Answered step by step

Verified Expert Solution

Question

1 Approved Answer

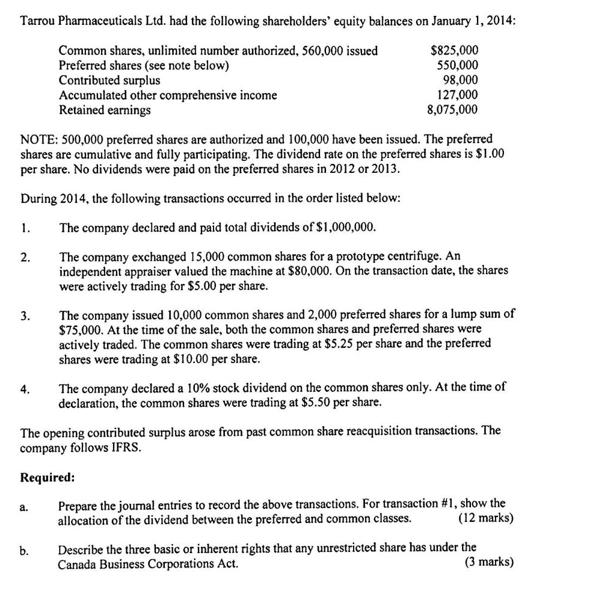

Tarrou Pharmaceuticals Ltd. had the following shareholders' equity balances on January 1, 2014: Common shares, unlimited number authorized, 560,000 issued Preferred shares (see note

Tarrou Pharmaceuticals Ltd. had the following shareholders' equity balances on January 1, 2014: Common shares, unlimited number authorized, 560,000 issued Preferred shares (see note below) Contributed surplus Accumulated other comprehensive income Retained earnings $825,000 550,000 98,000 127,000 8,075,000 NOTE: 500,000 preferred shares are authorized and 100,000 have been issued. The preferred shares are cumulative and fully participating. The dividend rate on the preferred shares is $1.00 per share. No dividends were paid on the preferred shares in 2012 or 2013. During 2014, the following transactions occurred in the order listed below: 1. The company declared and paid total dividends of $1,000,000. The company exchanged 15,000 common shares for a prototype centrifuge. An independent appraiser valued the machine at $80,000. On the transaction date, the shares were actively trading for $5.00 per share. 2. 3. The company issued 10,000 common shares and 2,000 preferred shares for a lump sum of $75,000. At the time of the sale, both the common shares and preferred shares were actively traded. The common shares were trading at $5.25 per share and the preferred shares were trading at $10.00 per share. The company declared a 10% stock dividend on the common shares only. At the time of declaration, the common shares were trading at $5.50 per share. 4. The opening contributed surplus arose from past common share reacquisition transactions. The company follows IFRS. Required: Prepare the journal entries to record the above transactions. For transaction #1, show the allocation of the dividend between the preferred and common classes. a. (12 marks) Describe the three basic or inherent rights that any unrestricted share has under the Canada Business Corporations Act. b. (3 marks)

Step by Step Solution

★★★★★

3.56 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Solution a Solution 1 Journal Entries ItemDate Account Titles Debit Credit 1 Common Stock Dividend Refer Note 1 700000 Preferred Stock Dividend 300000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started