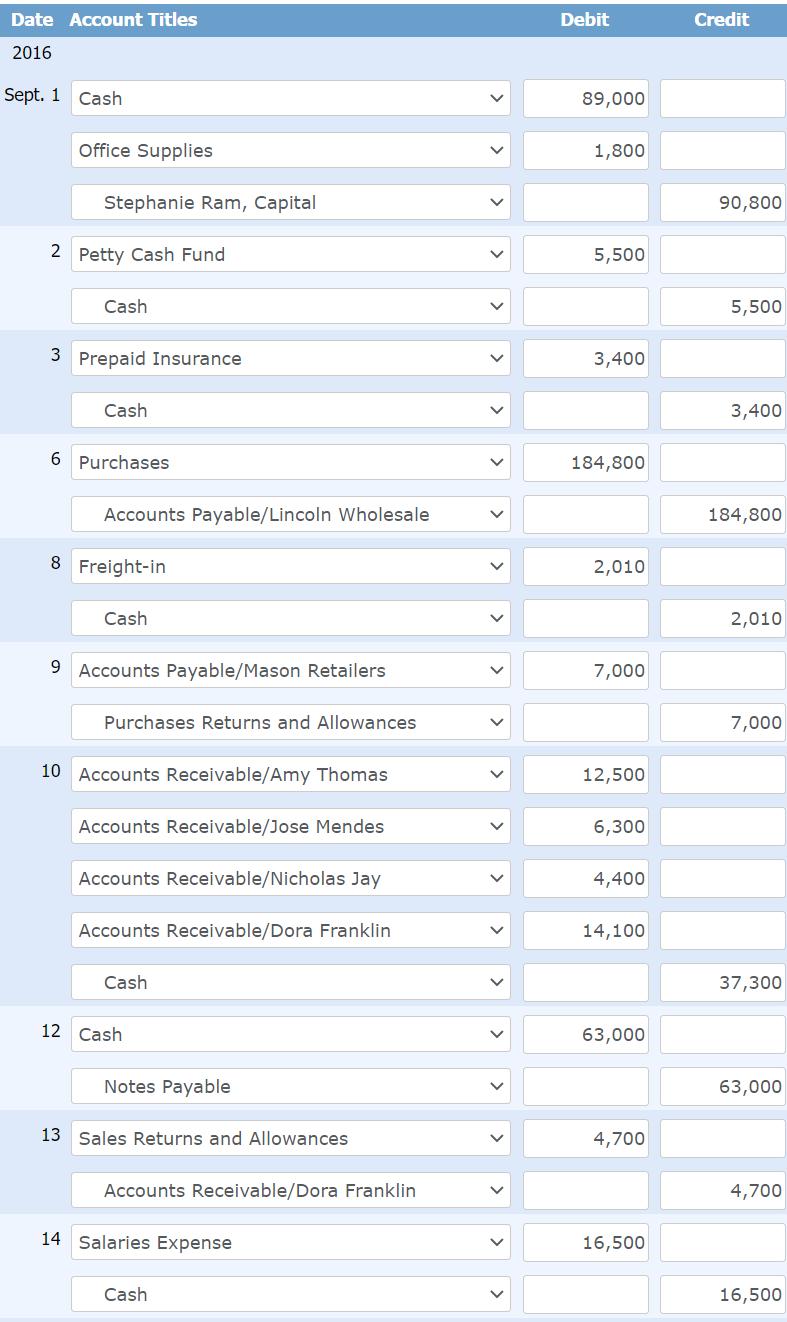

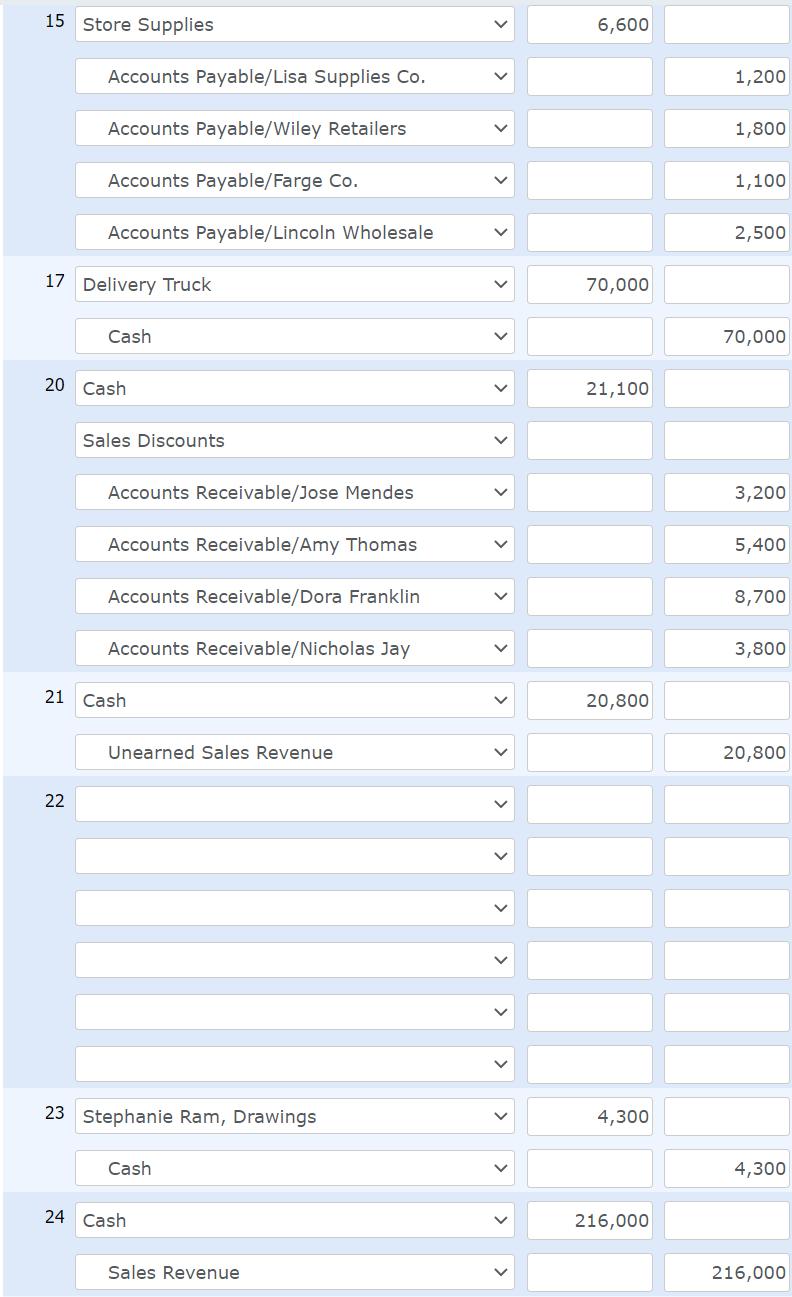

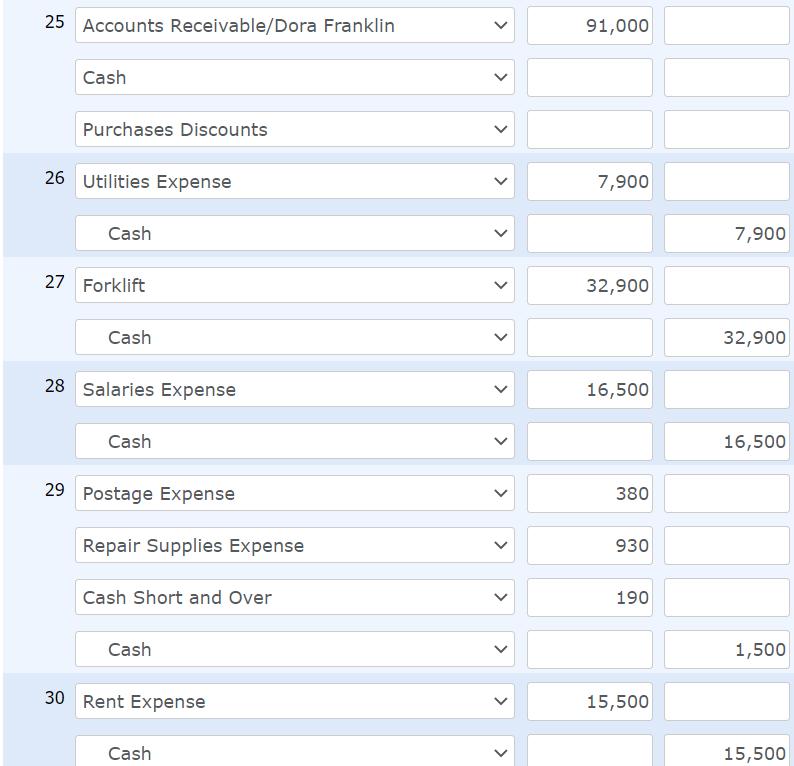

On August 1, 2016, Stephanie Ram, a sole proprietor, started a new business, Ram Wholesale Company. The company sells refrigerators (merchandise) to various retail stores

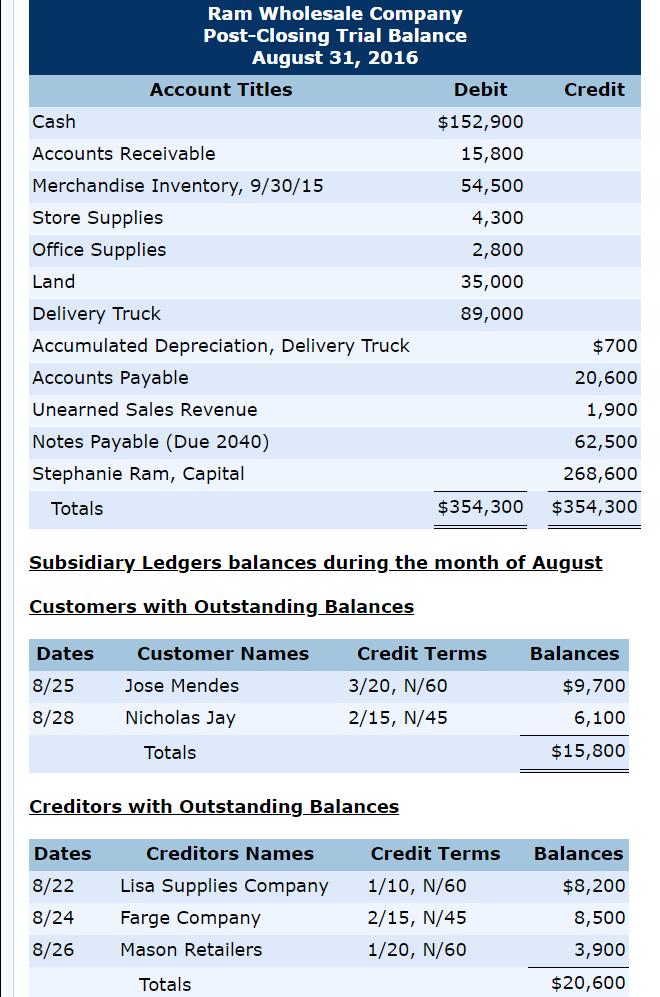

On August 1, 2016, Stephanie Ram, a sole proprietor, started a new business, Ram Wholesale Company. The company sells refrigerators (merchandise) to various retail stores and uses the periodic inventory system. At the end of August, the company’s Post-Closing Trial Balance showed the following accounts and balances:.

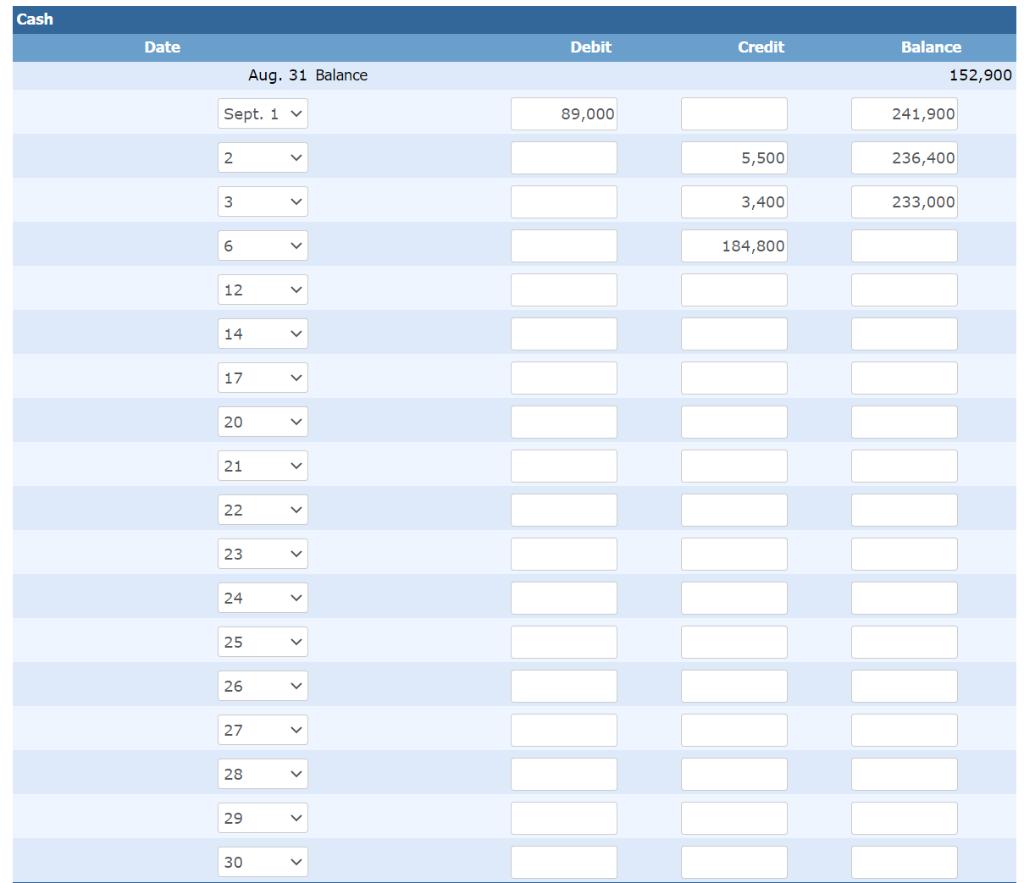

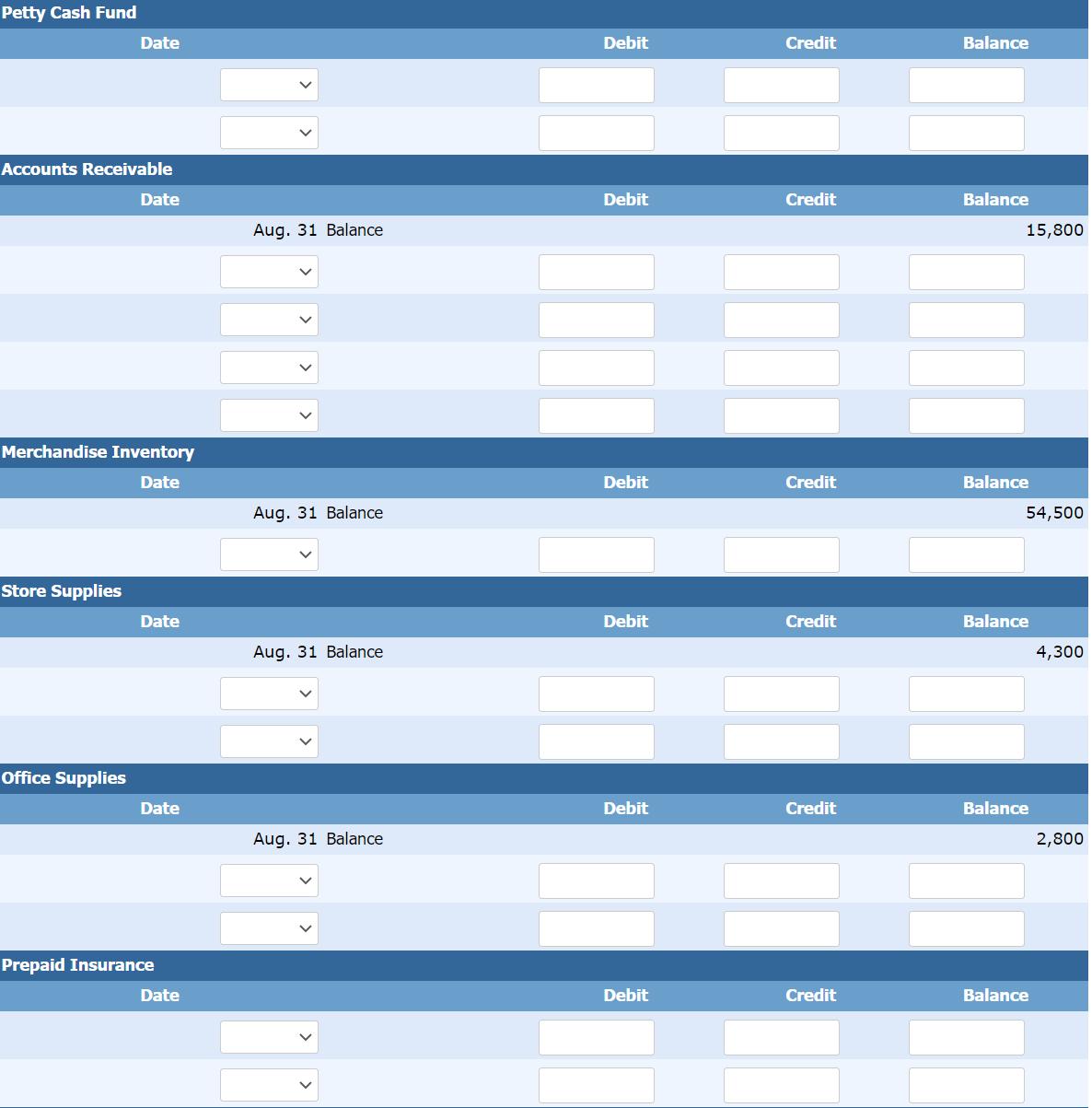

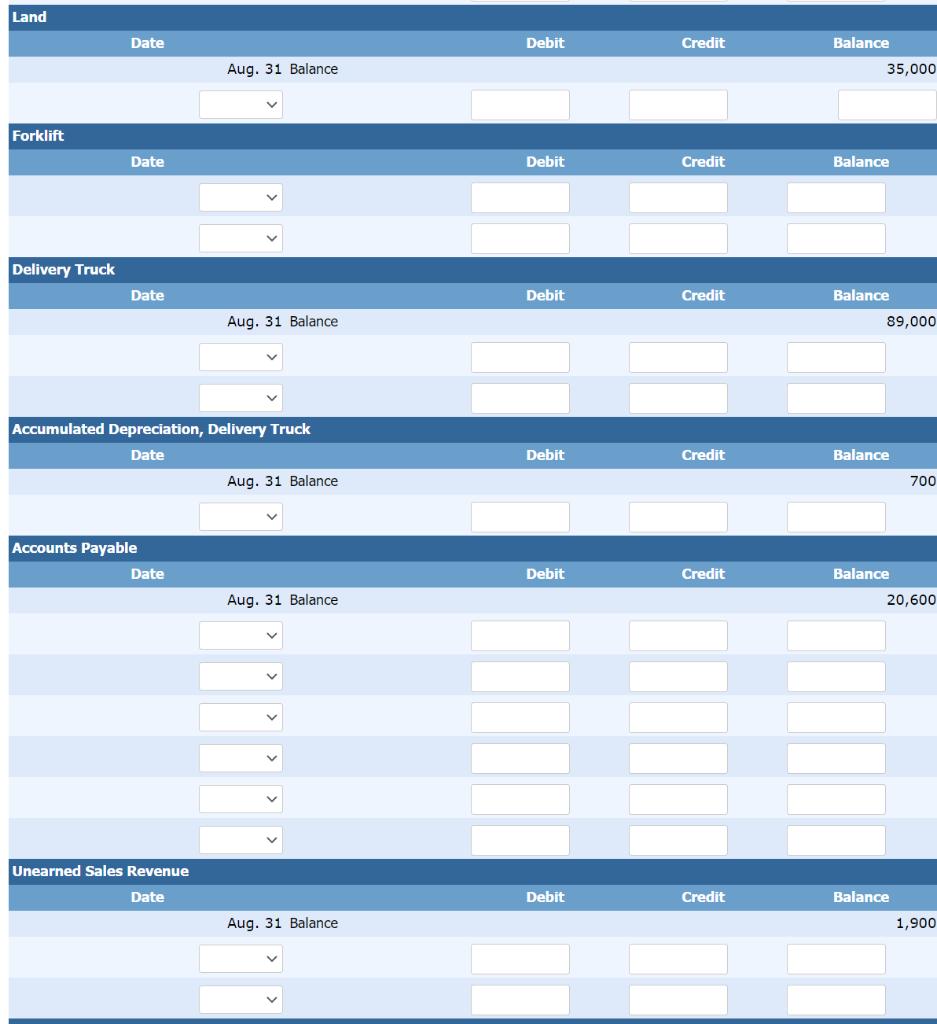

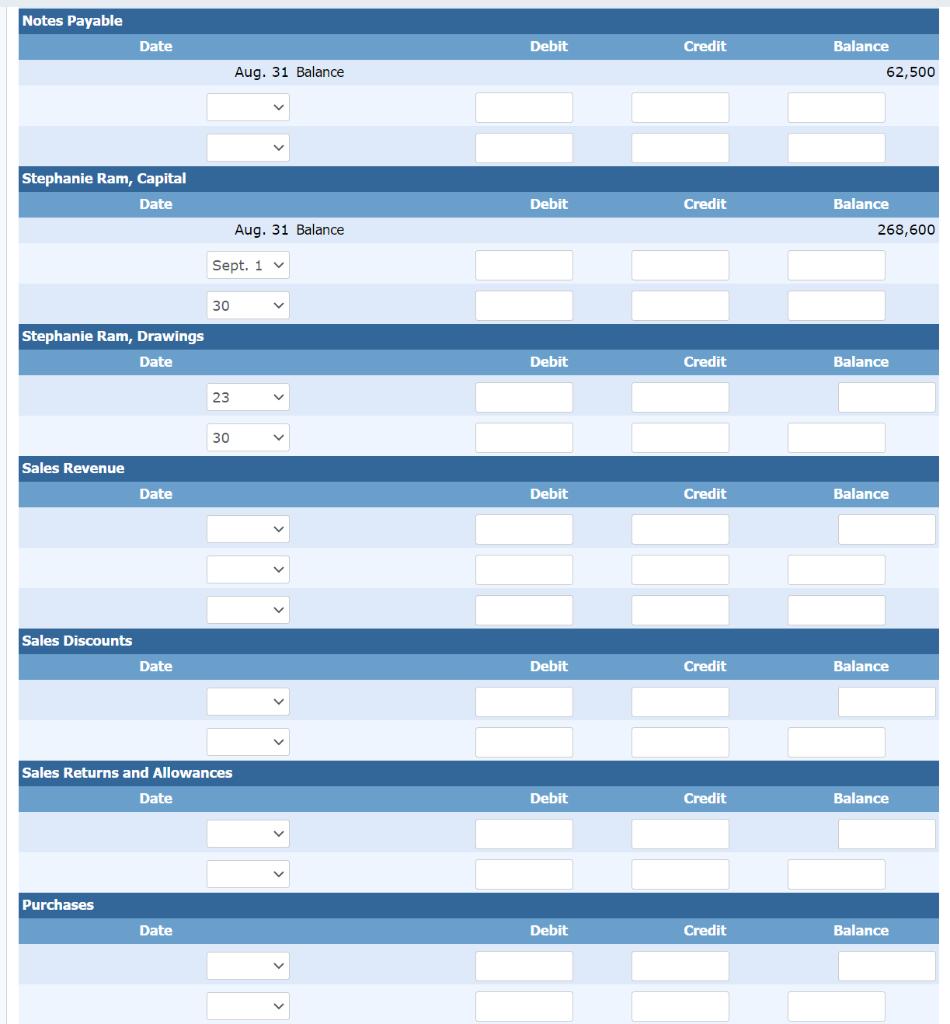

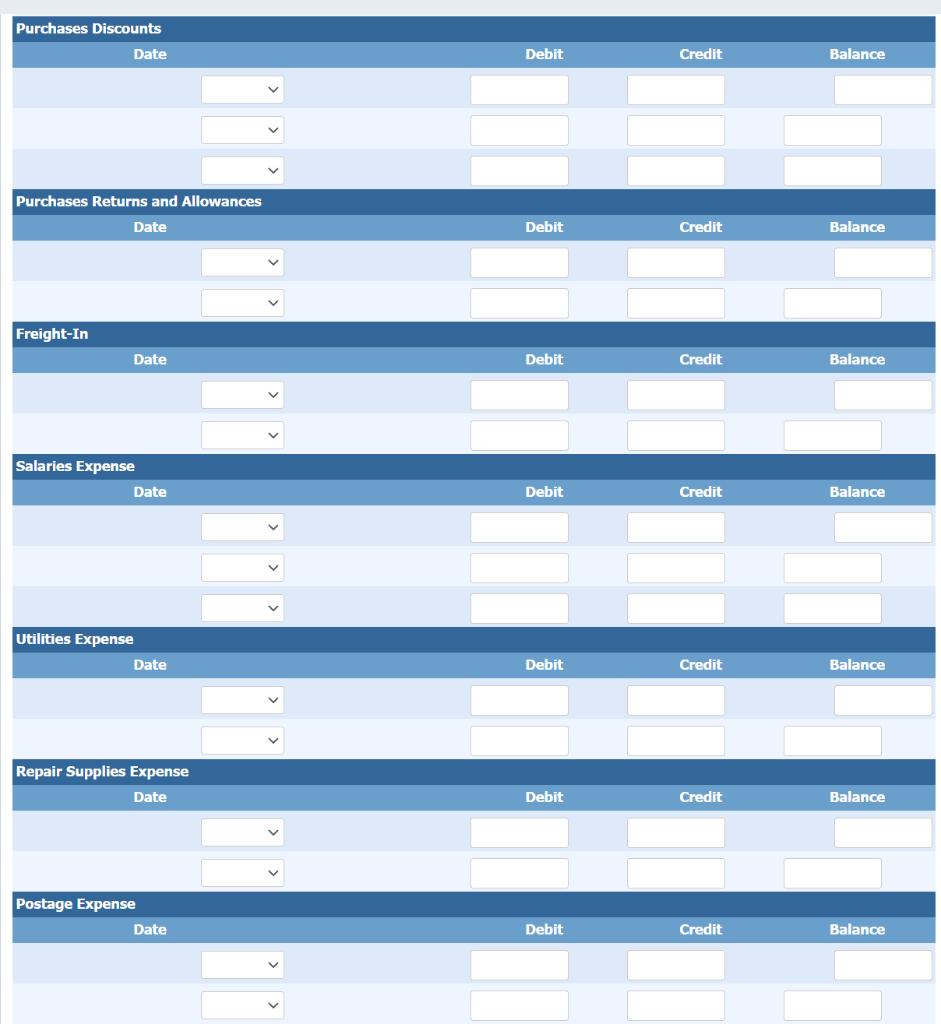

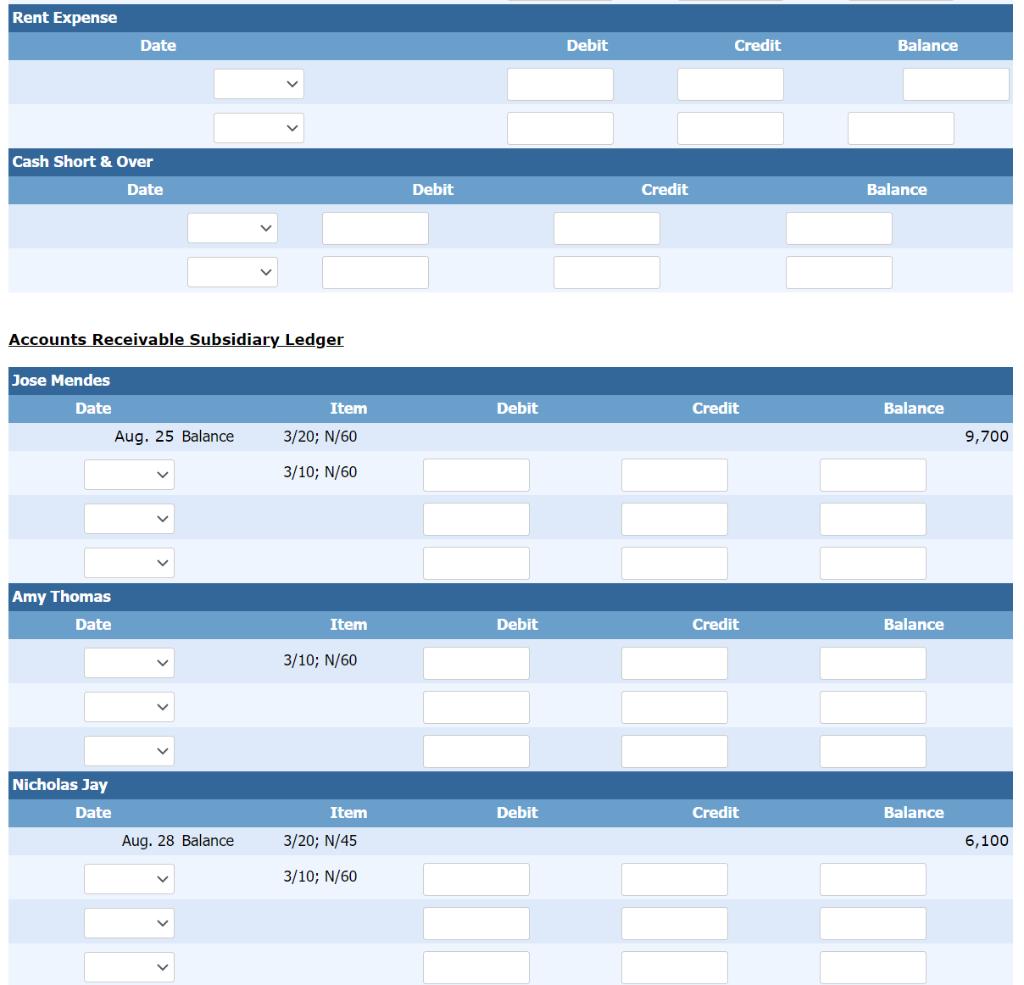

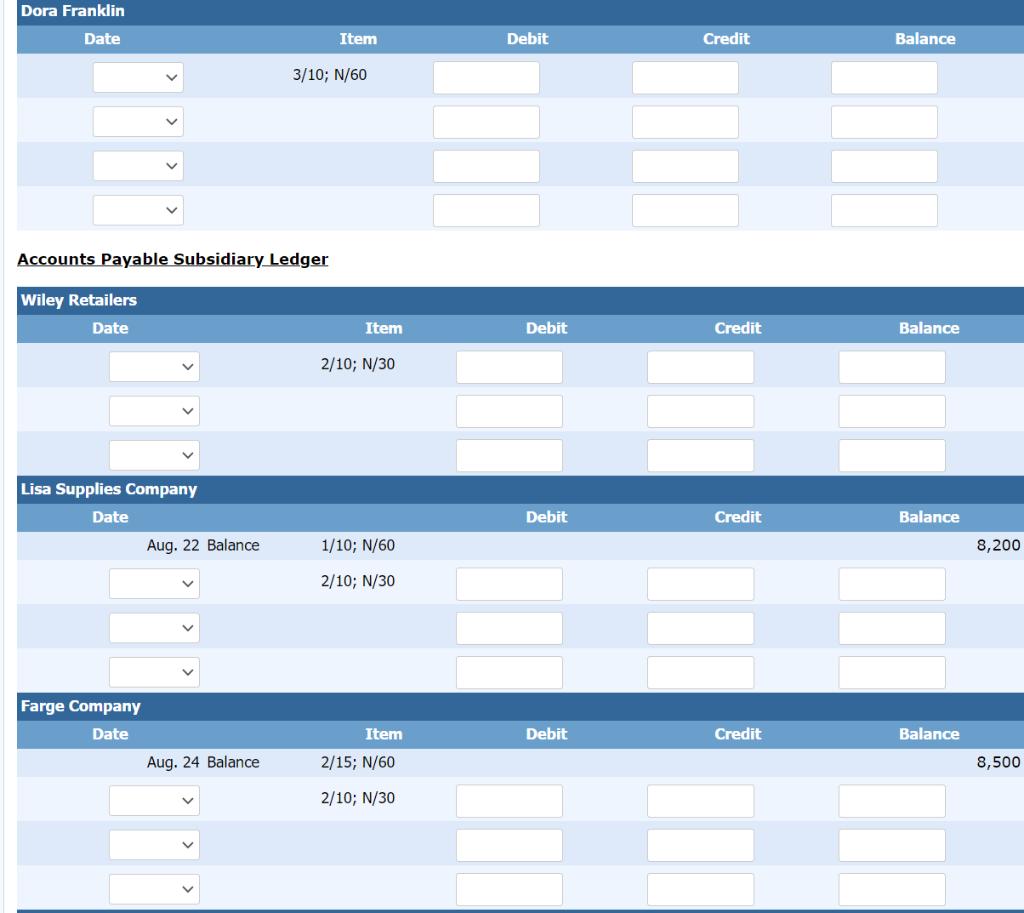

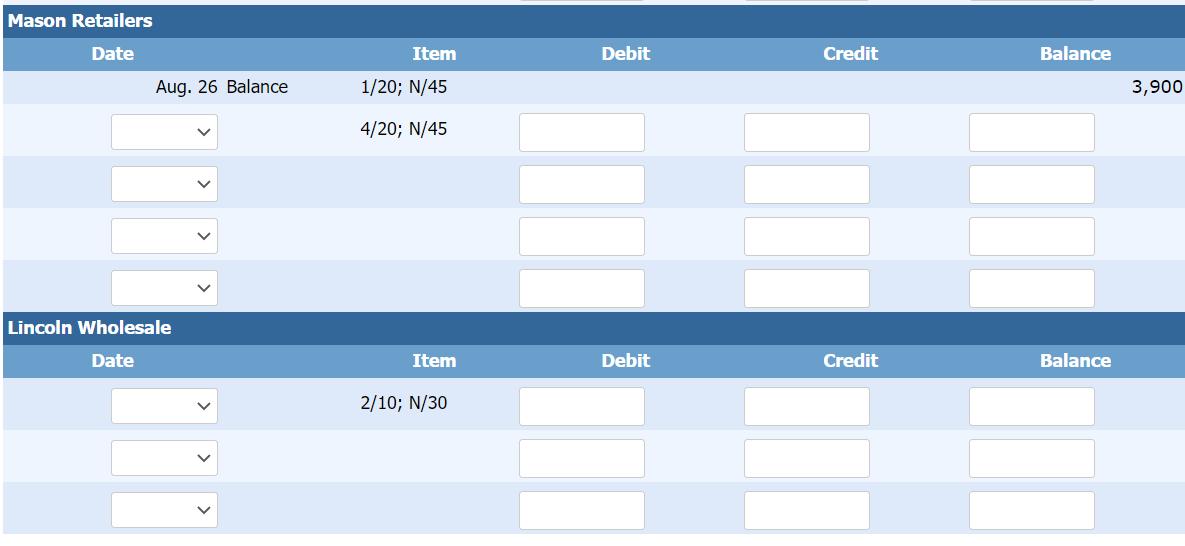

