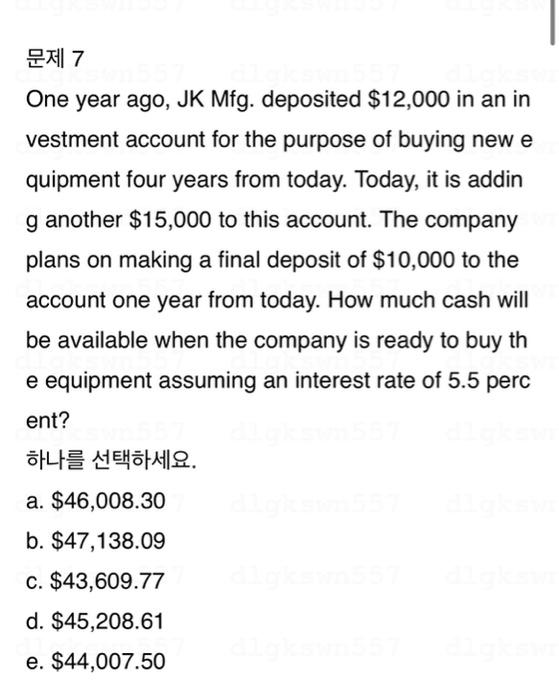

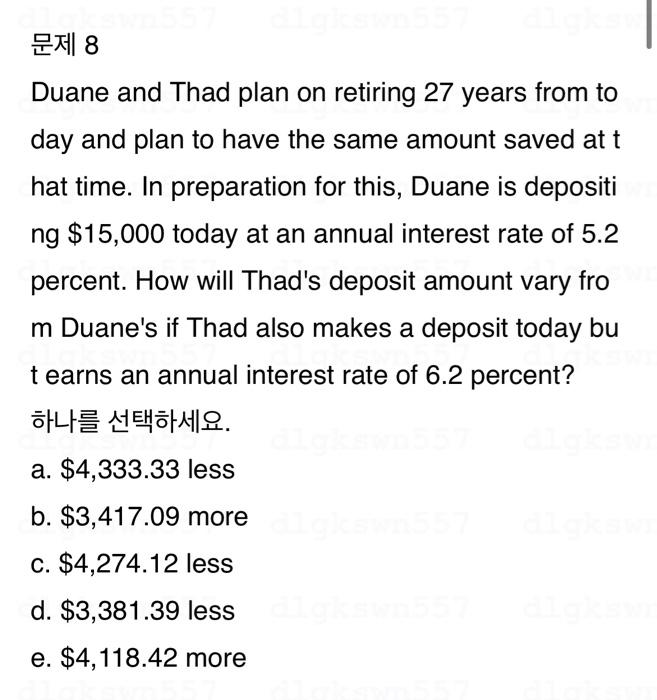

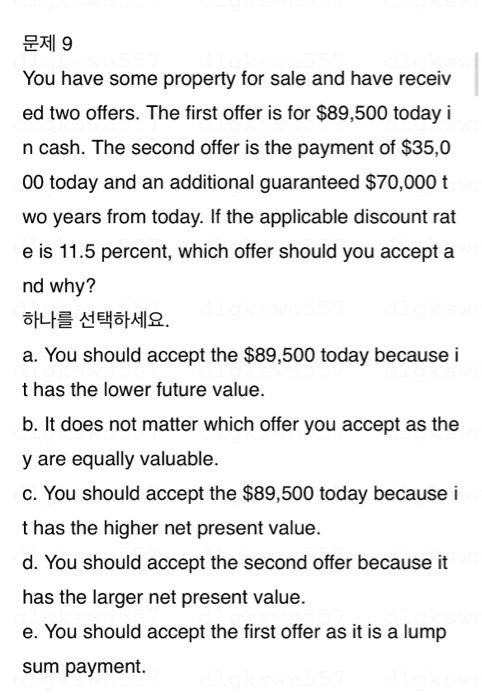

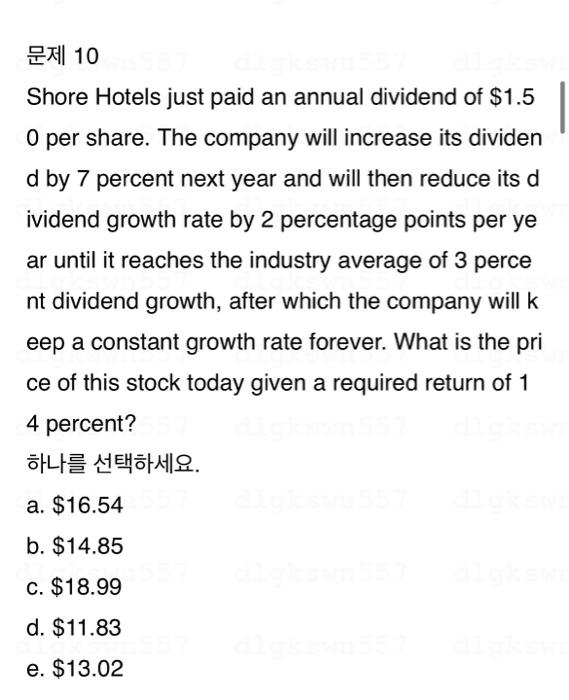

1Suppose Big Ewha, Inc., just paid a dividen d of $0.50 per share. It is expected to increase its dividend by 5% per year. If the market requires a r eturn of 10% on assets of this risk, how much sho uld the stock be selling for? . a. $0.50 b. $10.50 c. $2 d. $8.58 2 Advertisements in a financial newspaper announc ing a public offering of securities, along with a list of the investment banks handling the offering, are called: . a. red herrings b. Green Shoes. c. registration statements. d. tombstones. e cash gffers Which of the following yields on a stock can be ne gative? . a. Capital gains yield and total return b. Dividend yield, capital gains yield, and total ret urn c. Dividend yield and total return d. Dividend yield e. Capital gains yield 4 A bond has a coupon rate of 8 percent, 7 years to maturity, semiannual interest payments, and a YT M of 7 percent. If interest rates suddenly rise by 1.5 percent, what will be the percentage change i n the bond price? . a. -8.67 percent b. -8.16 percent c. -7.56 percent d. -7.64 percent e -8.87nercent 5 You own a stock that you think will produce a retu rn of 11 percent in a good economy and 3 percent in a poor economy. Given the probabilities of eac h state of the economy occurring, you anticipate t hat your stock will earn 6.5 percent next year. Whi ch one of the following terms applies to this 6.5p ercent? . a. Geometric return b. Arithmetic return c. Required return d. Expected return e. Historical return 6 According to Myers and Majluf's (1984) Pecking Order Theory, an entrepreneur will consider as the top priority source of financing ab usiness project. . a. None of the above b. Equities c. Bonds d. Lotteries e. Retained earnings 7 One year ago, JK Mfg. deposited $12,000 in an in vestment account for the purpose of buying new e quipment four years from today. Today, it is addin g another $15,000 to this account. The company plans on making a final deposit of $10,000 to the account one year from today. How much cash will be available when the company is ready to buy th e equipment assuming an interest rate of 5.5 perc ent? . a. $46,008.30 b. $47,138.09 c. $43,609.77 d. $45,208.61 e. $44,007.50 8 Duane and Thad plan on retiring 27 years from to day and plan to have the same amount saved at t hat time. In preparation for this, Duane is depositi ng $15,000 today at an annual interest rate of 5.2 percent. How will Thad's deposit amount vary fro m Duane's if Thad also makes a deposit today bu t earns an annual interest rate of 6.2 percent? . a. $4,333.33 less b. $3,417.09 more c. $4,274.12 less d. $3,381.39 less e. $4,118.42 more 9 You have some property for sale and have receiv ed two offers. The first offer is for $89,500 today i n cash. The second offer is the payment of $35,0 00 today and an additional guaranteed $70,000t wo years from today. If the applicable discount rat e is 11.5 percent, which offer should you accept a nd why? . a. You should accept the $89,500 today because i t has the lower future value. b. It does not matter which offer you accept as the y are equally valuable. c. You should accept the $89,500 today because i t has the higher net present value. d. You should accept the second offer because it has the larger net present value. e. You should accept the first offer as it is a lump sum payment. 