Question

Netflix experienced some membership turbulence in 2016 as a price increase was phased in for its US subscribers. In May 2014, Netflix announced that the

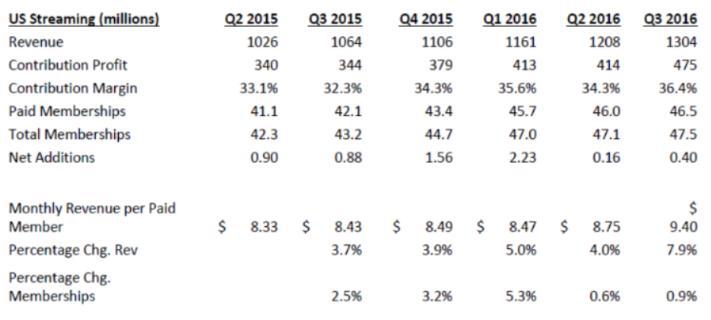

Netflix experienced some membership turbulence in 2016 as a price increase was phased in for its US subscribers. In May 2014, Netflix announced that the price of its standard subscription service would increase from $8 to $9. However, established customers were allowed to stay at the $7.99 price for two years. In 2015, Netflix increased the standard price to $9.99. As a result of the pricing plan and the deferred price increase, in May, 2016, the standard pricing plan for long time customers of Netflix increased from $7.99per month to $9.99per month. Netflix began notifying customers in April that the price increase would become effective in the second quarter. Netflix was trying to implement price increases more slowly after a 2011 increase led to negative publicity and a customer backlash. In that case, Netflix separated its streaming and DVD services, and charged separately for both services. However, regardless of the implementation of the price increase, the higher monthly prices seem to have impacted the growth of membership among US subscribers. In the two quarters before the price increase, Netflix added net membership of 1.6 million and 2.2 million members. By contrast, the number of members added in Q2 was only 160,000, and in Q3 only 400,000. The Q2 growth in US subscribers was the lowest since Netflix began reporting those numbers in 2012.

According to a MarketWatch article 1 on the price increase:Netflix said Monday that customers who learned in April that the price was about to increase had begun canceling their subscriptions, leading to unexpected “churn.” Netflix did not flat-out say inits letter to investors that the price increase led to higher churn among subscribers, however, instead saying it coincided with “press coverage” of the rate hike and that subscribers misunderstood “the news as an impending new price increase rather than the completion of two years of grandfathering.”The stock market reacted to news of Netflix price increase as well. The stock closed at $102.23 as of March 31, 2016. After the release of second quarter earnings in July, the stock price had fallen to $85.84 per share, a decline of 16%. This decline wiped out almost $7 billion of shareholder value during this period. Most of this decline was immediately following the release of the second quarter numbers.With competition increasing in for streaming services, especially with the growth of Amazon Prime Video and Hulu, the decline in membership growth could be a troubling sign.

1.Use the information on the change in membership, to estimate the own price elasticity for Netflix service.

2.What impact would this price change have on revenue and profits.

3.What concerns do you have regarding the reliability of your elasticity estimate?

4.What information / data would make your analysis better?

US Streaming (millions) Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Revenue 1026 1064 1106 1161 1208 1304 Contribution Profit 340 344 379 413 414 475 Contribution Margin 33.1% 32.3% 34.3% 35.6% 34.3% 36.4% Paid Memberships 41.1 42.1 43.4 45.7 46.0 46.5 Total Memberships 42.3 43.2 44.7 47.0 47.1 47.5 Net Additions 0.90 0.88 1.56 2.23 0.16 0.40 Monthly Revenue per Paid Member $ 8.33 $ 8.43 $ 8.49 $ 8.47 $ 8.75 9.40 Percentage Chg. Rev 3.7% 3.9% 5.0% 4.0% 7.9% Percentage Chg. Memberships 2.5% 3.2% 5.3% 0.6% 0.9%

Step by Step Solution

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

A Yes we can use the information in the case to estimate the elasticity of demand for Netflix subscr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started