Post the Journal Entries to the General Ledger and Subsidiary Ledgers. Amounts to the Accounts Receivable and Accounts Payable should be posted as a total amount to the Accounts Receivable and Accounts Payable accounts in the General Ledger. (Post the General Journal entries in chronological order to the respective accounts in the Ledgers below. Calculate the running balances for each account after each posting. Do not use dollar signs ($) when entering amounts. Only recalculate the ending balances to Ledger accounts where amounts were posted. To see comma-formatted numbers reflected in your final answers, you must enter your answers with commas.)

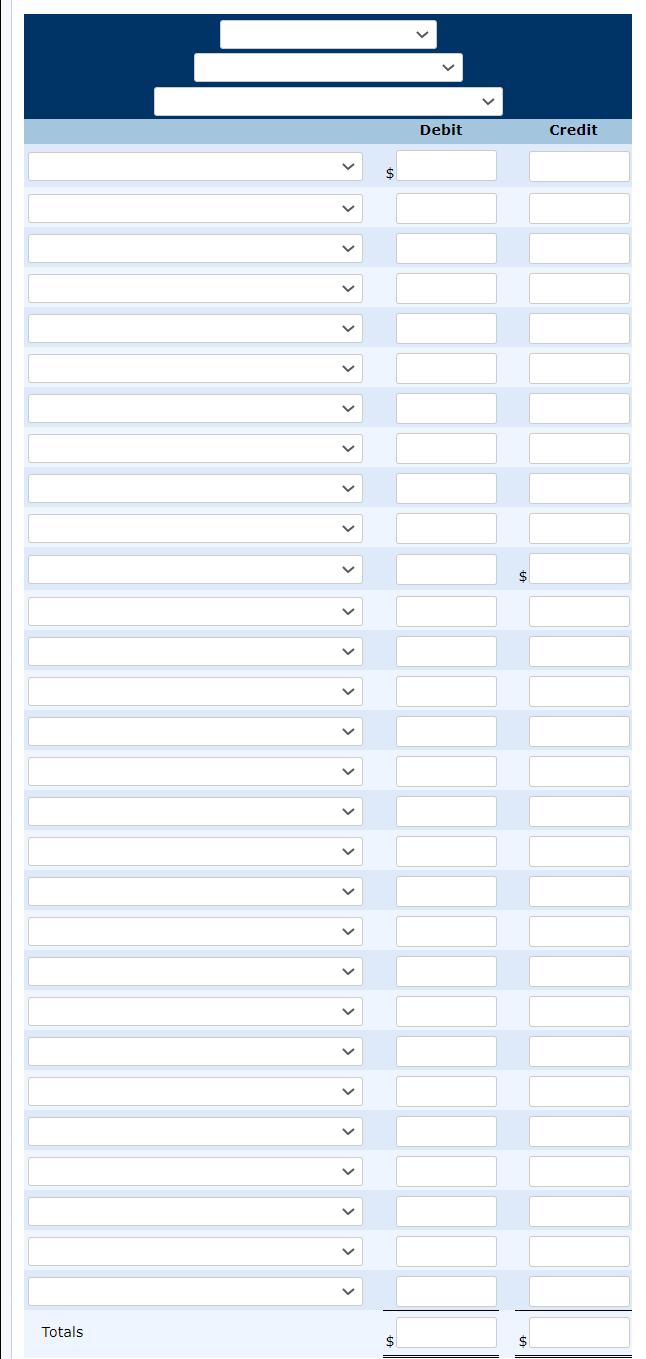

Prepare a Trial Balance using the account names and balances from the General Ledger. (Do not list those accounts that have zero ending balance. Do not use dollar signs ($) when entering amounts. To see comma-formatted numbers reflected in your final answers, you must enter your answers with commas.)

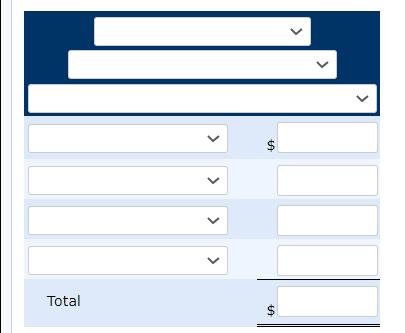

Using the information from the Accounts Receivable Subsidiary Ledger, prepare a Schedule of Accounts Receivable. (Do not use dollar signs ($) when entering amounts. To see comma-formatted numbers reflected in your final answers, you must enter your answers with commas.)