10 Shore Hotels just paid an annual dividend of $1.5 0 per share. The company will increase its dividen d by 7 percent next year and will then reduce its d ividend growth rate by 2 percentage points per ye ar until it reaches the industry average of 3 perce nt dividend growth, after which the company will k eep a constant growth rate forever. What is the pri ce of this stock today given a required return of 1 4 percent? . a. $16.54 b. $14.85 c. $18.99 d. $11.83 e. $13.02 11 Noelle owns 12 percent of The Toy Factory. She h as decided to retire and wants to sell all of her sh ares in this closely held, all-equity firm. The other shareholders have agreed to have the company b orrow the $248,000 needed to repurchase her sh ares of stock. What is the total market value of th e company? Ignore taxes. . a. $2,489,111 b. $2,414,141 c. $2,608,515 d. $2,066,667 e. $2,333,333 12 Shareholder A sold 500 shares of ABC stock on t he New York Stock Exchange. This transaction . a. took place in the primary market b. was a private placement c. was facilitated in the secondary market d. occurred in a dealer market e. involved a proxy 13 Bonner Metals wants to issue new 20-year bonds. The company currently has 8.5 percent bonds on the market that sell for $994, make semiannual p ayments, and mature in 7 years. What should the coupon rate be on the new bonds if the firm wants to sell them at par? . a. 9.23 percent b. 8.41 percent c. 8.75 percent d. 8.62 percent . 8.87 mprcent 14 A business owned by a solitary individual who has unlimited liability for the firm's debt is called a . a. general partnership b. limited partnership c. corporation d. limited liability company e. sole proprietorship 15 Which one of the following states that the cost of equity capital is directly and proportionally related to capital structure? . a. Homemade leverage b.Modigliani-Miller Theorem II c. Static theory of capital structure d. Pecking-order theory e. Modigliani-Miller Theorem I 16 M\&M Proposition I with no tax supports the argum ent that: . a. business risk has no effect on the return on ass ets. b. the cost of equity rises as leverage rises. c. business risk is irrelevant d. homemade leverage is irrelevant. e. a company's debt-equity ratio is completely irre levant. 17 Project A has a required return on 9.2 percent an d cash flows of $87,000,$32,600,$35,900, and $43,400 for Years 0 to 3 , respectively. Project B h as a required return of 12.7 percent and cash flow s of $85,000,$14,700,$21,200, and $89,800 for Years 0 to 3 , respectively. Which project(s) should you accept based on net present value if the proje cts are mutually exclusive? . a. Accept both projects b. Reject Project A and accept Project B c. Reject both projects d. Accept Project A and reject Project B e. Accept either one, but not both An agent who arranges a transaction between ab uyer and a seller of equity securities is called a: . a. capitalist. b. principal c. broker. d. dealer. e. floor trader. 19 Consider the following information on three stock s: A portfolio is invested 45 percent each in Stock A and Stock B and 10 percent in Stock C. What is t he expected risk premium on the portfolio if the ex pected T-bill rate is 3.2 percent? . a. 4.29 percent b. 12.38 percent c. 8.71 percent d. 11.47 percent e. 1.67 percent JLK is a partnership that was formed two years a go and has been extremely successful thus far. T he owners have decided to incorporate and offer shares of stock to the general public. What is this type of an equity offering called? . a. Private placement b. Shelf offering