Question

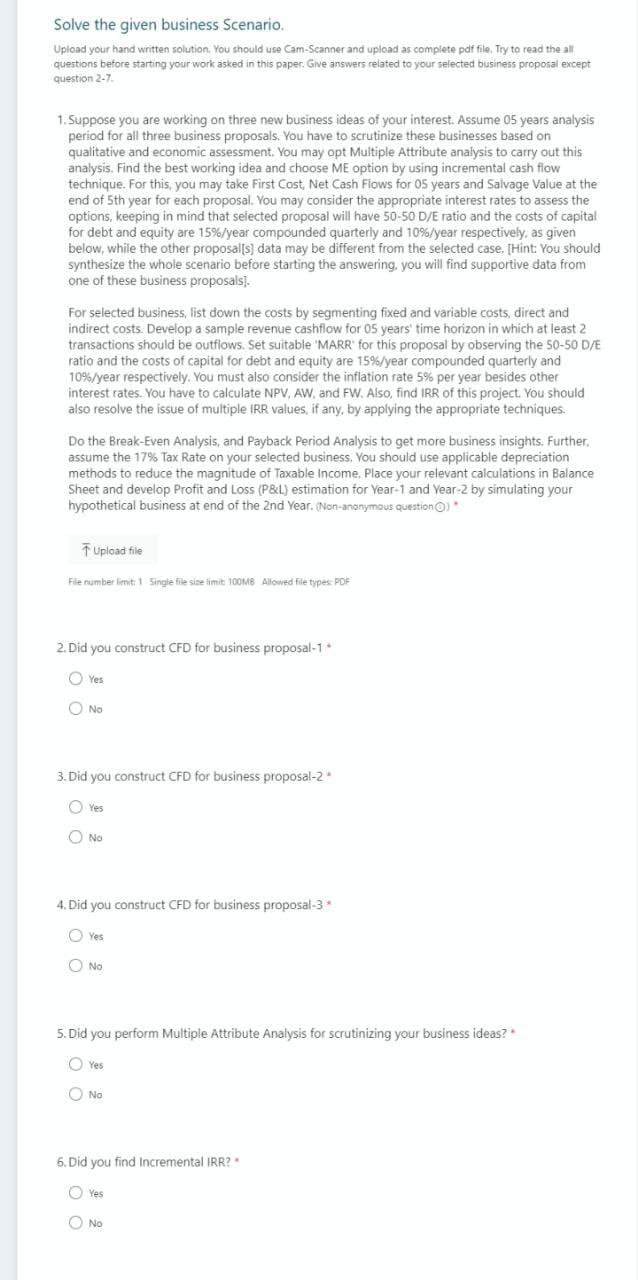

1.Suppose you are working on three new business ideas of your interest. Assume 05 years analysis period for all three business proposals. You have to

1.Suppose you are working on three new business ideas of your interest. Assume 05 years analysis period for all three business proposals. You have to scrutinize these businesses based on qualitative and economic assessment. You may opt Multiple Attribute analysis to carry out this analysis. Find the best working idea and choose ME option by using incremental cash flow technique. For this, you may take First Cost, Net Cash Flows for 05 years and Salvage Value at the end of 5th year for each proposal. You may consider the appropriate interest rates to assess the options, keeping in mind that selected proposal will have 50-50 D/E ratio and the costs of capital for debt and equity are 15%/year compounded quarterly and 10%/year respectively, as given below, while the other proposal[s] data may be different from the selected case. [Hint: You should synthesize the whole scenario before starting the answering, you will find supportive data from one of these business proposals].

For selected business, list down the costs by segmenting fixed and variable costs, direct and indirect costs. Develop a sample revenue cashflow for 05 years' time horizon in which at least 2 transactions should be outflows. Set suitable 'MARR' for this proposal by observing the 50-50 D/E ratio and the costs of capital for debt and equity are 15%/year compounded quarterly and 10%/year respectively. You must also consider the inflation rate 5% per year besides other interest rates. You have to calculate NPV, AW, and FW. Also, find IRR of this project. You should also resolve the issue of multiple IRR values, if any, by applying the appropriate techniques.

