The following information is available for Gerard Corporation (a) Compute earnings per share for 2012 and 2011

Question:

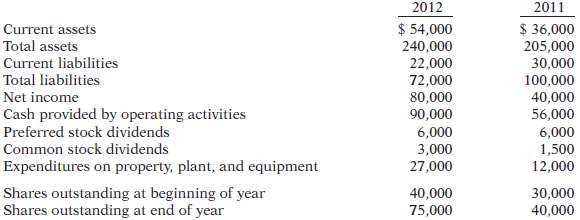

The following information is available for Gerard Corporation

(a) Compute earnings per share for 2012 and 2011 for Gerard, and comment on the change. Gerard??s primary competitor, Thorpe Corporation, had earnings per share of $1 per share in 2012. Comment on the difference in the ratios of the two companies.(b) Compute the current ratio and debt to total assets ratio for each year, and comment on the changes.(c) Compute free cash flow for each year, and comment on thechanges.

Free Cash FlowFree cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Unlike earnings or net income, free cash flow is a measure of profitability that excludes the...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting Tools for business decision making

ISBN: 978-0470534779

6th Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso

Question Posted: