Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.State the fixed period for this investment 2.Verify the simple interest earned on the Flexi Fixed deposit at 7,5% p.a. for the period 1 September

1.State the fixed period for this investment

2.Verify the simple interest earned on the Flexi Fixed deposit at 7,5% p.a. for the period 1 September 2016 to 31 October 2020 as R30 000,00. Show all calculations

3. Show how the reduction fee of R6 400,00 was calculated.

4.Cara states that the reduction in the interest amount for the period the money was invested is 21,3%. Show by means of calculations whether Carla and Sahraj's statement is correct

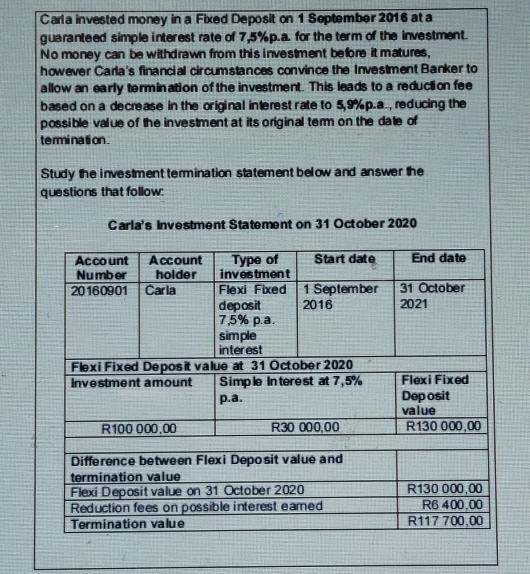

Carla invested money in a Fixed Deposit on 1 September 2016 at a guaranteed simple interest rate of 7,5%p.a. for the term of the investment. No money can be withdrawn from this investment before it matures, however Carla's financial circumstances convince the Investment Banker to allow an early termination of the investment. This leads to a reduction fee based on a decrease in the original interest rate to 5,9%p.a., reducing the possible value of the investment at its original term on the date of termination. Study the investment termination statement below and answer the questions that follow: Carla's Investment Statement on 31 October 2020 Account Account Number holder 20160901 Carla Type of investment Flexi Fixed deposit 7,5% p.a. simple interest Start date 1 September 2016 Flexi Fixed Deposit value at 31 October 2020 Investment amount Simple Interest at 7,5% p.a. R100 000,00 Difference between Flexi Deposit value and termination value Flexi Deposit value on 31 October 2020 Reduction fees on possible interest earned Termination value R30 000,00 End date 31 October 2021 Flexi Fixed Deposit value R130 000,00 R130 000,00 R6 400,00 R117 700,00

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 The fixed period for this investment is 5 years from 1 September 2016 to 31 October 2021 Question 2 To verify the simple interest earned on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started