Do the Break-Even Analysis, and Payback Period Analysis to get more business insights. Further, assume the 17% Tax Rate on your selected business. You should use applicable depreciation methods to reduce the magnitude of Taxable Income. Place your relevant calculations in Balance Sheet and develop Profit and Loss (P&L) estimation for Year-1 and Year-2 by simulating your hypothetical business at end of the 2nd Year. (Non-anonymous question)

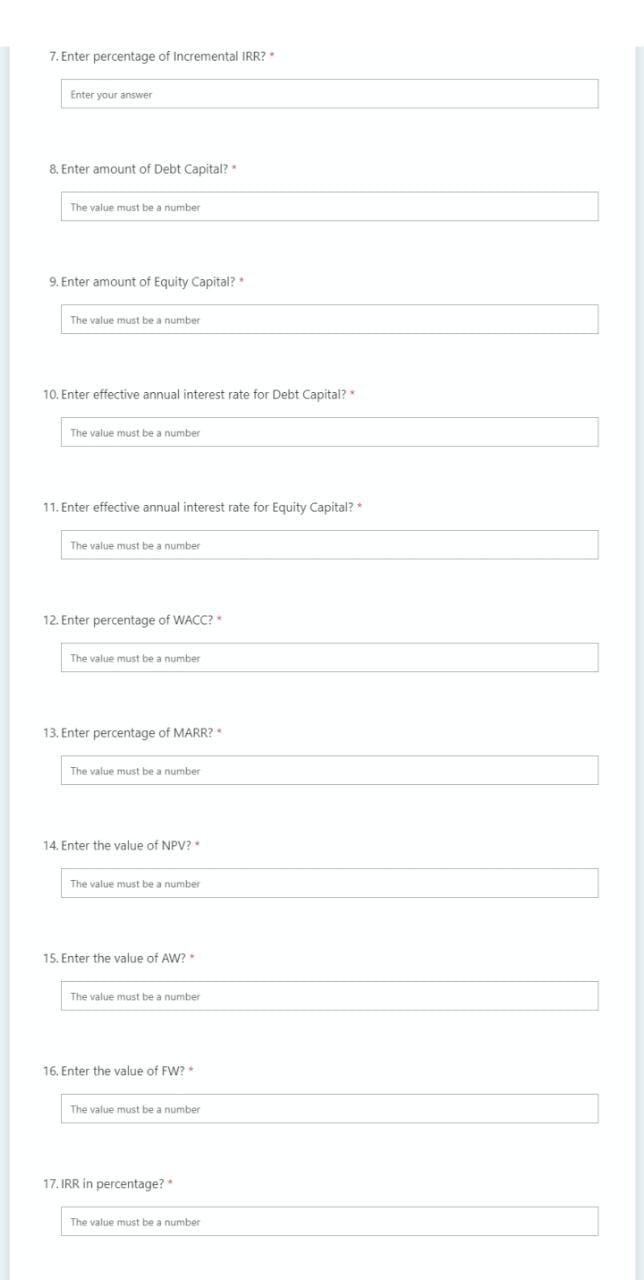

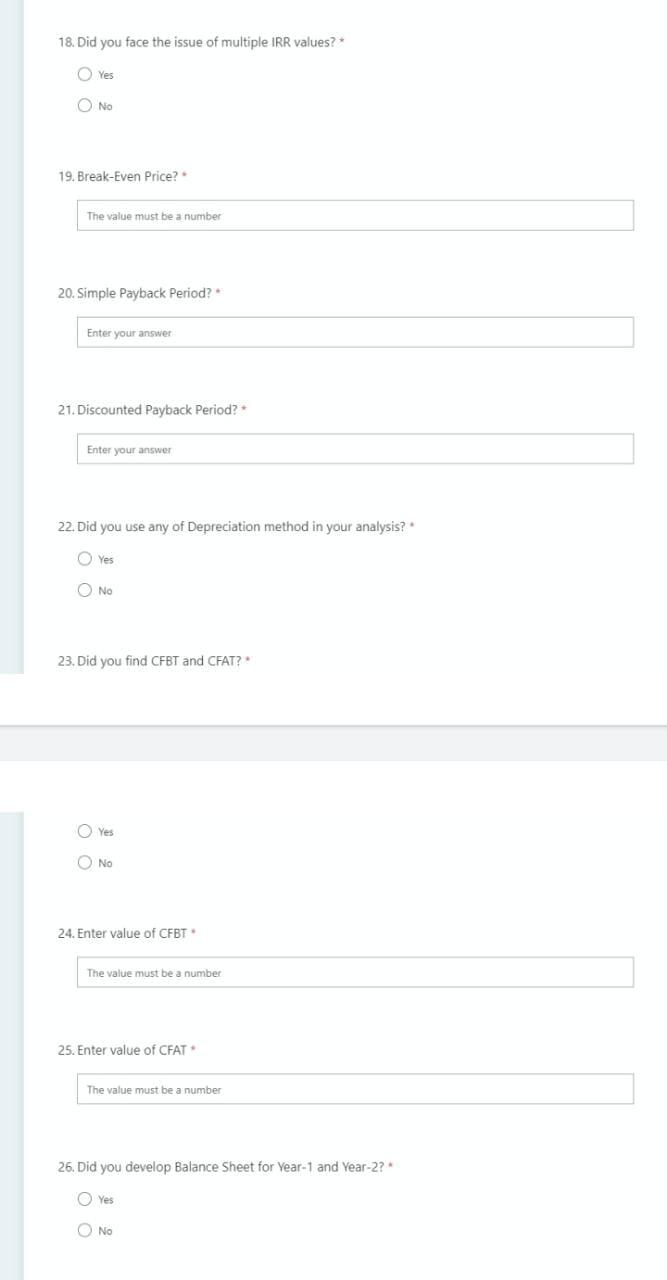

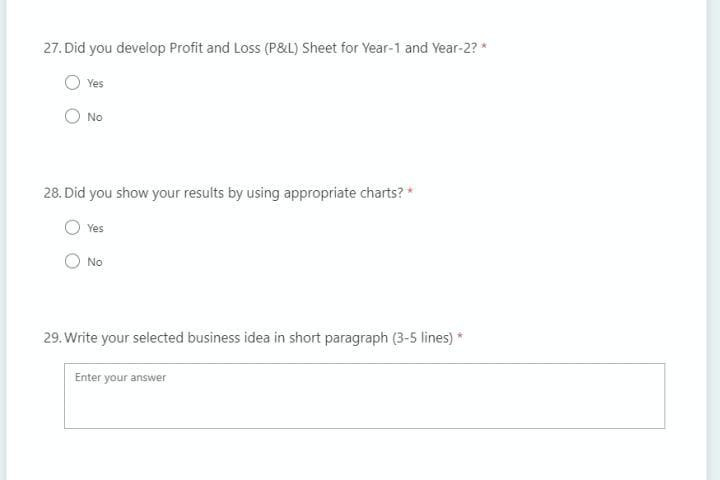

Solve the given business Scenario. Upload your hand written solution. You should use Cam-Scanner and upload as complete pdf file. Try to read the al questions before starting your work asked in this paper. Give answers related to your selected business proposal except question 2-7 1. Suppose you are working on three new business ideas of your interest. Assume 05 years analysis period for all three business proposals. You have to scrutinize these businesses based on qualitative and economic assessment. You may opt Multiple Attribute analysis to carry out this analysis. Find the best working idea and choose ME option by using incremental cash flow technique. For this, you may take First Cost, Net Cash Flows for 05 years and Salvage Value at the end of 5th year for each proposal . You may consider the appropriate interest rates to assess the options, keeping in mind that selected proposal will have 50-50 D/E ratio and the costs of capital for debt and equity are 15%/year compounded quarterly and 10%/year respectively, as given below, while the other proposal[s] data may be different from the selected case. (Hint: You should synthesize the whole scenario before starting the answering, you will find supportive data from one of these business proposals). For selected business, list down the costs by segmenting fixed and variable costs, direct and indirect costs. Develop a sample revenue cashflow for 05 years' time horizon in which at least 2 transactions should be outflows. Set suitable "MARR for this proposal by observing the 50-50 D/E ratio and the costs of capital for debt and equity are 15%/year compounded quarterly and 10%/year respectively. You must also consider the inflation rate 5% per year besides other interest rates. You have to calculate NPV, AW, and FW. Also, find IRR of this project. You should also resolve the issue of multiple IRR values, if any, by applying the appropriate techniques. Do the Break-Even Analysis, and Payback period Analysis to get more business insights. Further, assume the 17% Tax Rate on your selected business. You should use applicable depreciation methods to reduce the magnitude of Taxable income. Place your relevant calculations in Balance Sheet and develop Profit and Loss (P&L) estimation for Year-1 and Year 2 by simulating your hypothetical business at end of the 2nd Year. (Non-anonymous question ) Upload file File number limit 1 Single