c. Seasoned equity offering d. Initial public offering e. Venture capital offering 1Suppose Big Ewha, Inc., just paid a dividen d of $0.50 per share. It is expected to increase its dividend by 5% per year. If the market requires a r eturn of 10% on assets of this risk, how much sho uld the stock be selling for? . a. $0.50 b. $10.50 c. $2 d. $8.58 2 Advertisements in a financial newspaper announc ing a public offering of securities, along with a list of the investment banks handling the offering, are called: . a. red herrings b. Green Shoes. c. registration statements. d. tombstones. e cash gffers Which of the following yields on a stock can be ne gative? . a. Capital gains yield and total return b. Dividend yield, capital gains yield, and total ret urn c. Dividend yield and total return d. Dividend yield e. Capital gains yield 4 A bond has a coupon rate of 8 percent, 7 years to maturity, semiannual interest payments, and a YT M of 7 percent. If interest rates suddenly rise by 1.5 percent, what will be the percentage change i n the bond price? . a. -8.67 percent b. -8.16 percent c. -7.56 percent d. -7.64 percent e -8.87nercent 5 You own a stock that you think will produce a retu rn of 11 percent in a good economy and 3 percent in a poor economy. Given the probabilities of eac h state of the economy occurring, you anticipate t hat your stock will earn 6.5 percent next year. Whi ch one of the following terms applies to this 6.5p ercent? . a. Geometric return b. Arithmetic return c. Required return d. Expected return e. Historical return 6 According to Myers and Majluf's (1984) Pecking Order Theory, an entrepreneur will consider as the top priority source of financing ab usiness project. . a. None of the above b. Equities c. Bonds d. Lotteries e. Retained earnings 7 One year ago, JK Mfg. deposited $12,000 in an in vestment account for the purpose of buying new e quipment four years from today. Today, it is addin g another $15,000 to this account. The company plans on making a final deposit of $10,000 to the account one year from today. How much cash will be available when the company is ready to buy th e equipment assuming an interest rate of 5.5 perc ent? . a. $46,008.30 b. $47,138.09 c. $43,609.77 d. $45,208.61 e. $44,007.50 8 Duane and Thad plan on retiring 27 years from to day and plan to have the same amount saved at t hat time. In preparation for this, Duane is depositi ng $15,000 today at an annual interest rate of 5.2 percent. How will Thad's deposit amount vary fro m Duane's if Thad also makes a deposit today bu t earns an annual interest rate of 6.2 percent? . a. $4,333.33 less b. $3,417.09 more c. $4,274.12 less d. $3,381.39 less e. $4,118.42 more 9 You have some property for sale and have receiv ed two offers. The first offer is for $89,500 today i n cash. The second offer is the payment of $35,0 00 today and an additional guaranteed $70,000t wo years from today. If the applicable discount rat e is 11.5 percent, which offer should you accept a nd why? . a. You should accept the $89,500 today because i t has the lower future value. b. It does not matter which offer you accept as the y are equally valuable. c. You should accept the $89,500 today because i t has the higher net present value. d. You should accept the second offer because it has the larger net present value. e. You should accept the first offer as it is a lump sum payment. 