Answered step by step

Verified Expert Solution

Question

1 Approved Answer

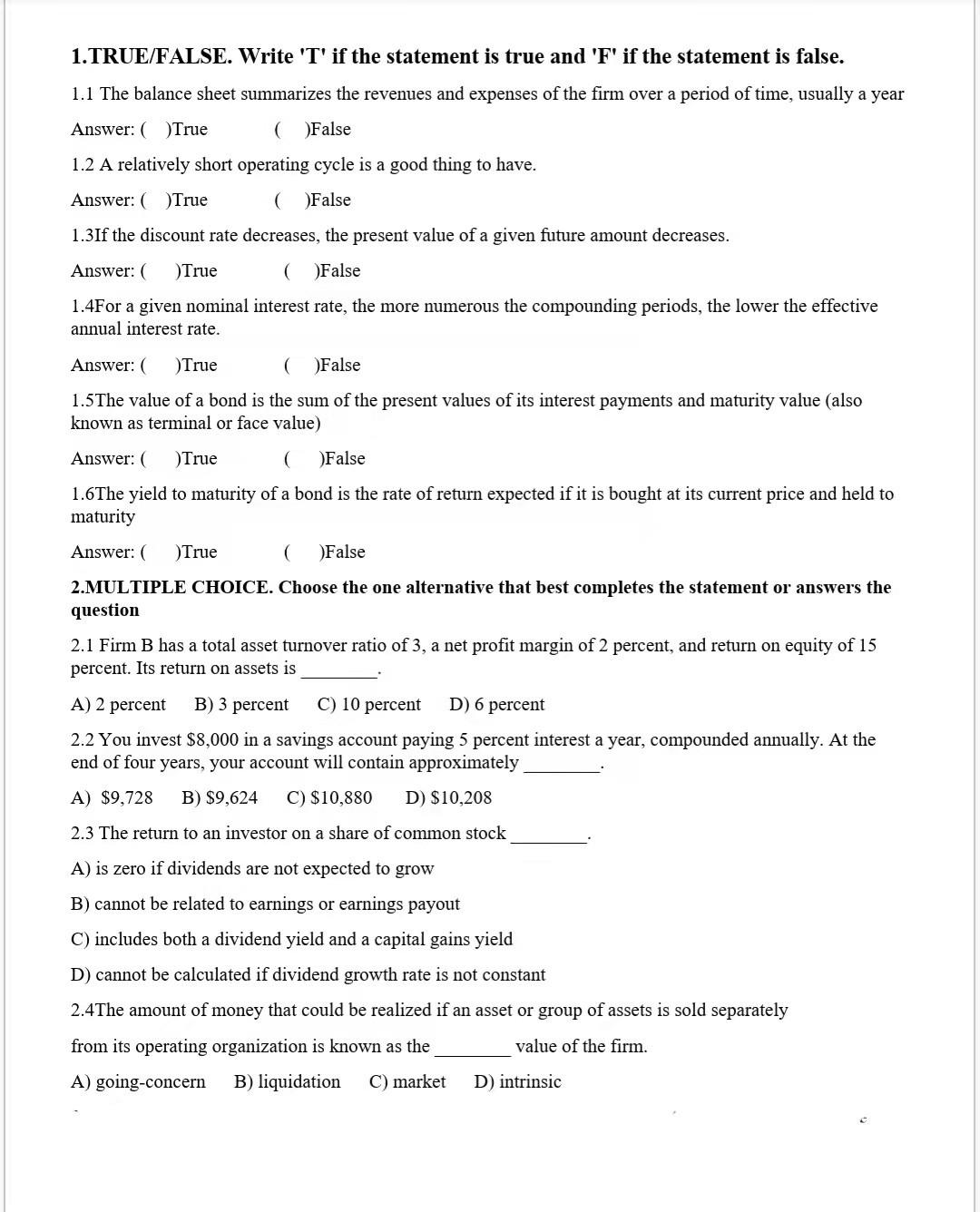

1.TRUE/FALSE. Write 'T' if the statement is true and 'F' if the statement is false. 1.1 The balance sheet summarizes the revenues and expenses of

1.TRUE/FALSE. Write 'T' if the statement is true and 'F' if the statement is false. 1.1 The balance sheet summarizes the revenues and expenses of the firm over a period of time, usually a year Answer: ( )True ( )False 1.2 A relatively short operating cycle is a good thing to have. Answer: (True ( )False 1.3If the discount rate decreases, the present value of a given future amount decreases. Answer: ( )True ( )False 1.4For a given nominal interest rate, the more numerous the compounding periods, the lower the effective annual interest rate. Answer: ( )True ( )False 1.5The value of a bond is the sum of the present values of its interest payments and maturity value (also known as terminal or face value) Answer: ( )True ( )False 1.6The yield to maturity of a bond is the rate of return expected if it is bought at its current price and held to maturity Answer: ( )True ( )False 2.MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question 2.1 Firm B has a total asset turnover ratio of 3, a net profit margin of 2 percent, and return on equity of 15 percent. Its return on assets is A) 2 percent B) 3 percent C) 10 percent D) 6 percent 2.2 You invest $8,000 in a savings account paying 5 percent interest a year, compounded annually. At the end of four years, your account will contain approximately A) $9,728 B) $9,624 C) $10,880 D) $10,208 2.3 The return to an investor on a share of common stock A) is zero if dividends are not expected to grow B) cannot be related to earnings or earnings payout C) includes both a dividend yield and a capital gains yield D) cannot be calculated if dividend growth rate is not constant 2.4The amount of money that could be realized if an asset or group of assets is sold separately from its operating organization is known as the value of the firm. A) going-concern B) liquidation C) market D) intrinsic

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started