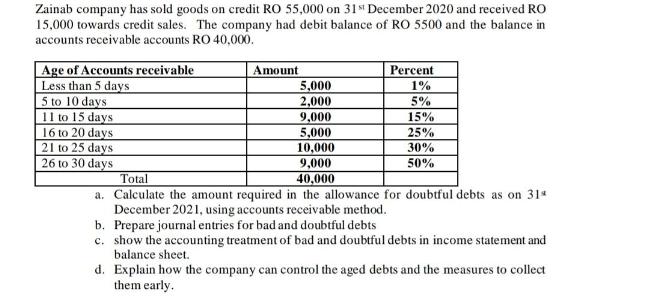

Zainab company has sold goods on credit RO 55,000 on 31st December 2020 and received RO 15,000 towards credit sales. The company had debit

Zainab company has sold goods on credit RO 55,000 on 31st December 2020 and received RO 15,000 towards credit sales. The company had debit balance of RO 5500 and the balance in accounts receivable accounts RO 40,000. Age of Accounts receivable Less than 5 days 5 to 10 days 11 to 15 days 16 to 20 days 21 to 25 days 26 to 30 days a. b. c. show the accounting treatment of bad and doubtful debts in income statement and balance sheet. Amount Percent 1% 5% 15% 25% 30% 50% 5,000 2,000 9,000 5,000 10,000 9,000 Total 40,000 Calculate the amount required in the allowance for doubtful debts as on 31 December 2021, using accounts receivable method. Prepare journal entries for bad and doubtful debts d. Explain how the company can control the aged debts and the measures to collect them early.

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the amount required in the allowance for doubtful debts as on 31st December 2021 using ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started