Answered step by step

Verified Expert Solution

Question

1 Approved Answer

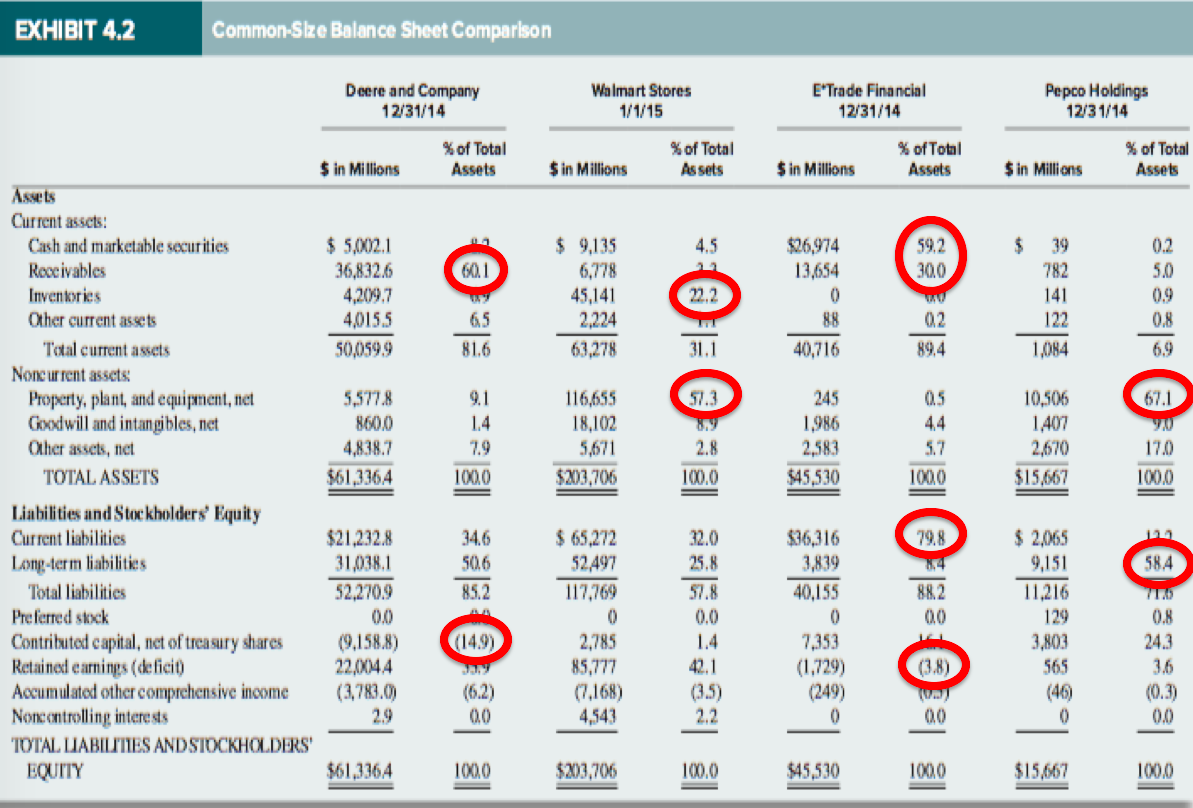

1.Summarize the main points in the previous illustration. 2.And describe your understanding about financial statement characteristics related with specif ic industry? Use examples would be

1.Summarize the main points in the previous illustration.

2.And describe your understanding about financial statement characteristics related with specif

ic industry? Use examples would be best. For example, one industry's characteristic compared with another industry's.

EXHIBIT 4.2 Common-Skze Balance Sheet Comparison Deere and Company 12/31/14 Walmart Stores 1/1/15 E'Trade Financial 12/31/14 Pepco Holdings 12/31/14 , $ in Millions % of Total Assets $ in Millions % of Total Assets $ in Millions % of Total Assets $ in Millions % of Total Assets $26,974 13.654 59.2 300 601 $ 5.002.1 36,8326 4,209.7 4,0155 50,0599 $ 9,135 6,778 45,141 2,224 63,278 122 1.084 40,716 89.4 57.3 67.1 5,577.8 8600 4,838.7 $61,3364 116,655 18,102 5,671 $203,706 245 1986 2,583 $45,530 10,506 1,407 2,670 $15.667 2.8 100.0 17.0 1000 100,0 Current assets! Cash and marketable securities Roccivables Inventories Other current assets Total current assets Noncurrent assets Property, plant, and equipment, niet Goodwill and intangibles.net Other assets, net TOTAL ASSETS Liabilities and Stockholders' Equity Current liabilities Long-term liabilities Total liabilities Preferred stock Contributed capital, net of treasury shares Retained earnings (deficit) Accumulated other comprehensive income Noncontrolling interests TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 32.0 79.8 906 $ 65,272 52,497 117,769 25.8 $36,316 3,839 40,155 584 85.2 $21.232.8 31,038.1 52,2709 0.0 (9,158.8) 22/0044 (3,783.0) 29 57.8 0.0 $ 2,065 9,151 11,216 129 3,803 565 0.8 (14.9) 1.4 42.1 2,785 85,777 (7,168) 4,543 7,353 (1,729) (249) 243 3.6 (0.3) 00 $61,3364 1000 $203,706 100.0 $45,530 100 $15.667 100.0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started