10 Shore Hotels just paid an annual dividend of $1.5 0 per share. The company will increase its dividen d by 7 percent next year and will then reduce its d ividend growth rate by 2 percentage points per ye ar until it reaches the industry average of 3 perce nt dividend growth, after which the company will k eep a constant growth rate forever. What is the pri ce of this stock today given a required return of 1 4 percent? . a. $16.54 b. $14.85 c. $18.99 d. $11.83 e. $13.02 11 Noelle owns 12 percent of The Toy Factory. She h as decided to retire and wants to sell all of her sh ares in this closely held, all-equity firm. The other shareholders have agreed to have the company b orrow the $248,000 needed to repurchase her sh ares of stock. What is the total market value of th e company? Ignore taxes. . a. $2,489,111 b. $2,414,141 c. $2,608,515 d. $2,066,667 e. $2,333,333 12 Shareholder A sold 500 shares of ABC stock on t he New York Stock Exchange. This transaction . a. took place in the primary market b. was a private placement c. was facilitated in the secondary market d. occurred in a dealer market e. involved a proxy 13 Bonner Metals wants to issue new 20-year bonds. The company currently has 8.5 percent bonds on the market that sell for $994, make semiannual p ayments, and mature in 7 years. What should the coupon rate be on the new bonds if the firm wants to sell them at par? . a. 9.23 percent b. 8.41 percent c. 8.75 percent d. 8.62 percent . 8.87 mprcent 14 A business owned by a solitary individual who has unlimited liability for the firm's debt is called a . a. general partnership b. limited partnership c. corporation d. limited liability company e. sole proprietorship 15 Which one of the following states that the cost of equity capital is directly and proportionally related to capital structure? . a. Homemade leverage b.Modigliani-Miller Theorem II c. Static theory of capital structure d. Pecking-order theory e. Modigliani-Miller Theorem I 16 M\&M Proposition I with no tax supports the argum ent that: . a. business risk has no effect on the return on ass ets. b. the cost of equity rises as leverage rises. c. business risk is irrelevant d. homemade leverage is irrelevant. e. a company's debt-equity ratio is completely irre levant. 17 Project A has a required return on 9.2 percent an d cash flows of $87,000,$32,600,$35,900, and $43,400 for Years 0 to 3 , respectively. Project B h as a required return of 12.7 percent and cash flow s of $85,000,$14,700,$21,200, and $89,800 for Years 0 to 3 , respectively. Which project(s) should you accept based on net present value if the proje cts are mutually exclusive? . a. Accept both projects b. Reject Project A and accept Project B c. Reject both projects d. Accept Project A and reject Project B e. Accept either one, but not both An agent who arranges a transaction between ab uyer and a seller of equity securities is called a: . a. capitalist. b. principal c. broker. d. dealer. e. floor trader. 19 Consider the following information on three stock s: A portfolio is invested 45 percent each in Stock A and Stock B and 10 percent in Stock C. What is t he expected risk premium on the portfolio if the ex pected T-bill rate is 3.2 percent? . a. 4.29 percent b. 12.38 percent c. 8.71 percent d. 11.47 percent e. 1.67 percent JLK is a partnership that was formed two years a go and has been extremely successful thus far. T he owners have decided to incorporate and offer shares of stock to the general public. What is this type of an equity offering called? . a. Private placement b. Shelf offering c. Seasoned equity offering d. Initial public offering e. Venture capital offering