Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1st problem is 18-2B you dont have to answer those its just info. Im looking for 18-3B Chapter 18 Managerial Accounting Concepts and Principles 795

1st problem is 18-2B you dont have to answer those its just info. Im looking for 18-3B

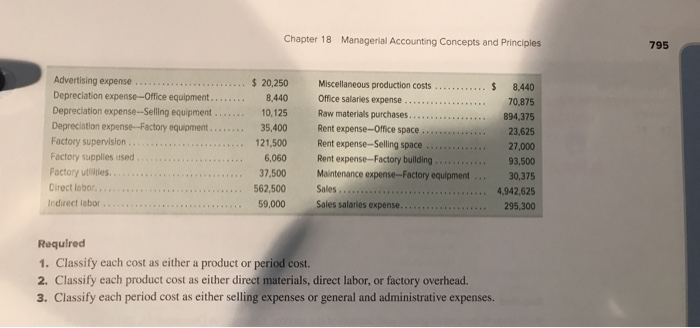

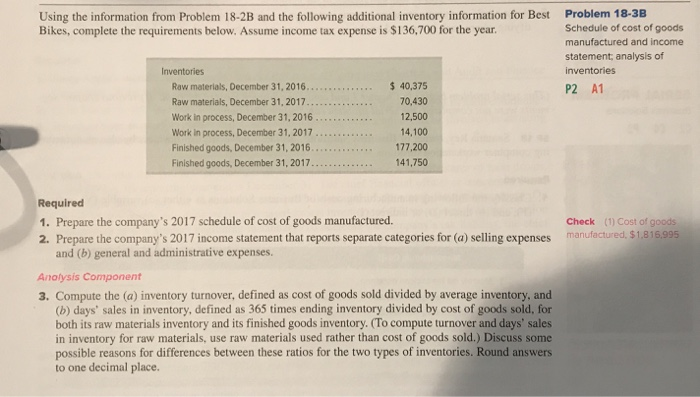

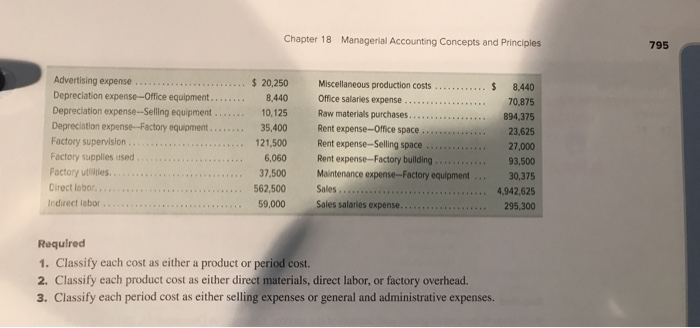

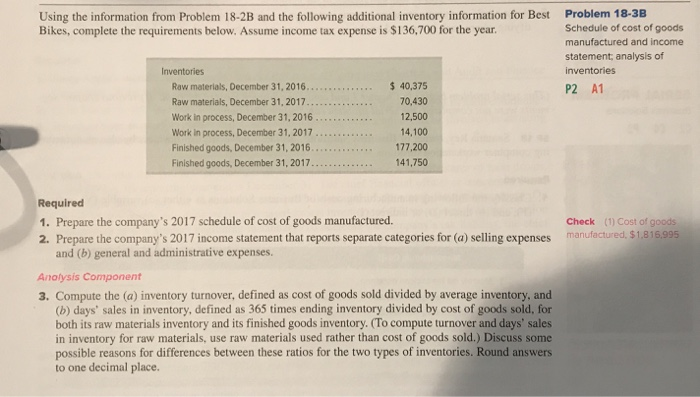

Chapter 18 Managerial Accounting Concepts and Principles 795 Advertising expense Depreciation expense-Office equipment....8,440 Depreciation expense-Selling equipment Deprecistion expense-Factory equipment 35,400 Rent expense-Office space Factory supervision Factory supplies used octory utiitles. irect lobor..562,500 Sales.. ndirect lebo.. Office salaries expense 70,875 894,375 23,625 27,000 93,500 30,375 4,942,625 295,300 10,125 121,500 6,060 37.500 Rent expense-Selling space Rent expense-Factory building Maintenance expense-Factory equipment 59,000 Required 1. Classify each cost as either a product or period cost. 2. Classify each product cost as either direct materials, direct labor, or factory overhead. 3. Classify each period cost as either selling expenses or general and administrative expenses. Using the information from Problem 18-2B and the following additional inventory information for Best Bikes, complete the requirements below. Assume income tax expense is $136,700 for the year Problem 18-3B Schedule of cost of goods manufactured and income statement, analysis of inventories Inventories Raw materials, December 31, 2016. Raw materials, December 31, 2017 Work in process, December 31, 2016 $ 40,375 70,430 12,500 14,100 P2 A1 Finished goods, December 31, 2017 141,750 Required 1. Prepare the company's 2017 schedule of cost of goods manufactured. 2. Prepare the company's 2017 income statement that reports separate categories for (a) selling expenses manufactured, $1,815995 Check (1) Cost of goods and (b) general and administrative expenses. Anolysis Component 3. Compute the (a) inventory turnover, defined as cost of goods sold divided by average inventory, and (b) days' sales in inventory, defined as 365 times ending inventory divided by cost of goods sold, for both its raw materials inventory and its finished goods inventory. (To compute turnover and days' sales in inventory for raw materials, use raw materials used rather than cost of goods sold.) Discuss some possible reasons for differences between these ratios for the two types of inventories. Round answers to one decimal place

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started