Question

Better Mousetraps has developed a new trap. It can go into production for an initial investment in equipment of $5.7 million. The equipment will be

Better Mousetraps has developed a new trap. It can go into production for an initial investment in equipment of $5.7 million. The equipment will be depreciated straight line over 6 years to a value of zero, but in fact it can be sold after 6 years for $638,000. The firm believes that working capital at each date must be maintained at a level of 15% of next year’s forecast sales. The firm estimates production costs equal to $1.70 per trap and believes that the traps can be sold for $8 each. Sales forecasts are given in the following table. The project will come to an end in 6 years., when the trap becomes technologically obsolete. The firm’s tax bracket is 35%, and the required rate of return on the project is 11%. Use the MACRS depreciation schedule. |

Year: | 0 | 1 | 2 | 3 | 4 | 5 | 6 | Thereafter |

Sales (millions of traps) | 0 | .4 | .5 | .7 | .7 | .5 | .3 | 0 |

| a. | What is project NPV? (Do not round intermediate calculations. Enter your answer in millions rounded to 4 decimal places.) |

| NPV | $ million |

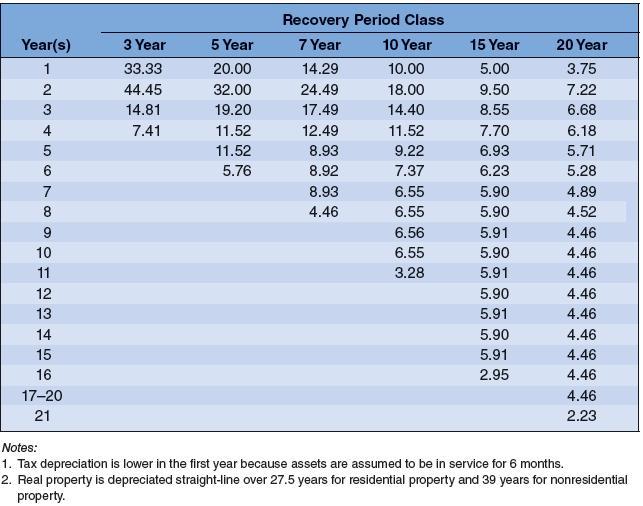

| b. | By how much would NPV increase if the firm depreciated its investment using the 5-year MACRS schedule? (Do not round intermediate calculations. Enter your answer in whole dollars not in millions.) |

The NPV increases by $ .

|

Recovery Period Class 7 Year Year(s) 3 Year 5 Year 10 Year 15 Year 20 Year 1 33.33 20.00 14.29 10.00 5.00 3.75 44.45 32.00 24.49 18.00 9.50 7.22 3 14.81 19.20 17.49 14.40 8.55 6.68 7.41 11.52 12.49 11.52 7.70 6.18 11.52 8.93 9.22 6.93 5.71 5.76 8.92 7.37 6.23 5.28 6.55 6.55 7 8.93 5.90 4.89 8 4.46 5.90 4.52 9 6.56 5.91 4.46 10 6.55 5.90 4.46 11 3.28 5.91 4.46 12 5.90 4.46 13 5.91 4.46 14 5.90 4.46 15 5.91 4.46 16 2.95 4.46 17-20 4.46 21 2.23 Notes: 1. Tax depreciation is lower in the first year because assets are assumed to be in service for 6 months. 2. Real property is depreciated straight-line over 27.5 years for residential property and 39 years for nonresidential property. 45

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a Project NPV Part a 0 1 2 3 4 5 6 Sales units millions 040 050 070 070 050 030 sales price 8 8 8 8 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started