Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1st Drop down options: leveraged lease, tax oriented lease 2nd Drop down: forfeiture, limits, a loss, CCA recapture Leasing is a very lucrative source of

1st Drop down options: leveraged lease, tax oriented lease

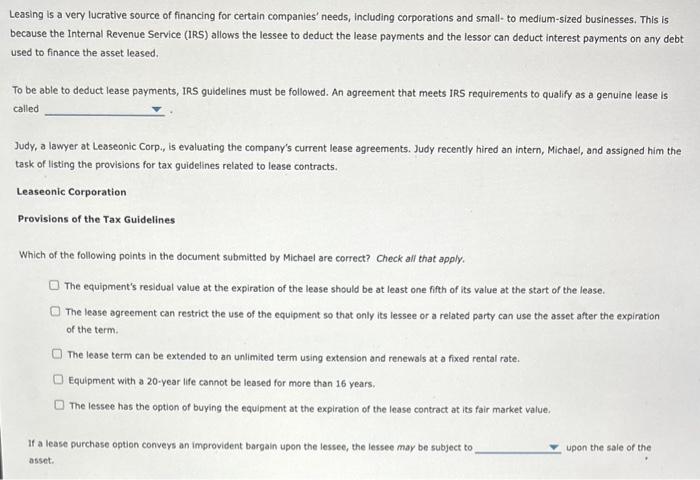

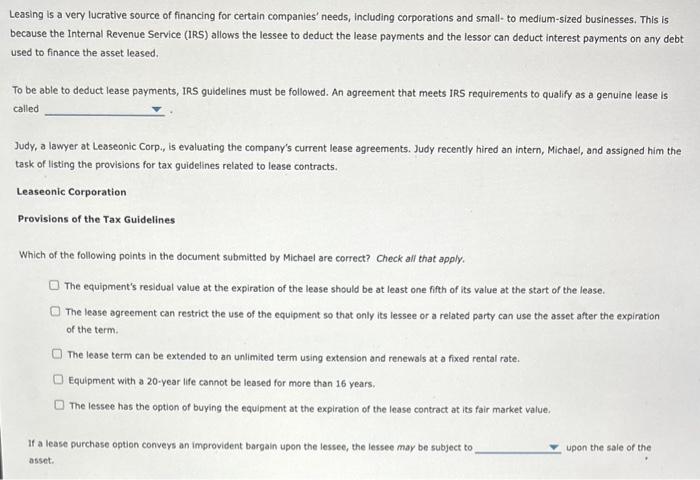

Leasing is a very lucrative source of financing for certain companies' needs, Including corporations and small- to medium-sized businesses. This is because the Internal Revenue Service (IRS) allows the lessee to deduct the lease payments and the lessor can deduct interest payments on any debt used to finance the asset leased. To be able to deduct lease payments, IRS guidelines must be followed. An agreement that meets IRS requirements to qualify as a genuine lease is called Judy, a lawyer at Leaseonic Corp., is evaluating the company's current lease agreements. Judy recently hired an intern, Michael, and assigned him the task of listing the provisions for tax guidelines related to lease contracts. Leaseonic Corporation Provisions of the Tax Guidelines Which of the following points in the document submitted by Michael are correct? Check all that apply. The equipment's residual value at the expiration of the lease should be at least one fifth of its value at the start of the lease. The lease agreement can restrict the use of the equipment so thot only its lessee or a related party can use the asset after the expiration of the term. The lease term can be extended to an unlimited term using extension and renewals at a fixed rental rate. Equipment with a 20-year life cannot be leased for more than 16 years. The lessee has the option of buying the equipment at the expiration of the lease contract at its fair market value. If a lease purchase option conveys an improvident bargain upon the lessee, the lessee may be subject to asset 2nd Drop down: forfeiture, limits, a loss, CCA recapture

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started