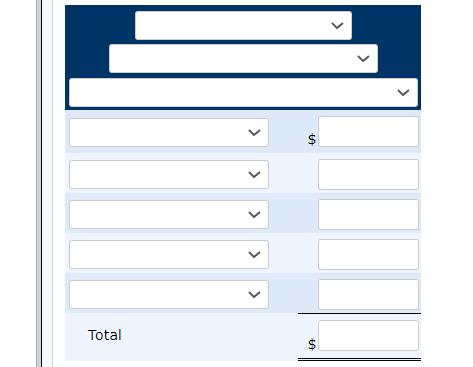

Using the information from the Accounts Payable Subsidiary Ledger, prepare a Schedule of Accounts Payable.

Ram Wholesale Company Post-Closing Trial Balance August 31, 2016 Account Titles Debit Credit Cash $152,900 Accounts Receivable 15,800 Merchandise Inventory, 9/30/15 54,500 Store Supplies 4,300 Office Supplies 2,800 Land 35,000 Delivery Truck 89,000 Accumulated Depreciation, Delivery Truck $700 Accounts Payable 20,600 Unearned Sales Revenue 1,900 Notes Payable (Due 2040) 62,500 Stephanie Ram, Capital 268,600 Totals $354,300 $354,300 Subsidiary Ledgers balances during the month of August Customers with Outstanding Balances Dates Customer Names Credit Terms Balances 8/25 Jose Mendes 3/20, N/60 $9,700 8/28 Nicholas Jay 2/15, N/45 6,100 Totals $15,800 Creditors with Outstanding Balances Dates Creditors Names Credit Terms Balances 8/22 Lisa Supplies Company 1/10, N/60 $8,200 8/24 Farge Company 2/15, N/45 8,500 8/26 Mason Retailers 1/20, N/60 3,900 Totals $20,600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

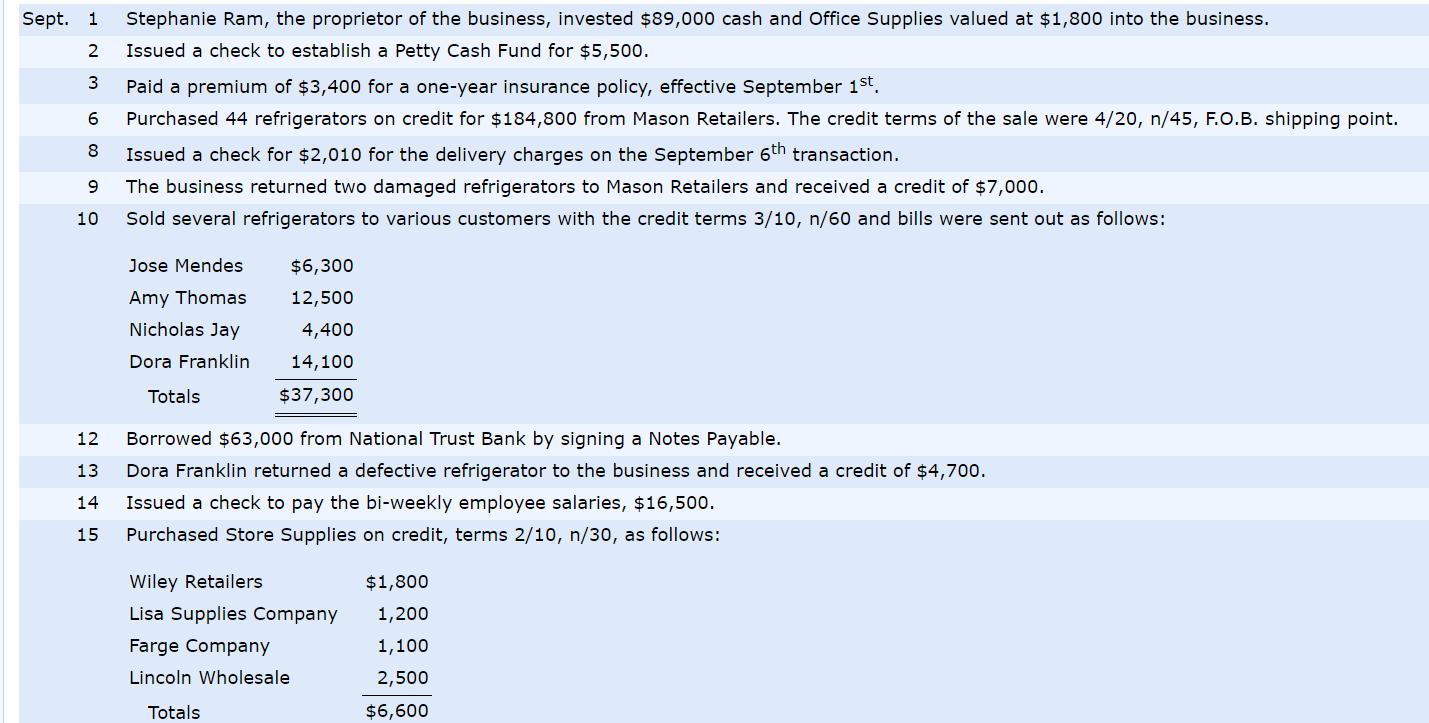

Ram Wholesale Company General journal for September 2016 Date Account title Debit Credit Sep1 Cash 87700 Office supplies 1900 Stephaine Ram 89600 Sep2 Petty cash 5000 Cash 5000 Sep3 Prepaid insurance ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started