Question

1.The formula for net tax benefit of debt is [(1 - Tp) - (1 Tc) * (1 T)] where Tp represents personal interest income

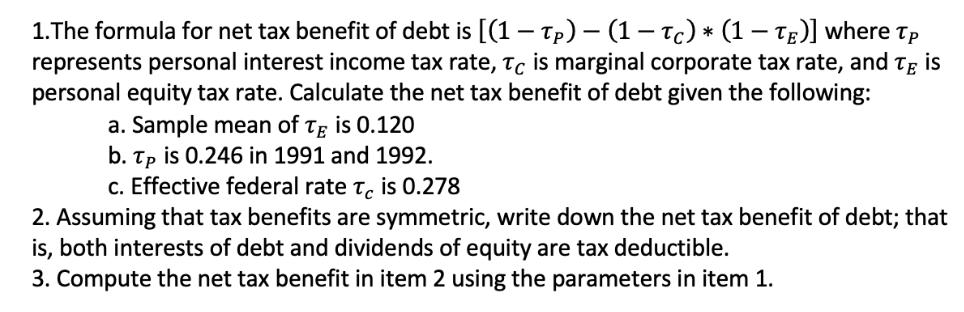

1.The formula for net tax benefit of debt is [(1 - Tp) - (1 Tc) * (1 T)] where Tp represents personal interest income tax rate, Tc is marginal corporate tax rate, and Te is personal equity tax rate. Calculate the net tax benefit of debt given the following: a. Sample mean of TE is 0.120 b. Tp is 0.246 in 1991 and 1992. c. Effective federal rate Te is 0.278 2. Assuming that tax benefits are symmetric, write down the net tax benefit of debt; that is, both interests of debt and dividends of equity are tax deductible. 3. Compute the net tax benefit in item 2 using the parameters in item 1.

Step by Step Solution

3.48 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net tax benefit of debt using the given information we can plu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Corporate Finance

Authors: Stephen A. Ross, Randolph W. Westerfield, Bradford D.Jordan

8th Edition

978-0073530628, 978-0077861629

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App