Answered step by step

Verified Expert Solution

Question

1 Approved Answer

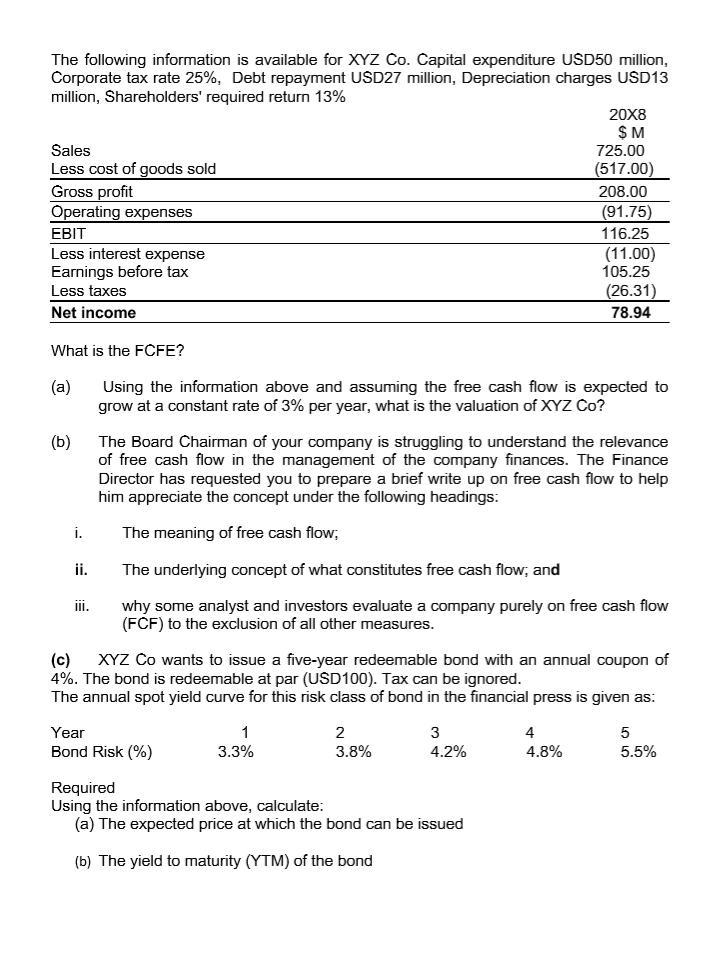

The following information is available for XYZ Co. Capital expenditure USD50 million, Corporate tax rate 25%, Debt repayment USD27 million, Depreciation charges USD13 million,

The following information is available for XYZ Co. Capital expenditure USD50 million, Corporate tax rate 25%, Debt repayment USD27 million, Depreciation charges USD13 million, Shareholders' required return 13% 20X8 $ M Sales 725.00 Less cost of goods sold (517.00) Gross profit Operating expenses 208.00 (91.75) EBIT 116.25 Less interest expense Earnings before tax Less taxes (11.00) 105.25 (26.31) Net income 78.94 What is the FCFE? (a) Using the information above and assuming the free cash flow is expected to grow at a constant rate of 3% per year, what is the valuation of XYZ Co? (b) The Board Chairman of your company is struggling to understand the relevance of free cash flow in the management of the company finances. The Finance Director has requested you to prepare a brief write up on free cash flow to help him appreciate the concept under the following headings: i. The meaning of free cash flow; ji. The underlying concept of what constitutes free cash flow; and why some analyst and investors evaluate a company purely on free cash flow (FCF) to the exclusion of all other measures. ii. XYZ Co wants to issue a five-year redeemable bond with an annual coupon of (c) 4%. The bond is redeemable at par (USD100). Tax can be ignored. The annual spot yield curve for this risk class of bond in the financial press is given as: Year 1 2 3 4 5 Bond Risk (%) 3.3% 3.8% 4.2% 4.8% 5.5% Required Using the information above, calculate: (a) The expected price at which the bond can be issued (b) The yield to maturity (YTM) of the bond

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

feFE is fn eguity holder ly aud ue add D FEFE calelation thord term i ameotmeint imWoukig capi le an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started