file size limit 100MB Allowed file types: PDF 2. Did you construct CFD for business proposal-1 Yes No 3. Did you construct CFD for business proposal-2 Yes O No 4. Did you construct CFD for business proposal-3 Yes O No 5. Did you perform Multiple Attribute Analysis for scrutinizing your business ideas? Yes No 6. Did you find Incremental IRR? Yes No 7. Enter percentage of incremental IRR? Enter your answer 8. Enter amount of Debt Capital? The value must be a number 9. Enter amount of Equity Capital? The value must be a number 10. Enter effective annual interest rate for Debt Capital? The value must be a number 11. Enter effective annual interest rate for Equity Capital? The value must be a number 12. Enter percentage of WACC? The value must be a number 13. Enter percentage of MARR? The value must be a number 14. Enter the value of NPV? The value must be a number 75. Enter the value of AW? The value must be a number 16. Enter the value of FW? The value must be a number 17. IRR in percentage? The value must be a number 18. Did you face the issue of multiple IRR values? Yes O No 19. Break-Even Price? The value must be a number 20. Simple Payback Period? Enter your answer 21. Discounted Payback Period? Enter your answer 22. Did you use any of Depreciation method in your analysis? Yes O No 23. Did you find CFBT and CFAT? Yes O No 24. Enter value of CFBT The value must be a number 25. Enter value of CFAT The value must be a number 26. Did you develop Balance Sheet for Year 1 and Year-2? Yes O No 27. Did you develop Profit and Loss (P&L) Sheet for Year-1 and Year-2?* Yes No 28. Did you show your results by using appropriate charts? Yes No 29. Write your selected business idea in short paragraph (3-5 lines) * Enter your answer Solve the given business Scenario. Upload your hand written solution. You should use Cam-Scanner and upload as complete pdf file. Try to read the al questions before starting your work asked in this paper. Give answers related to your selected business proposal except question 2-7 1. Suppose you are working on three new business ideas of your interest. Assume 05 years analysis period for all three business proposals. You have to scrutinize these businesses based on qualitative and economic assessment. You may opt Multiple Attribute analysis to carry out this analysis. Find the best working idea and choose ME option by using incremental cash flow technique. For this, you may take First Cost, Net Cash Flows for 05 years and Salvage Value at the end of 5th year for each proposal . You may consider the appropriate interest rates to assess the options, keeping in mind that selected proposal will have 50-50 D/E ratio and the costs of capital for debt and equity are 15%/year compounded quarterly and 10%/year respectively, as given below, while the other proposal[s] data may be different from the selected case. (Hint: You should synthesize the whole scenario before starting the answering, you will find supportive data