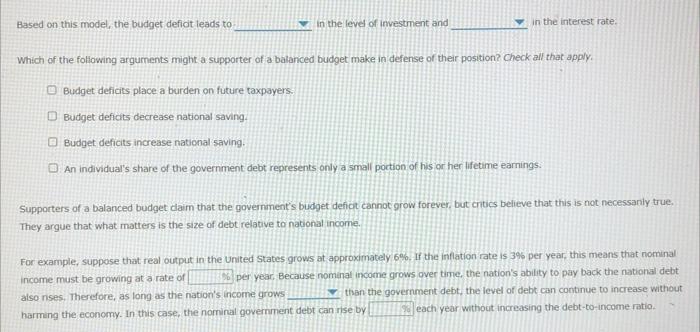

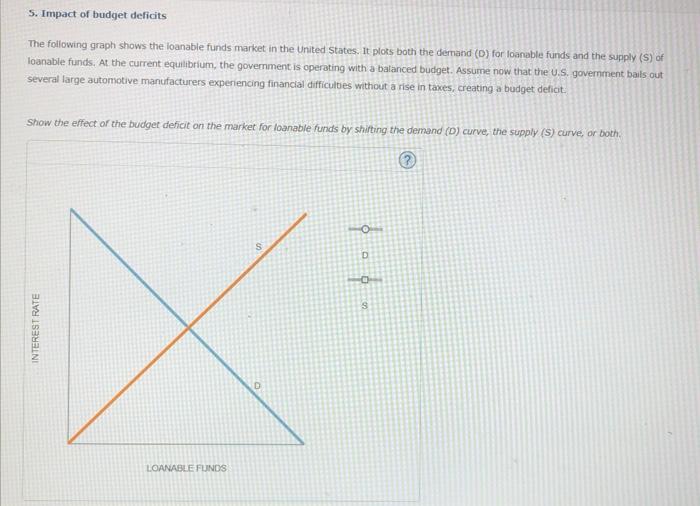

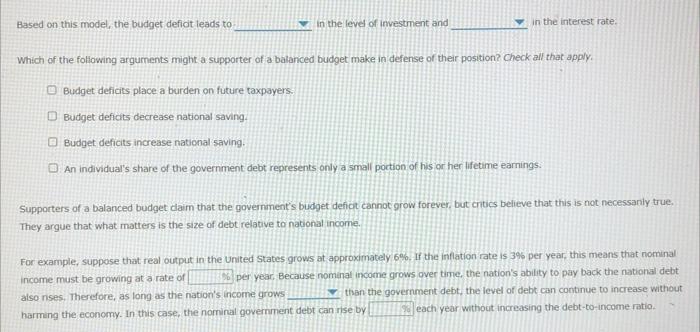

5. Impact of budget deficits The following graph shows the loanable funds market in the united states. It plots both the demand (D) for loanable funds and the supply (S) of loanable funds. At the current equilibrium, the government is operating with a balarced budget. Assume now that the U.S. govemment bails out several large automotive manufacturers experiencing financlal difficultes without a rise in taxes, creating a budget deficit. Show the effect of the budget deficit on the market for loanable funds by shitting the demand (D) curve, the supply (S) curve, or both. Based on this model, the budget defiot leads to in the level of imvestment and in the interest rate: Which of the foliowing arguments might a supporter of a batanced budget make in defense of their position? Check all that apply, Budget deficits place a burden on future taxpayers. Budget deficits decrease national saving. Budget deficits increase national saving. An individual's share of the government debt represents only a small poction of his or her lifetime earnings: Supporters of a balanced budget claim that the government's budget defict cannot grow forever, but chics believe that this is not necessanily true. They argue that what matters is the size of debt relative to national income. For example, suppose that real output in the United States grows at approximately 6%. If the inflation rate is 3% income must be growing at a rate of per year. Because nominal income grows over time, the nation's ability to pay back the national debt also nises, Therefore, as long as the nation's income grows: than the government debt, the level of debt can continue to increase without harming the economy. In this case, the nominal govermment debt can rise by each year without-increasing the debt-to-income ratio 2nd blank:increase/decrease

3rd blank: slower /faster

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started