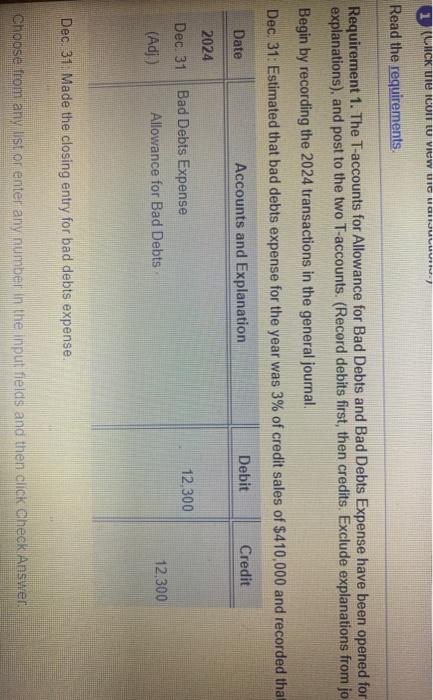

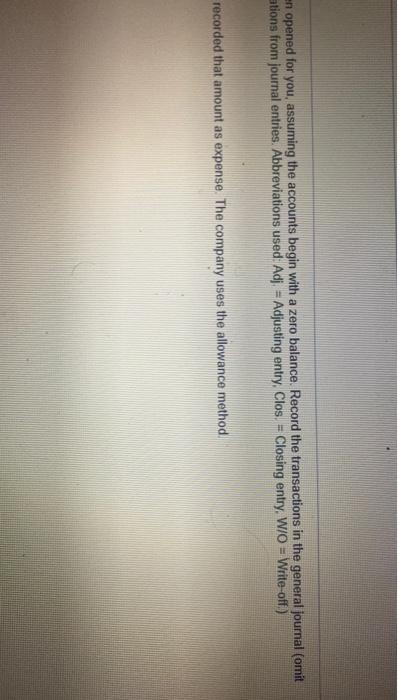

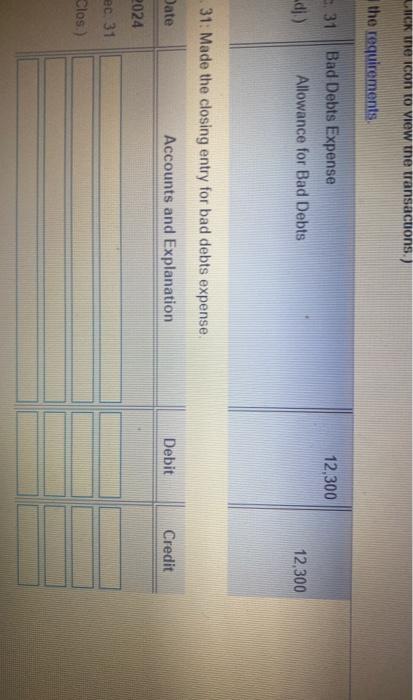

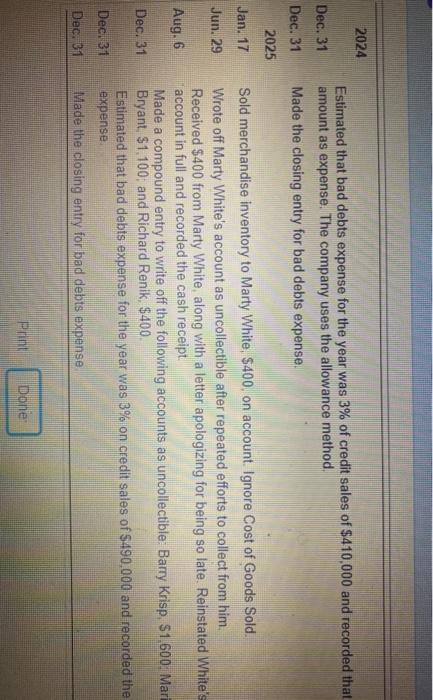

1UCK UIL CUIFU VIUW UIC Read the requirements, Requirement 1. The T-accounts for Allowance for Bad Debts and Bad Debts Expense have been opened for explanations), and post to the two T-accounts. (Record debits first, then credits. Exclude explanations from jo Begin by recording the 2024 transactions in the general journal. Dec 31: Estimated that bad debts expense for the year was 3% of credit sales of $410,000 and recorded that Date Accounts and Explanation Debit Credit 2024 Dec. 31 Bad Debts Expense 12.300 12.300 (Adj) Allowance for Bad Debts Dec. 31 Made the closing entry for bad debts expense Choose from any listonenter any number in the input fields and then click Check Answer en opened for you, assuming the accounts begin with a zero balance. Record the transactions in the general journal (omit stions from journal entries. Abbreviations used Adj = Adjusting entry, Clos. = Closing entry, W/O = Write-off.) recorded that amount as expense. The company uses the allowance method Click the icon to view the transacuons.) the requirements 5.31 12.300 Bad Debts Expense Allowance for Bad Debts 12.300 31: Made the closing entry for bad debts expense Date Accounts and Explanation Debit Credit 2024 ec 31 Clos.) 2024 Dec. 31 Estimated that bad debts expense for the year was 3% of credit sales of $410,000 and recorded that amount as expense. The company uses the allowance method. Made the closing entry for bad debts expense. Dec. 31 2025 Jan. 17 Jun. 29 Aug. 6 Sold merchandise inventory to Marty White, $400, on account. Ignore Cost of Goods Sold. Wrote off Marty White's account as uncollectible after repeated efforts to collect from him. Received $400 from Marty White, along with a letter apologizing for being so late. Reinstated White's account in full and recorded the cash receipt Made a compound entry to write off the following accounts as uncollectible Barry Krisp. $1.600. Mari Bryant. $1.100, and Richard Renik, $400 Estimated that bad debts expense for the year was 3% on credit sales of $490,000 and recorded the expense Made the closing entry for bad debts expense Dec. 31 Dec. 31 Dec. 31 Pan Done