from one of these business proposals). For selected business, list down the costs by segmenting fixed and variable costs, direct and indirect costs. Develop a sample revenue cashflow for 05 years' time horizon in which at least 2 transactions should be outflows. Set suitable "MARR for this proposal by observing the 50-50 D/E ratio and the costs of capital for debt and equity are 15%/year compounded quarterly and 10%/year respectively. You must also consider the inflation rate 5% per year besides other interest rates. You have to calculate NPV, AW, and FW. Also, find IRR of this project. You should also resolve the issue of multiple IRR values, if any, by applying the appropriate techniques. Do the Break-Even Analysis, and Payback period Analysis to get more business insights. Further, assume the 17% Tax Rate on your selected business. You should use applicable depreciation methods to reduce the magnitude of Taxable income. Place your relevant calculations in Balance Sheet and develop Profit and Loss (P&L) estimation for Year-1 and Year 2 by simulating your hypothetical business at end of the 2nd Year. (Non-anonymous question ) Upload file File number limit 1 Single file size limit 100MB Allowed file types: PDF 2. Did you construct CFD for business proposal-1 Yes No 3. Did you construct CFD for business proposal-2 Yes O No 4. Did you construct CFD for business proposal-3 Yes O No 5. Did you perform Multiple Attribute Analysis for scrutinizing your business ideas? Yes No 6. Did you find Incremental IRR? Yes No 7. Enter percentage of incremental IRR? Enter your answer 8. Enter amount of Debt Capital? The value must be a number 9. Enter amount of Equity Capital? The value must be a number 10. Enter effective annual interest rate for Debt Capital? The value must be a number 11. Enter effective annual interest rate for Equity Capital? The value must be a number 12. Enter percentage of WACC? The value must be a number 13. Enter percentage of MARR? The value must be a number 14. Enter the value of NPV? The value must be a number 75. Enter the value of AW? The value must be a number 16. Enter the value of FW? The value must be a number 17. IRR in percentage? The value must be a number 18. Did you face the issue of multiple IRR values? Yes O No 19. Break-Even Price? The value must be a number 20. Simple Payback Period? Enter your answer 21. Discounted Payback Period? Enter your answer 22. Did you use any of Depreciation method in your analysis? Yes O No 23. Did you find CFBT and CFAT? Yes O No 24. Enter value of CFBT The value must be a number 25. Enter value of CFAT The value must be a number 26. Did you develop Balance Sheet for Year 1 and Year-2? Yes O No 27. Did you develop Profit and Loss (P&L) Sheet for Year-1 and Year-2?* Yes No 28. Did you show your results by using appropriate charts? Yes No 29. Write your selected business idea in short paragraph (3-5 lines) * Enter your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started